Table of Contents

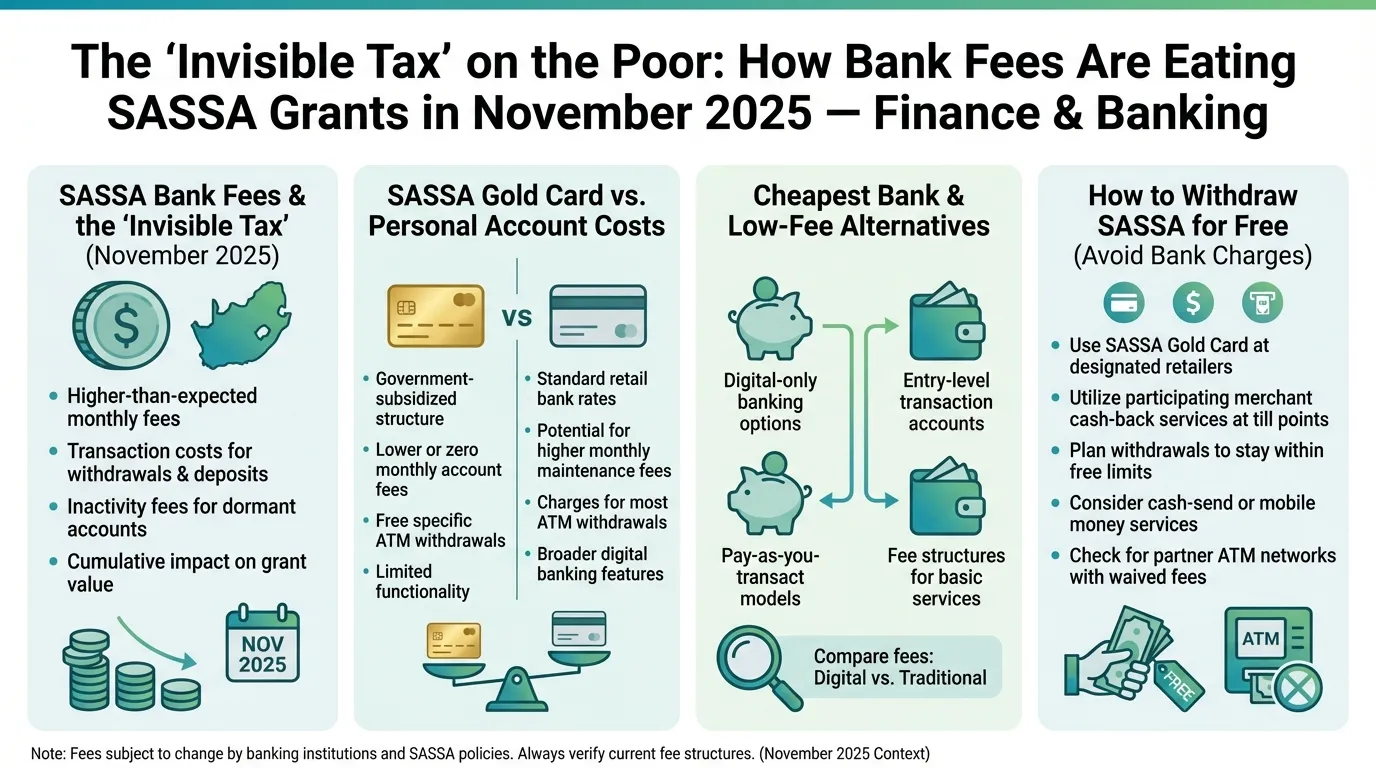

Discover the hidden banking fees depleting SASSA grants in November 2025. Our financial analysis compares Gold Cards, high street banks, and digital accounts to help you save every Rand. Learn the ‘Retailer Strategy’ and stop paying to get paid.

