Table of Contents

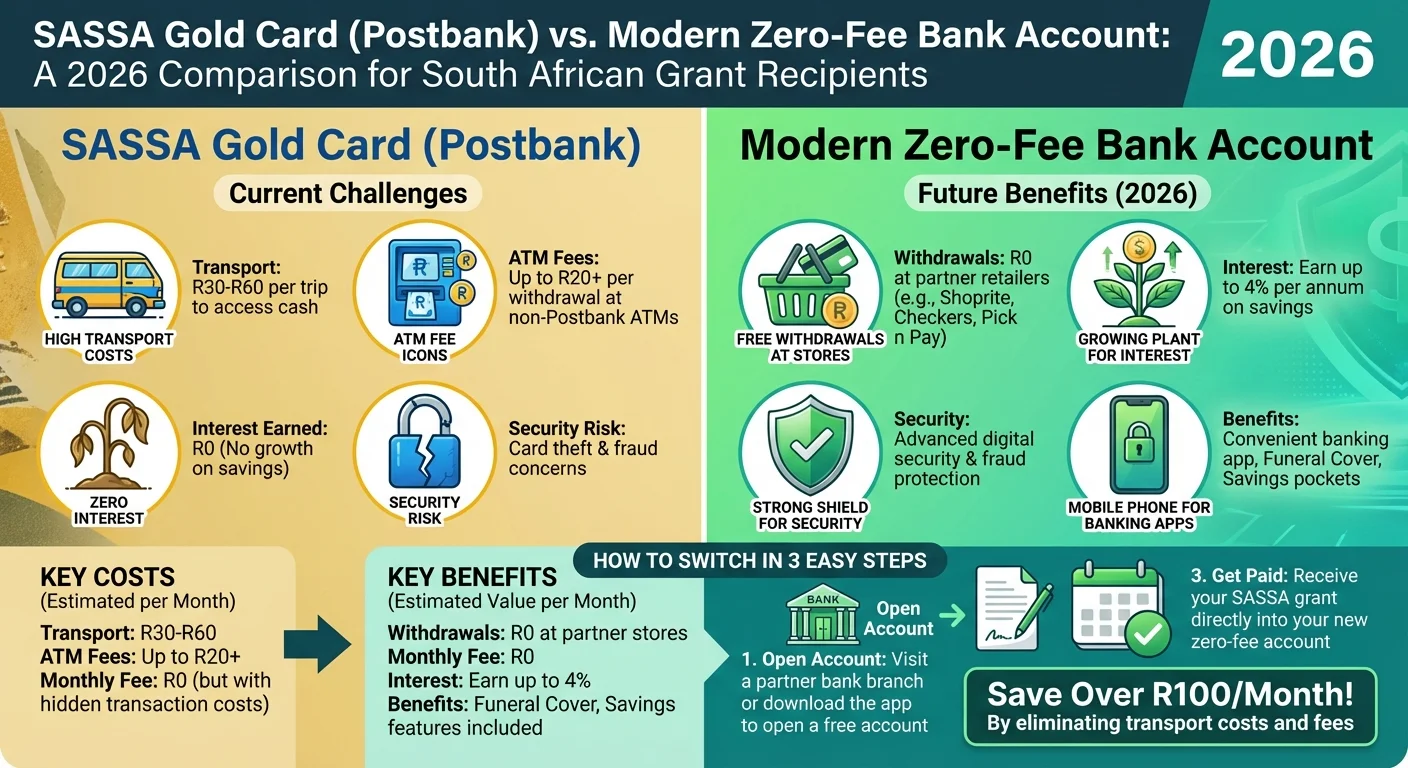

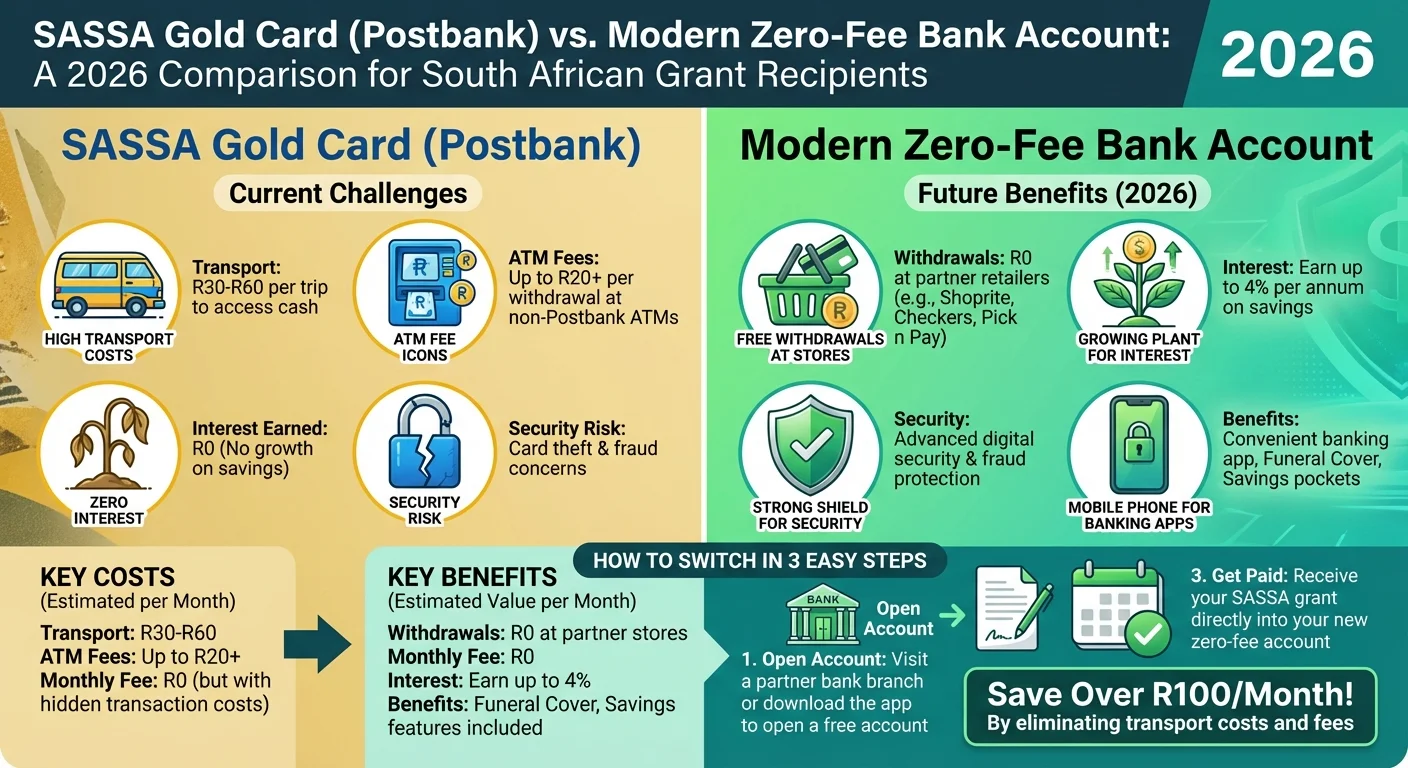

Are you a SASSA grant recipient in 2026? You could be unknowingly losing a significant portion of your grant to hidden fees, transport costs, and lost opportunities. We investigate the real cost of the SASSA Gold Card, compare it to modern zero-fee bank accounts from providers like Capitec and TymeBank, and show you exactly how to make the switch. Learn how to protect your money, build a financial future, and avoid the pitfalls that keep many beneficiaries trapped in a cycle of debt.

