Table of Contents

Is money missing from your SASSA grant? You might be a victim of ‘ghost deductions’. Discover how scammers are using unauthorized debit orders to steal millions from beneficiaries in December 2025 and how to block them immediately.

The Mystery of the Missing R99: A Festive Season Nightmare

It is a story we hear too often. You wait patiently for the December 2025 payment dates, you calculate every cent for your festive grocery list, and you head to the ATM or retailer. But when you check your balance, something is wrong. You are short. Maybe it’s R89, maybe R99, or even R150.

You didn’t spend it. The bank fees shouldn’t be that high. So, where did it go?

Welcome to the world of ‘Ghost Deductions’—the silent predator eating away at South Africa’s social grants. While everyone is focused on whether their SRD Status Check is approved, a quieter crisis is happening inside the bank accounts of approved beneficiaries. In December 2025, as transaction volumes spike and people let their guard down, these rogue deductions are hitting harder than ever.

This isn’t just about ‘bank fees’. This is about third-party companies, rogue insurance brokers, and scam artists unlawfully dipping their hands into your grant before you even touch it.

What Are ‘Ghost Deductions’ and Why Now?

A ‘Ghost Deduction’ is an unauthorized debit order processed against your bank account. These are often for small amounts—typically between R49 and R99—because scammers know that smaller amounts are less likely to trigger immediate panic than stealing the whole R370 or R2,180 at once.

Why is this trending in December 2025?

- Volume: With millions of transactions happening for the festive season, fraudulent debit orders are easier to hide in the noise.

- Distraction: Beneficiaries are busy shopping and traveling, often checking their balances less carefully.

- Data Leaks: Syndicates often buy personal data (ID numbers and bank account details) on the black market to set up these fraudulent orders.

These deductions often appear with vague references on your bank statement, such as “MZANSICOVER”, “TARGETSVM”, or just a string of random numbers. They pose as legitimate services like funeral cover, airtime subscriptions, or legal aid—services you never signed up for.

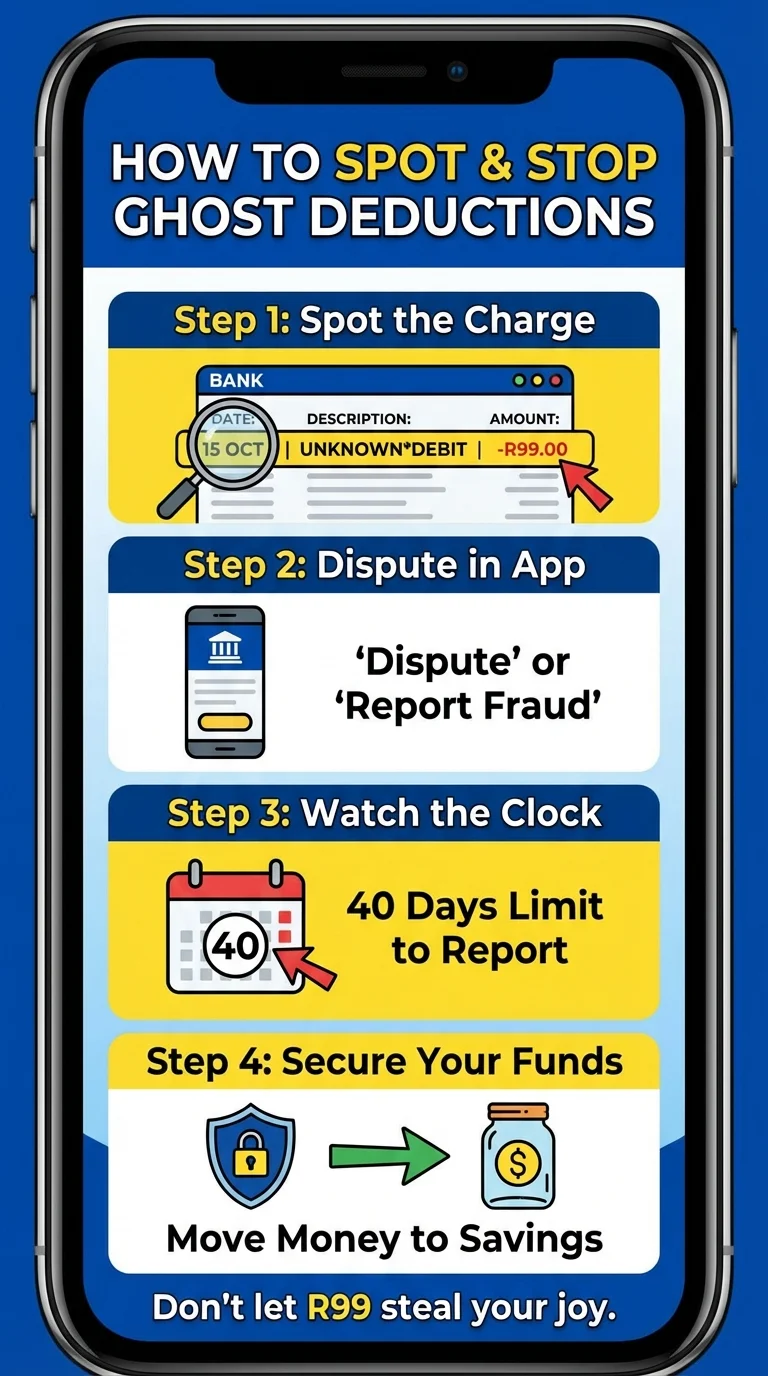

The ‘R99’ Trap: How to Spot It on Your Statement

Financial literacy is your best defense. You cannot fix what you do not see. To catch a ghost deduction, you need to look at your transaction history—not just your balance.

