Table of Contents

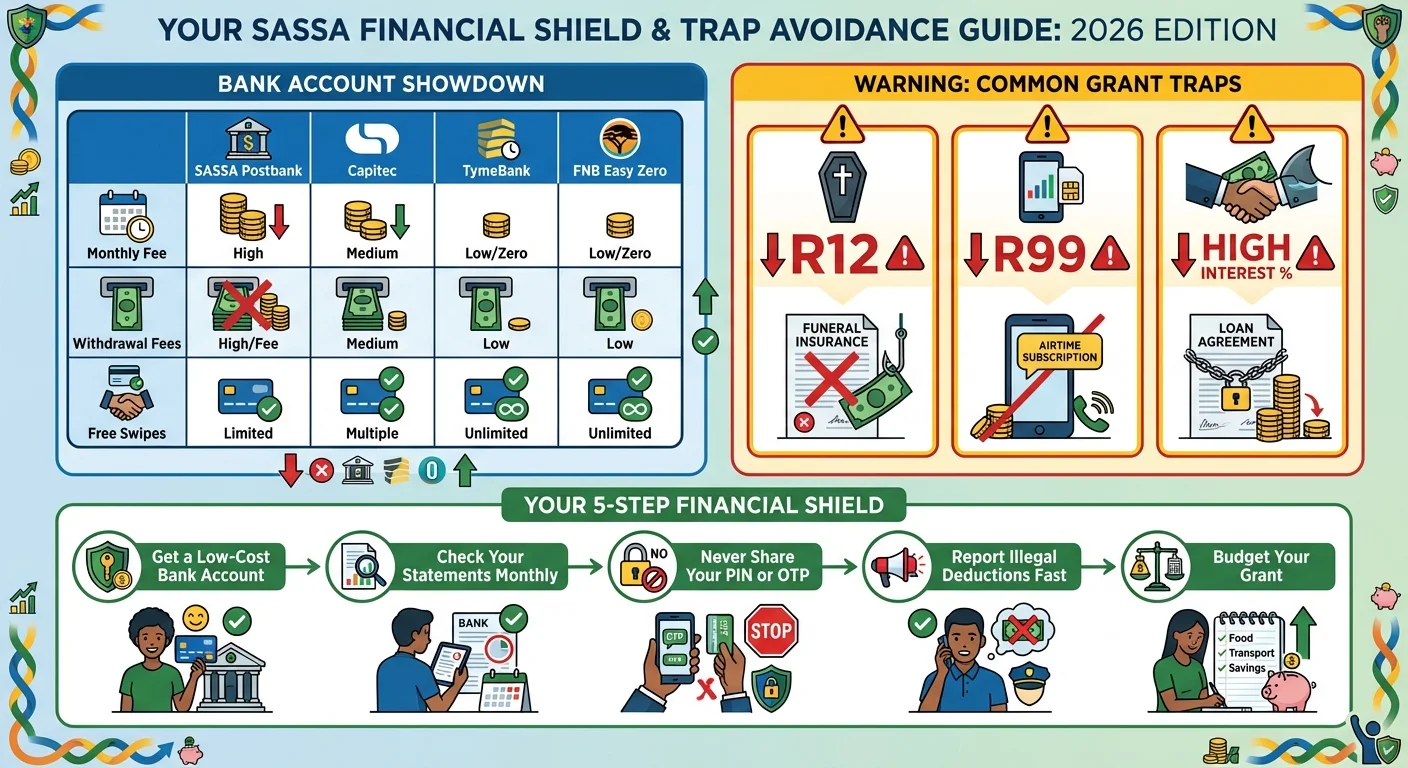

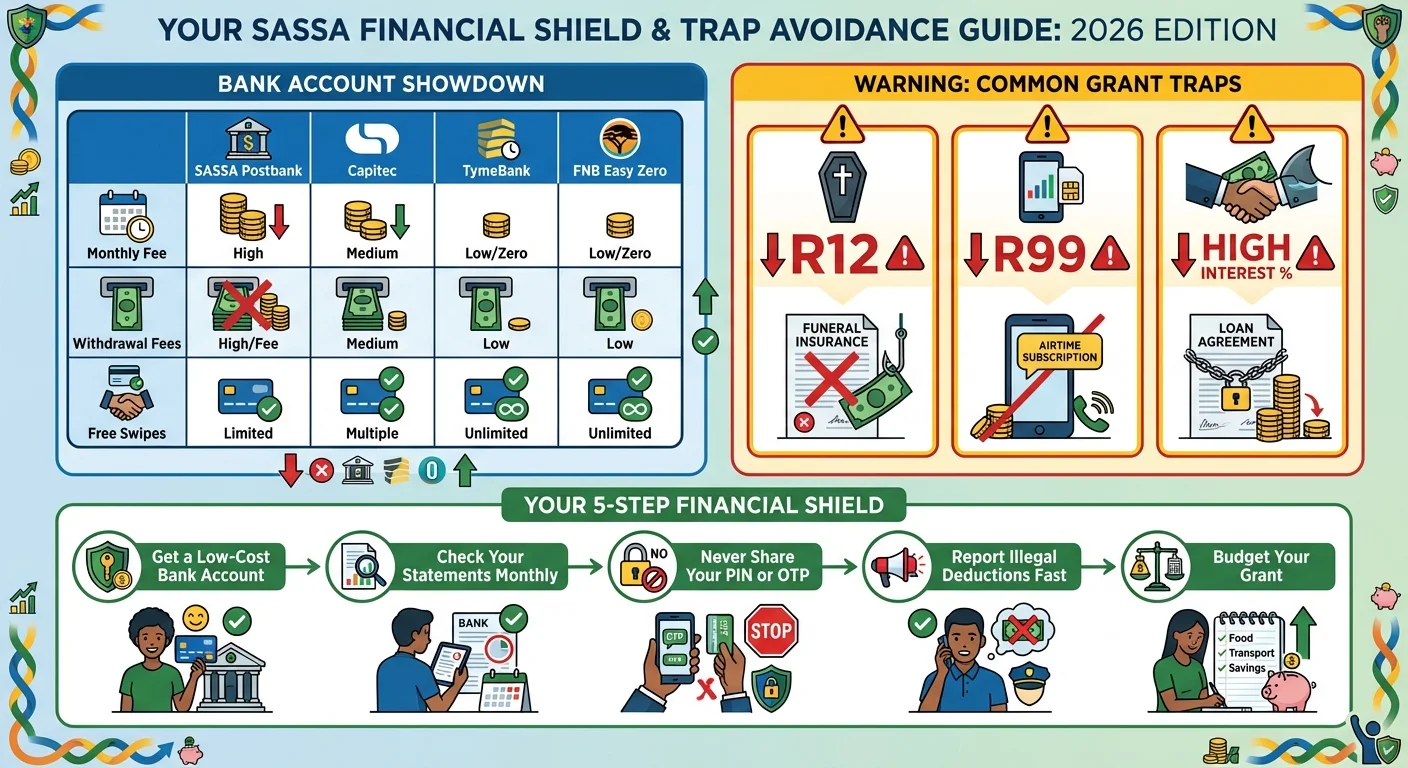

Are you finding less money in your account than you expected? You’re not alone. This comprehensive 2026 guide exposes the costly secrets of the SASSA payment system, from high Postbank fees to the controversial R12 funeral cover and EasyPay deductions. We analyze the best low-cost bank accounts from Capitec, TymeBank, and FNB, providing a step-by-step plan to secure your grant, fight back against illegal debits, and build a financial shield for your family.