The Silent Thief in Your Pocket: November 2025 Financial Alert

It is November 2025, and as South Africans brace for the expensive festive season, a silent thief is operating in plain sight. It’s not a scammer sending SMS links, and it’s not a glitch in the SASSA system. It is the subtle, cumulative erosion of your grant through banking fees and withdrawal charges.

For a beneficiary relying on the SRD grant (currently R370), losing even R20 to a withdrawal fee represents a significant percentage of their total income. Yet, millions of beneficiaries unknowingly donate this money to financial institutions every month simply by using the wrong withdrawal method or ATM.

This article is not just a news update; it is a financial intervention. We are breaking down the real cost of accessing your money in late 2025 and providing a strategy to stop the leak immediately.

The Math of Poverty: Why R370 Isn’t Really R370

Let’s look at the cold, hard numbers for November 2025. If you are banking with a traditional ‘Big Four’ bank and you withdraw your cash at a different bank’s ATM (SASwitch), you could be paying upwards of R25 to R35 per transaction. Add a balance enquiry fee (often R8-R10 at ATMs) and a monthly account fee (R5-R10 for entry-level accounts), and you could easily lose R50 of your grant instantly.

R50 is roughly 13.5% of a R370 grant.

Imagine if the wealthy paid a 13.5% tax just to withdraw their salary? There would be outrage. Yet, this is the reality for many SASSA beneficiaries who have been pushed towards ‘Personal Bank Accounts’ without proper financial education on fee structures.

The 2025 Banking Showdown: Gold Card vs. Digital vs. Traditional

In the landscape of November 2025, not all payment methods are created equal. Here is our unfiltered analysis of where your money is safest from fees:

1. The SASSA Gold Card (Postbank)

- The Pro: It remains the king of fee-free transactions at participating retailers (Boxer, Pick n Pay, Shoprite, Checkers, Usave). You swipe, you get cash, you pay zero fees. Three free cash withdrawals at retailers per month.

- The Con: Reliability issues and system glitches at Postbank have historically plagued this method, leading to fears of cards not working when needed.

2. Digital Challengers (TymeBank, Bank Zero)

- The Pro: These banks have revolutionized low-cost banking. TymeBank, for example, allows free withdrawals at Pick n Pay and Boxer till points. Their monthly account fees are often zero.

- The Con: Cash deposits (if you ever need to add money) can attract fees, and using their card at a traditional ATM is still expensive.

3. Traditional Banks (Capitec, FNB, Standard Bank, Absa, Nedbank)

- The Pro: Reliability. You know the money is there, and their apps work.

- The Con: If you are not on a specific ’lifeline’ or low-income account package, the fees can be brutal. Withdrawing cash at an ATM is the most expensive way to access your grant.

The ‘Retailer Strategy’: How Smart Beneficiaries Pay Zero Fees

If you take one thing away from this article, let it be the Retailer Strategy. In 2025, the ATM is your enemy. The till point is your friend.

Most major South African retailers offer ‘Cash Back’ or ‘Cash at Till’ functionality. This effectively turns the cashier into a human ATM. The cost? usually significantly lower than an ATM, and often free depending on your bank and the store partnership.

The Strategy:

- Stop checking balances at ATMs. Use your phone (USSD or App) to check your balance for free or very low cost.

- Go to a retailer. Shoprite, Checkers, Boxer, Pick n Pay, or Usave.

- Buy a small essential item (like a loaf of bread or bar of soap) that you need anyway.

- Draw your full cash amount at the till.

By bundling your withdrawal with a necessary purchase, you often bypass the standalone ‘withdrawal fee’ structure of many banks, or pay a flat, low rate (e.g., R2-R4) compared to the R20+ at an ATM.

Why Switching Payment Methods NOW (November) Matters for December

December is the busiest month for the banking system. ATMs run out of cash, queues at retailers stretch for blocks, and systems go offline due to volume.

If you are currently stuck in a high-fee banking option, November 26 to November 30 is your window of opportunity to switch.