The Red Flags to Look For:

- Strange Names: Any reference you don’t recognize. If it says “INSURE” but you don’t have insurance, that’s a red flag.

- Odd Amounts: Scammers love psychological pricing. R89, R99, R115 are common “subscription” price points.

- Recurring Dates: These deductions often hit within 24 hours of the SASSA Payment Dates, aiming to grab the cash the moment it lands.

How to Check:

- USSD: Dial your bank’s USSD code (e.g.,

*120*3279#for Capitec) and select “Last 5 Transactions”. - App: Log into your banking app and scroll through your December history line by line.

- ATM: Print a mini-statement. It costs a few Rands but could save you hundreds.

How to Stop and Reverse Rogue Debit Orders (Bank by Bank)

If you find a ghost deduction, do not panic—act. South African banking laws (DebiCheck) are designed to protect you, but the system isn’t perfect. You have the right to dispute unauthorized debits. Here is how to do it for the most common SASSA accounts in 2025.

Capitec Bank (Using the App)

Capitec is widely used by grant recipients. Their app makes this process relatively easy.

- Sign in and select your savings account.

- Tap “Transact” and then “Debit Orders”.

- Enter your PIN.

- Select the unauthorized debit order from the history list.

- Choose a reason (e.g., “No Authority to Debit”).

- Tap “Stop & Reverse”. Note: There may be a small fee to stop it, but reversing it puts the stolen money back in your account.

TymeBank

- Log into the TymeBank App or Internet Banking.

- Navigate to “Services” or “Debit Orders”.

- Select “Dispute Debit Order”.

- Select the transaction and confirm the dispute.

Postbank / SASSA Gold Card

This is the most challenging one, as digital tools are limited.

- Call Center: Dial 0800 53 54 55 (Postbank). Prepare for hold times.

- In-Branch: Your best bet is to visit a Post Office or Postbank branch with your ID and card. Ask for a “Dispute Form”.

- USSD: Try dialing

*120*218#(if active for your specific card batch) to view transactions, but disputes usually require speaking to a human.

CRITICAL WARNING: You usually only have 40 days to dispute a debit order to get a full reversal. Do not wait until January!

The ‘DebiCheck’ Failure: Why Is This Still Happening?

You might be asking, “I thought DebiCheck was supposed to stop this?” You are right. The DebiCheck system was implemented to ensure you electronically confirm any new debit order.

However, scammers have found loopholes:

- “Naedo” Legacy Systems: Some older deduction systems still exist in dark corners of the banking network.

- Fake Acceptances: Unscrupulous agents might trigger a confirmation request to your phone (USSD pop-up). If you accidentally click “1” or “OK” just to clear the screen, you have legally accepted the contract.

- Identity Theft: If a scammer has enough of your data, they might bypass verification steps entirely.

The Lesson: Never blindly click “OK” or “Accept” on a USSD pop-up on your phone unless you initiated the transaction yourself.

How to Protect Your Grant in 2026

As we move into the new year, take these steps to “scam-proof” your SASSA money:

- Separate Your Money: Consider moving your grant money out of the receiving account immediately. Transfer it to a savings account (like a TymeBank GoalSave or Capitec savings plan) that does not allow external debit orders. This creates a “firewall” between scammers and your cash.

- SMS Notifications: Ensure you have SMS notifications enabled (even for small amounts). It costs a little, but knowing immediately when R99 leaves your account allows you to reverse it instantly.

- Guard Your Slip: Never throw your ATM slip in the bin at the mall. It contains partial account info that scammers can use to build a profile on you.

Your grant is your lifeline. Do not let ‘ghosts’ feast on it this festive season. Check your statement today.

Frequently Asked Questions

How can I tell if a deduction on my SASSA card is unauthorized?

Can I get my money back if I reverse a debit order?

Does SASSA deduct money for funeral plans?

How much does it cost to stop a debit order at Capitec?

Why does my SASSA balance show less money than the grant amount?

Can I block all debit orders on my SASSA card?

What is the USSD code to check my SASSA balance on a phone?

*120*3210#. For other banks, use their specific codes (e.g., Capitec *120*3279#, Standard Bank *120*2345#).Is it safe to keep money in my SASSA account over December?

Read Next

SASSA Grant Declined in January 2026? The Hidden Reasons & Your 4-Step Fix

Received a shocking ‘Declined’ status for your January 2026 R350 …

The Real Reason SASSA's February 2026 Payment Dates Will Squeeze You Dry (And How to Survive)

This is the official SASSA payment schedule for February 2026. We expose why the …

Comments & Discussions