The R100 Hole in Your Grant: SASSA’s Biggest Financial Mistake

Let’s be brutally honest. For millions of South Africans relying on social grants, every single Rand counts. Yet, in January 2026, a quiet financial crisis is unfolding: the very card designed to deliver your grant—the SASSA Gold Card—could be the reason you’re losing money. We’re not talking about a few cents; we’re talking about a potential loss of over R100 every single month. This isn’t a system glitch; it’s a fundamental flaw in relying on an outdated system that costs you in transport, bank fees, and lost opportunities. While the grant system is a lifeline, the default payment method is becoming an anchor. It’s time to ask a tough question: Is the ‘convenience’ of the Gold Card actually a costly mistake?

Deconstructing the True Cost of the SASSA Gold Card in 2026

The SASSA Gold Card, managed by Postbank, is presented as a free service, but the reality on the ground in 2026 is very different. The costs are often indirect but they add up fast. Let’s break down this ‘R100 mistake’:

- Transport Costs (R30 - R60): Many beneficiaries, especially in rural areas, have to travel to a Post Office or a specific ATM that won’t charge exorbitant fees. A single taxi trip can cost R15 each way. Two trips to check a balance and then withdraw can easily eat up R60 of your grant.

- ATM Fees (R10 - R30): If you can’t get to a designated pay point, using another bank’s ATM to withdraw your funds comes with a hefty price. These fees can range from R7 to R20+ per withdrawal, punishing you for needing your money urgently.

- The Cost of Cash (Priceless): Carrying your entire grant in cash after withdrawal is a major security risk. Robberies at pay points are a known and tragic reality. The safety and peace of mind you lose are immeasurable.

- Lost Interest (R5 - R10): While it seems small, a modern bank account offers interest on your balance. Leaving your R350 in a Postbank account earns you absolutely nothing. A savings account could be generating a few Rands for you every month, which adds up over a year.

When you combine these factors, the R100 figure becomes a conservative estimate for many. It’s money leaking out of your pocket before you’ve even had a chance to spend it.

The 2026 Alternative: Why Your Grant Deserves a Modern Bank Account

The solution isn’t to reject the grant; it’s to take control of how you receive it. Moving your SASSA payment to a modern, zero-fee bank account is the single most powerful financial move a beneficiary can make in 2026. Here’s why:

- Eliminate Fees: Banks like TymeBank, Capitec, and FNB offer accounts with zero monthly fees and free transactions at retail partners (like Pick n Pay or Boxer). You can withdraw your cash while doing your grocery shopping, saving you time and transport money.

- Enhanced Security: A bank card with a PIN is infinitely safer than cash. If it’s lost or stolen, you can cancel it immediately. Banking apps add another layer of security, allowing you to freeze your card from your phone.

- Build a Financial Footprint: Using a formal bank account creates a transaction history. This is vital if you ever want to apply for credit, a store account, or prove your income for any reason. The Gold Card offers none of this.

- Unlock More Services: Once you’re in the formal banking system, you gain access to other products. You can get affordable funeral cover, set up savings pockets, and use mobile banking tools to manage your money effectively. Your grant becomes a stepping stone, not just a lifeline.

Top 3 Zero-Fee Bank Accounts for SASSA Grants in January 2026

Choosing a new bank can be daunting. Here are three of the best options for SASSA beneficiaries in 2026, focusing on low costs and high accessibility:

TymeBank ‘EveryDay’ Account:

- Monthly Fee: R0

- Withdrawals: Free at Pick n Pay and Boxer tills. Standard fees at other ATMs.

- Key Feature: Extremely easy to open an account at a TymeBank kiosk in-store. Their GoalSave feature also offers one of the best interest rates on savings.

Capitec ‘Global One’ Account:

- Monthly Fee: R5 (low and predictable)

- Withdrawals: Free cash withdrawals at PnP, Checkers, Shoprite, and Boxer.

- Key Feature: Extensive branch network and an award-winning banking app. You can also get affordable funeral cover for as little as R40 per month.