Changing your banking details on the SASSA SRD portal takes time to verify (usually 7-14 days). If you update your details now to a lower-cost bank (like a TymeBank account or a low-fee Capitec EasyAccount), the change should be active in time for the December payment cycle.

Warning: Do not switch your bank account if your November payment is currently ‘Processing’. Wait until the money is in your hand, then switch immediately for the next month.

Common ‘Fee Traps’ to Avoid in Late 2025

We’ve analyzed beneficiary complaints from social media and news reports in late 2025. Here are the most common ways people are accidentally losing money:

- The ‘Insufficient Funds’ Fee: If you try to swipe or withdraw R370 but only have R360 in your account (because a monthly fee was deducted), the transaction fails. The bank then charges you a ‘Declined Transaction Fee’ (often R5-R8). You lose money for having no money. Always check your balance on your phone first.

- The SMS Notification Trap: Many accounts charge 50c to R1 per SMS notification. For a R370 grant, turning off SMS notifications and using the free Banking App notifications instead can save you R12+ a year. It’s small, but it adds up.

- The ‘Wrong ATM’ Penalty: Withdrawing from a SASwitch ATM (an ATM that doesn’t belong to your bank) is the fastest way to lose R30. Walk the extra blocks to find your own bank’s ATM or, better yet, use a retailer.

Step-by-Step: How to Change Your Banking Details for Cheaper Fees

Ready to stop the financial bleeding? If you’ve opened a new, lower-cost bank account, here is how to update SASSA immediately:

- Go to the Official SRD Website: Visit srd.sassa.gov.za.

- Scroll to ‘How do I change my banking details’: Click the section for South African ID Holders.

- Enter ID Number: A One-Time Pin (OTP) will be sent to your registered cell phone.

- Capture the OTP: Enter the pin to access your secure profile.

- Select ‘Bank Account’: Do not select ‘Cash Send’ if you want to avoid collection queues. Select ‘Bank Account’.

- Enter New Details: Input your new bank name, branch code, and account number accurately.

- Submit: SASSA will verify this with the bank. This status usually changes to ‘Verification Pending’.

Opinion: Financial Dignity is a Right

It is easy to dismiss R20 or R30 as ‘small change’. But in the context of South Africa’s social security, it is a matter of dignity. The financial sector has a responsibility to ensure that social grants are not treated as a revenue stream for corporate fees.

Until a policy change enforces fee-free grant accounts across all banks, the burden of knowledge falls on you, the beneficiary. You must be smarter, sharper, and more strategic than the system designed to profit from you. Treat your banking choice as a business decision. Your ‘business’ is managing your survival, and you cannot afford unnecessary overheads.

Conclusion: Take Back Your R370

As we head towards the end of 2025, do not let lethargy or habit cost you money. Check your bank statement today. Look for ‘Withdrawal Fee’, ‘Service Fee’, or ‘SASwitch Fee’. If you see them, you are paying a poverty tax.

Use the remaining days of November to restructure how you receive your money. Whether it’s switching to a digital bank, committing to the retailer withdrawal method, or simply stopping the balance enquiry habit, you have the power to give yourself a ‘raise’ simply by cutting costs.

Frequently Asked Questions

Which bank is the cheapest for SASSA grants in 2025?

How much does it cost to withdraw SASSA money at an ATM?

Can I change my SASSA banking details in November 2025?

Is the SASSA Gold Card expiring in 2025?

Why did I get less than R370 in my account?

How do I check my SASSA balance without paying a fee?

Can I use TymeBank for SASSA SRD?

What is the best way to avoid long queues in December 2025?

Read Next

SASSA Grant Declined in January 2026? The Hidden Reasons & Your 4-Step Fix

Received a shocking ‘Declined’ status for your January 2026 R350 …

The Real Reason SASSA's February 2026 Payment Dates Will Squeeze You Dry (And How to Survive)

This is the official SASSA payment schedule for February 2026. We expose why the …

Comments & Discussions