The Shocking Truth: Why Your SASSA Grant Feels Lighter in 2026

It’s the day you’ve been waiting for, the SASSA payment notification arrives. But when you check your balance, your heart sinks. The amount is less than you expected. R12 is gone here, R99 there, plus a withdrawal fee you didn’t budget for. In January 2026, this is the harsh reality for millions of South Africans who depend on social grants. It’s not just inflation; your grant is actively being eaten away by a system of hidden fees, confusing products, and predatory practices.

This isn’t just a guide; it’s an intervention. We are going to expose the financial traps that are designed to keep you poor and show you exactly how to take back control. The government provides the grant as a lifeline, but it’s up to you to protect it. Let’s start by looking at the very card in your wallet.

Problem #1: The SASSA Gold Card - A Friend or Foe?

For years, the SASSA Gold Card, issued by Postbank, was the standard. While it has served its purpose, in 2026 it’s becoming a financial liability for many. The government itself is urging beneficiaries to switch to commercial bank accounts, and for good reason.

The Hidden Costs of the Gold Card:

- Limited Free Withdrawals: You typically get one free withdrawal at a Post Office. After that, the fees start stacking up, especially at other bank ATMs.

- Network Issues: Post Office queues are notoriously long, and system downtime can mean you go home empty-handed after hours of waiting.

- Vulnerability to Deductions: The system has historically been a target for third-party companies initiating debit orders, sometimes without clear consent. While regulations have tightened, the risk profile remains a concern for many.

While the card is familiar, familiarity is costing you money. The future of grant payments is in a personal bank account that you control completely. For the latest official Payment Dates, always check our dedicated page to plan your withdrawals wisely.

Problem #2: The R12 Funeral Cover & Other ‘Small’ Deductions

A deduction of R12 or R30 for funeral cover might seem small. Salespeople often present it as a responsible choice. But let’s do the math. R12 per month is R144 per year. Over five years, that’s R720. For that money, are you getting cover that truly protects your family, or is it a low-value policy with countless exclusions?

The Trap:

- Low Payouts: Many of these cheap policies offer payouts so small (e.g., R5,000 - R10,000) they barely cover the cost of a basic funeral in 2026.

- Aggressive Sales Tactics: Beneficiaries are often signed up without fully understanding the terms and conditions.

- Difficult to Cancel: Stopping these debit orders can be a nightmare, involving endless phone calls and paperwork.

Our Analysis: While funeral cover is important, these specific products marketed to grant recipients often offer poor value. You are better off putting that R12 into a savings account or seeking a more reputable policy from a major insurer, where your money buys you more comprehensive cover.

Problem #3: The EasyPay Everywhere ‘Green Card’ & Predatory Lenders

The rise of third-party payment providers like EasyPay Everywhere (the ‘green card’) has been a source of immense controversy. While they offer loans and other services, they have been accused of causing unauthorized deductions for everything from airtime to electricity, leaving beneficiaries with little to nothing on payment day.

Red Flags to Watch For in 2026:

- Pressure to take out loans: Being told you ‘qualify’ for a loan the moment your grant is available.

- Bundled services: Signing up for one thing and unknowingly agreeing to multiple debit orders.

- Sky-high interest rates: Loans that trap you in a cycle of debt, where most of your next grant is used to pay off the last loan.

These lenders prey on desperation. They position themselves near pay points and use convincing language. Your SASSA grant should be for survival, not to enrich predatory companies. If your grant was unfairly declined and you’re considering a loan, first try the official route. Our Appeals Guide can help you fight the decision.

The Solution: Your 2026 Guide to Low-Cost Banking

Taking control starts with choosing the right tool. A modern, low-cost bank account is your best shield. Here are the top contenders for SASSA beneficiaries in 2026, designed to save you money.

1. Capitec Bank:

- Monthly Fee: Very low (around R5).

- Why it’s great: Widespread availability of ATMs, a user-friendly app, and the ability to get cash at till points (like Pick n Pay, Shoprite) for a very low, flat fee. Their savings options are also excellent.

