Table of Contents

Discover why thousands of South Africans are switching their SASSA payment methods in November 2025. Learn how to save up to R50 a month just by changing your bank and avoid the December payment bottleneck.

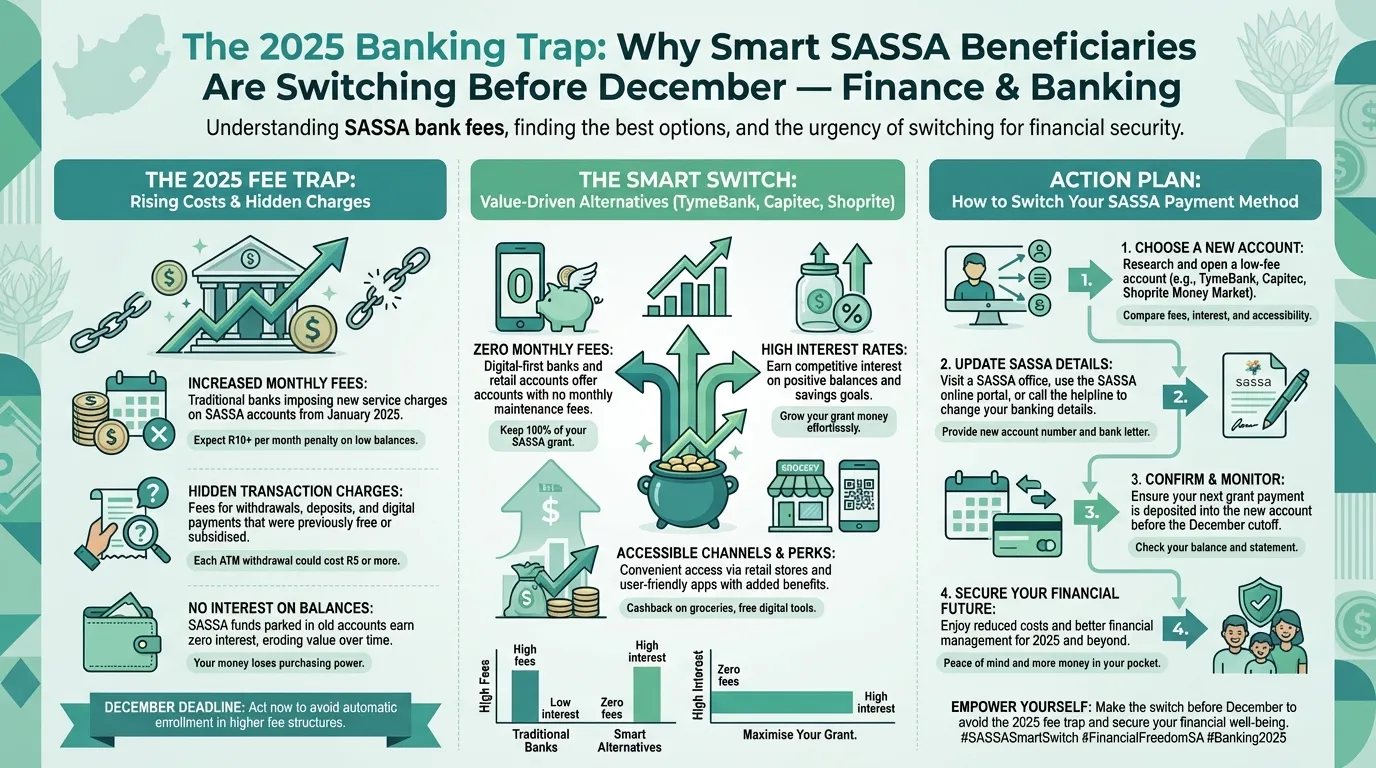

The Hidden Tax on Your Survival: Why November 2025 is the Tipping Point

It is November 26, 2025, and as we look toward the expensive festive season, a harsh reality is setting in for millions of SASSA beneficiaries. While we debate government policy and the sustainability of the SRD grant, there is a silent predator eating away at the meager funds provided to South Africa’s most vulnerable: banking fees.

For years, we have accepted that ‘banking costs money.’ But when your income is R370 (or the current equivalent grant value), paying R20 to R50 in withdrawal fees, monthly maintenance charges, and ‘insufficient funds’ penalties is not just a cost of doing business—it is a tax on survival.

Opinion: If you are still receiving your grant through a high-fee traditional bank account or, worse, a cash-send service that charges for collection, you are voluntarily giving up nearly 10% of your grant every year. In 2025, with the rise of digital banking and retail accounts, staying with an expensive bank is a mistake you cannot afford.

The Math Doesn’t Lie: How Much Are You Really Losing?

Let us look at the numbers for late 2025. Inflation has touched every part of the grocery basket. Every rand counts. Yet, reports suggest that many beneficiaries are using accounts that charge:

- Withdrawal Fees: R8 - R15 per transaction at ATMs.

