Table of Contents

A deep dive into the financial products marketed to SASSA beneficiaries in South Africa for 2025. We expose the truth behind ‘zero-fee’ bank accounts, the dangers of easy-qualify loans, costly funeral policies, and how to fight back against illegal debit order deductions. Learn to choose the right bank, manage your money, and make your grant last longer.

The Hard Truth: Your SASSA Grant is a Target

Let’s be brutally honest. For millions of South Africans, the SASSA grant is not just support; it’s a lifeline. But for a vast financial industry, that lifeline is seen as a guaranteed monthly income stream ripe for the picking. Every month, as the SASSA payment dates approach, a silent battle for your money begins. Banks, micro-lenders, and insurance companies have built entire business models around your grant. In December 2025, this issue has reached a crisis point. Beneficiaries report losing anywhere from R50 to R200 or more before they even touch their cash, all due to a complex web of fees, deductions, and financial products they often don’t understand or remember signing up for. This isn’t just a financial problem; it’s an assault on the dignity of the most vulnerable.

The ‘Zero-Fee’ Bank Account Myth of 2025

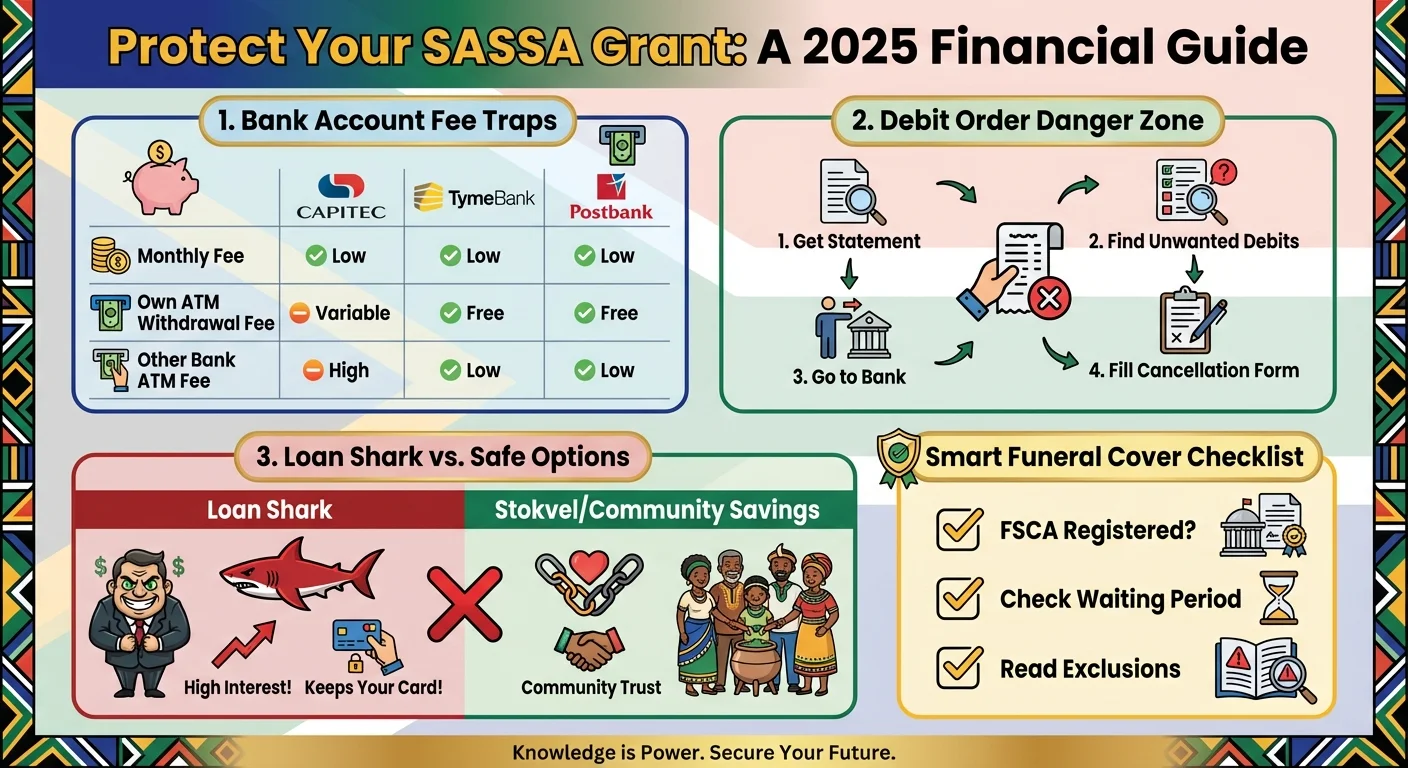

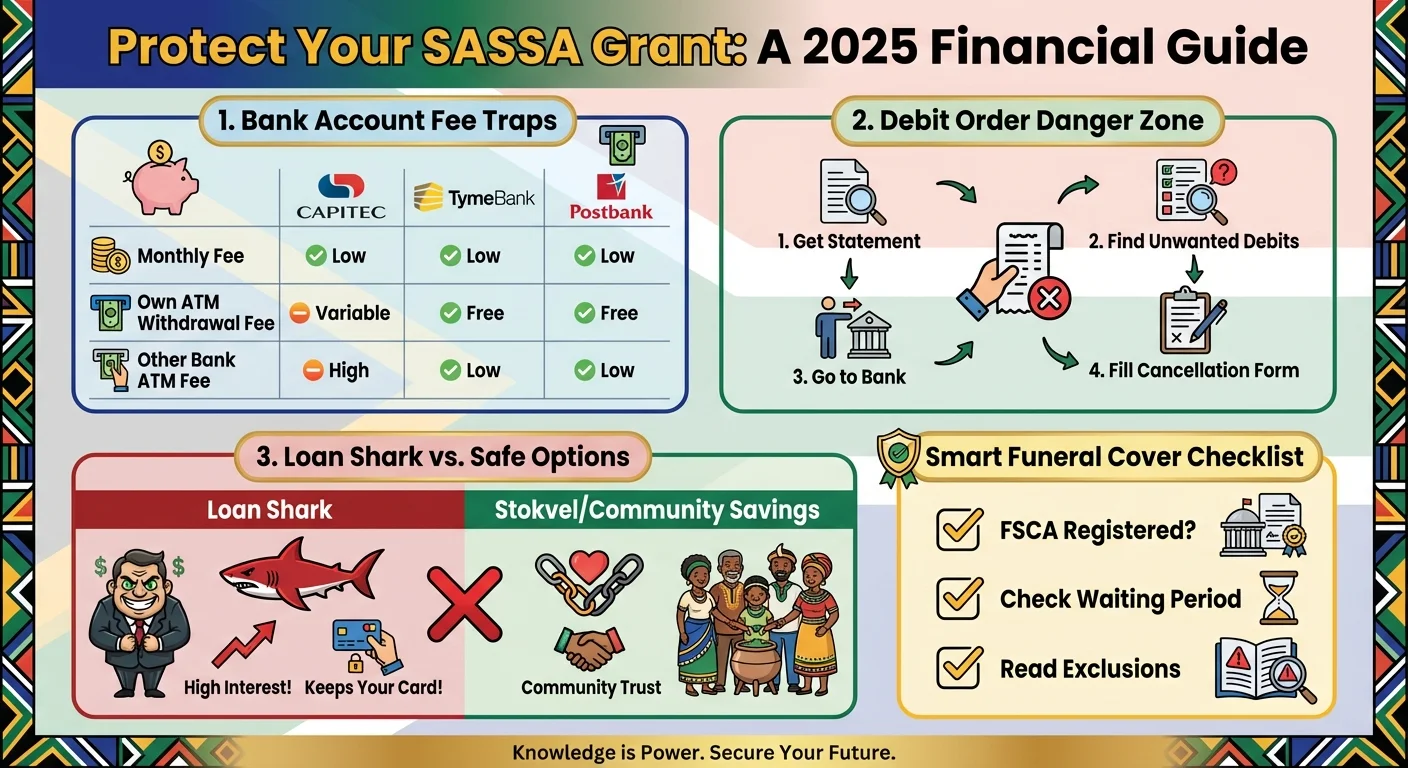

The government and SASSA have actively encouraged beneficiaries to move from cash pay points to bank accounts for safety and convenience. Banks have responded with a flood of ’easy-access’, ’low-cost’, or even ‘zero-fee’ accounts specifically for grant recipients. But is ‘free’ really free? Our 2025 analysis says a resounding ’no’.