FNB ‘Easy Zero’ Account:

- Monthly Fee: R0

- Withdrawals: First R1000 withdrawal per month is free at FNB ATMs.

- Key Feature: Great for those who prefer using a traditional ATM. Strong mobile banking features, including the ability to send eWallets.

How to Switch Your SASSA Payment to Your Personal Bank Account: The 2026 Guide

Ready to make the switch? The process is straightforward, but you must follow it carefully. Don’t let anyone at SASSA tell you it’s not possible.

Step 1: Open Your New Bank Account. Go to your chosen bank (like Capitec or a TymeBank kiosk) and open an account. Make sure you get a bank account confirmation letter or a stamped statement. It MUST be in your name, as SASSA cannot pay into someone else’s account.

Step 2: Get the Official SASSA Form. You need the ‘SASSA Annexure C’ (Consent Form for Bank Payment). You can request this form at your nearest SASSA office.

Step 3: Complete and Submit the Form. Fill out the form with your personal details and your new banking details. Take the completed form, your green bar-coded ID or Smart ID card, and your bank confirmation letter to the SASSA office.

Step 4: Wait for Verification. SASSA will then verify your new banking details. This can take up to one payment cycle, so do not close your old Postbank account immediately. Check your SASSA SRD Status online to see when the payment method is updated. The next payment should then go into your new account. Keep an eye on the official SASSA Payment Dates to know when to expect your grant.

Beyond Survival: Using Your New Account to Unlock Funeral Cover

One of the most significant benefits of having a formal bank account is access to affordable financial products. For many South African families, the unexpected cost of a funeral can be devastating. With a bank account receiving a regular SASSA payment, you become eligible for reliable funeral cover, often for less than R50 a month. This is a responsible step that protects your family from falling into debt during a difficult time. Banks like Capitec and retailers like Shoprite (via their partnership with OUTsurance) offer simple, easy-to-understand funeral policies that can be paid directly from your account. This is a level of financial security the Gold Card simply cannot provide.

Warning: The Loan Shark (‘Mashonisa’) Trap and How Your Bank Protects You

When cash is tight, especially near the end of the month, the temptation to turn to loan sharks is high. These informal lenders often operate near pay points and prey on vulnerable grant recipients. They charge outrageous interest rates and use intimidation for collection. Having your grant paid into a bank account creates a buffer. It removes you from the physical location of these predators. Furthermore, by building a transaction history, you may eventually qualify for small, safe, and regulated loans from your bank in an emergency, with fair interest rates and clear repayment terms. This is a crucial step in breaking the cycle of debt.

Conclusion: Your Grant, Your Choice, Your Financial Future

The SASSA grant system is a vital social safety net, but in 2026, it’s time for beneficiaries to become empowered consumers. Continuing to use the SASSA Gold Card without questioning the hidden costs is a mistake that leaves precious money on the table. By making a simple change to a modern, zero-fee bank account, you are not just choosing a different card; you are choosing security over risk, opportunity over stagnation, and financial empowerment over dependency. It’s your money. It’s time to make it work for you.

Frequently Asked Questions

Can SASSA pay my R350 grant into my Capitec account in 2026?

How do I change my SASSA banking details online for the R350 grant?

What are the bank charges for the SASSA Gold Card?

Is it safe to get my SASSA grant paid into my bank account?

Will changing my bank details delay my January 2026 payment?

Can I get a loan from the bank if I only receive a SASSA grant?

What happens to my SASSA Gold Card when it expires in 2026?

Can I open a bank account for my SASSA grant without proof of address?

Read Next

SASSA January 2026 Payment Dates CONFIRMED: Why You Must Check Before You Collect

The official SASSA grant payment dates for January 2026 are here. This guide …

Why Your SASSA Grant Is Secretly Costing You R2,500+ a Year in 2026: The Truth About Bank Fees, Loans & Funeral Cover

In 2026, hidden bank fees, predatory loans, and overpriced funeral policies are …

Comments & Discussions