- Monthly Fees: R5 - R10 just to keep the account open.

- Balance Enquiries: R2 - R5 per check.

If you withdraw your cash in two batches and check your balance twice, you could easily lose R40 a month. That is R480 a year—more than a whole month’s grant payment!

Imagine if the government announced they were skipping one month of payments every year. There would be riots. Yet, by choosing the wrong bank, you are effectively doing this to yourself.

The ‘Big Four’ vs. The Digital Disruptors in 2025

The banking landscape in South Africa has shifted dramatically by November 2025. The traditional ‘Big Four’ banks, while reliable, often come with fee structures designed for salary earners, not grant recipients.

The Smart Money Move: We are seeing a massive migration of savvy beneficiaries toward low-cost digital options.

- TymeBank: With zero monthly fees and partnerships with Pick n Pay and Boxer for free withdrawals, this remains a top contender.

- Shoprite Money Market Account: Not strictly a bank, but a transactional capability that allows you to spend your grant directly on food without withdrawing cash, saving 100% of withdrawal fees.

- Capitec (Global One): While not fee-free, their dominance continues due to accessibility, though users must be wary of ATM withdrawal costs.

My Analysis: If you are paying a monthly fee just to receive a grant, you are in the wrong relationship. Your bank should be paying you interest, not charging you rent for your money.

Why Cash Send and E-Wallets Are a Trap

Many beneficiaries opt for ‘Cash Send’ or ‘E-Wallet’ options to avoid opening bank accounts. In 2025, this is arguably the worst financial decision you can make regarding your grant.

Here is why:

- Expiration Risks: If you don’t collect within a certain window, the money can be reversed or become difficult to claim.

- Security: If your phone is stolen, your voucher SMS is gone. Recovering it is a nightmare compared to blocking a bank card.

- No Digital Footprint: Using a bank account builds a credit history (even a small one) and proof of income, which is vital if you ever want to access micro-loans or store accounts responsibly in the future.

Step-by-Step: How to Switch Your Payment Method Before December

With the December payment run approaching, changing your banking details right now (late November) is risky but necessary if you want to start 2026 on a better footing.

Warning: Changes made after the 20th of the month usually apply to the following month. If you switch today (Nov 26), expect the change to reflect for your January 2026 payment. Your December payment will likely go to your old account.

The Process for 2025:

- Open the New Account First: Do not close your old account until the money lands in the new one.

- Visit the SRD Portal: Go to

srd.sassa.gov.za. - Scroll to ‘How do I change my banking details’: Enter your ID number.

- Verify: You will receive an SMS link. Click it.

- Select ‘Personal Bank Account’: Enter your new account details strictly in your own name.

- Wait for Verification: SASSA verifies this with the Department of Home Affairs and the bank. This takes 5-7 business days.

The Postbank Gold Card: Is It Still Worth It?

The Postbank Gold Card has had a tumultuous history of technical glitches and system offline errors. While it offers the benefit of three free withdrawals at participating retailers, the reliability issues we saw in 2023 and 2024 have made many wary.

Verdict: If you already have a working Gold Card that hasn’t expired, keep it. But if you are applying for a new payment method, a personal account with a stable private bank (like TymeBank or Capitec) offers more control and better customer service when things go wrong. Do not rely on a system that has a history of failing on pay day.

Troubleshooting: Why Your ‘Bank Details Pending’ Status Won’t Change

A common frustration in November 2025 is the dreaded ‘Bank Details Pending’ status. If you are stuck here, it is usually for one of three reasons:

- Name Mismatch: The name on your bank account does not match your ID exactly. If your ID says ‘James Peter Zulu’ and your bank account says ‘J.P. Zulu’, the automated system might flag it.

- Mobile Number Mismatch: The phone number registered with SASSA must match the one linked to the bank account for verification checks.

- Fraud Check: If the bank account has been used for other SASSA grants (like a child support grant for a different person), it gets flagged. Rule of 2025: One ID, One Bank Account.

Conclusion: Take Your Power Back

The SRD grant is not a lot of money. That is exactly why you cannot afford to waste a single cent of it on unnecessary banking fees. The banks rely on your apathy—they profit when you don’t check your statements.

As we head into December, take an hour to review your finances. Switch to a low-cost account. Stop paying to access your own money. It is the single most effective financial raise you can give yourself in 2025.

Frequently Asked Questions

Which bank is best for SASSA payments in 2025?

How long does it take for SASSA to verify new bank details?

Can I use someone else's bank account for my SASSA grant?

What happens if I change my banking details today (26 November)?

Why is my SASSA status approved but no payment date?

Read Next

SASSA Grant Declined in January 2026? The Hidden Reasons & Your 4-Step Fix

Received a shocking ‘Declined’ status for your January 2026 R350 …

The Real Reason SASSA's February 2026 Payment Dates Will Squeeze You Dry (And How to Survive)

This is the official SASSA payment schedule for February 2026. We expose why the …

Comments & Discussions