2. TymeBank:

- Monthly Fee: Zero.

- Why it’s great: No monthly fees is a huge win. You can open an account in minutes at a Pick n Pay or Boxer kiosk. You can also deposit and withdraw cash at these stores, making it very accessible.

3. FNB Easy Zero Account:

- Monthly Fee: Zero.

- Why it’s great: From a major bank, this account has no monthly fee. You get free card swipes and can use FNB’s extensive ATM network. Some transactions have costs, so you need to understand the fee structure, but for basic grant reception, it’s a strong choice.

Our Verdict: For most SASSA beneficiaries, TymeBank or the FNB Easy Zero account are the most cost-effective options due to their zero monthly fees. Capitec is a close second with its powerful app and low transaction costs. Any of these three is a massive upgrade from the old system.

Step-by-Step: How to Switch Your SASSA Payment to Your New Bank Account

Ready to make the change? It’s simpler than you think. You do not need to visit a SASSA office. You can do it online.

- Open Your New Account: First, go to Capitec, TymeBank, or FNB and open one of the low-cost accounts mentioned above. Get your official, stamped bank statement or proof of account.

- Visit the SASSA Website: Go to the official SASSA SRD website (srd.sassa.gov.za).

- Find the Banking Details Section: Look for the option to change or submit your banking details. You will need your ID number.

- Follow the Prompts: The system will send an SMS to your registered phone number with a secure link. Click it.

- Enter Your New Bank Details: Carefully enter your new bank name, account number, and branch code. Double-check everything for accuracy.

- Submit and Wait: Submit the details. SASSA will then verify your new account. This can take a few days. The change will typically apply from the next payment cycle.

Before you do anything, it’s wise to perform an SRD Status Check to ensure your grant is active for the upcoming month.

Your Financial Shield: How to Report and Block Illegal Deductions

If you see a deduction you don’t recognize, you must act immediately. You have rights, and there are official channels to fight back.

- Step 1: Contact Your Bank: Call your bank’s fraud department immediately. Instruct them to reverse the debit order (if it’s within 40 days) and block the company from debiting you in the future.

- Step 2: Fill Out the SASSA Affidavit: SASSA has a specific form for reporting unauthorized deductions. You can get this at a SASSA office. Complete it and submit it. This officially logs your complaint.

- Step 3: Lodge a Complaint with a Regulator: If it’s a loan-related issue, complain to the National Credit Regulator (NCR). If it’s an insurance policy, complain to the Financial Sector Conduct Authority (FSCA).

Never give your PIN or personal details to anyone. No one from SASSA or a bank will ever ask for your PIN.

Beyond Survival: Making Your Grant Work for You

Protecting your grant is the first step. The next is making it grow. Even saving R20 or R50 per month from your grant can make a huge difference over time. Use your new banking app to open a savings pocket. Set a small, achievable goal. This simple act is the first step from dependency towards financial freedom. It builds a buffer for emergencies so that you’re less likely to fall for a predatory loan when a crisis hits. Your grant is a tool; use it to build a better future, not just to survive the present.

Frequently Asked Questions

Which bank is the absolute best for SASSA grants in 2026?

Can SASSA legally deduct money for funeral cover or airtime?

How do I stop EasyPay Everywhere (green card) from taking my money?

Is it safe to change my SASSA banking details online?

Will I get my money this month if I change my bank details now?

What is the fastest way to get help with a payment problem?

Are store accounts a good idea for SASSA beneficiaries?

How can I check if a lender is registered and not a loan shark?

Read Next

The R350 SASSA Trap: How Banks and Lenders Target Your Grant in January 2026

An in-depth 2026 investigation into the predatory financial products targeting …

SASSA January 2026 Payment Dates: The Confirmed Schedule & Why Your R350 Might Be Delayed

Get the official, confirmed SASSA payment dates for January 2026 for all grants, …

Comments & Discussions