The Hidden Cost Breakdown:

- Withdrawal Fees: The account might have no monthly fee, but withdrawing cash costs money. Using another bank’s ATM can cost you R10 - R20 per withdrawal. A few trips to the ATM can quickly add up to R50.

- Failed Debit Order Fees: This is a major trap. If a company tries to deduct money and your balance is too low, the bank charges you a penalty fee, often between R20 and R50. You lose money for not having enough money.

- Statement Fees: Need a printed statement from the branch? That’ll be R25, please. Want to check your balance at an ATM? That’s another R2.

- Decline Fees: If you try to pay with your card and the transaction is declined for insufficient funds, some banks will still charge you a fee.

These small amounts seem insignificant, but over a year, they can amount to an entire month’s grant disappearing into bank coffers. The Postbank account, while often recommended, has also faced its own challenges with system glitches and accessibility, proving that no single solution is perfect.

Debit Order Danger: The Silent Grant Killers

A debit order can feel like a ghost in your account—a silent, invisible force that takes your money before you wake up on payment day. While legitimate debit orders for things like a cell phone contract or store account exist, a predatory industry has emerged targeting SASSA beneficiaries.

High-pressure salespeople at pension payout points or shopping centres often sell airtime, electricity, or insurance policies that come with a debit order form. In a rush, many people sign without fully understanding the long-term cost. The result? A R99 deduction here, a R120 deduction there, and suddenly your R2,080 Older Persons Grant is down to R1,800. Fighting these is difficult and time-consuming, a process many elderly or infirm grant recipients simply cannot manage.

How to Fight Back: Your 2025 Debit Order Cancellation Guide

You have the right to control your money. The National Payment System Act gives you the power to dispute and cancel debit orders. Here is the process for 2025:

- Get Your Bank Statement: Go to your bank branch or use an ATM to get a 3-month statement. Don’t rely on your SMS notifications.

- Identify Unauthorized Deductions: Scrutinize every single debit order. If you don’t recognize the company name or the service, flag it immediately.

- Visit Your Bank Branch: Go to the enquiries desk and state clearly: ‘I want to dispute and cancel an unauthorized debit order.’

- Fill Out the Mandated Form: The bank must provide you with a specific form for this purpose. Fill it out completely. You do not need to contact the company that is deducting the money yourself; the bank must act on your instruction.

- Demand a Reversal (If Possible): For recent deductions (usually within the last 40 days), you can request that the bank reverses the payment. Success can vary, but it’s crucial to ask.

- Get Proof: Do not leave the bank without a stamped copy of your cancellation form or a reference number. This is your evidence if the deduction continues.

The Funeral Cover Dilemma: Peace of Mind or Predatory Premiums?

Ensuring a dignified burial is a profound cultural and personal priority. Sadly, this deep-seated need is exploited. Beneficiaries are often sold funeral policies with premiums of R150-R250 per month, promising massive payouts. However, the fine print often contains clauses that make claims difficult, or the premiums are disproportionately high for the cover provided.

Before you sign up for any funeral cover in 2025, ask these questions:

- Is the provider registered? Ask for their Financial Sector Conduct Authority (FSCA) license number.

- What is the waiting period? Some policies have a 6-month or even 12-month waiting period for natural death. If the person passes away before this, you get nothing but your premiums back.

- What are the exclusions? Are there specific causes of death that are not covered?

- Are there premium increases? Will your premium go up every year? By how much?

Consider reputable, well-known insurers or even your bank’s own insurance products, which are often more regulated and transparent than policies sold on the street.

Loan Sharks in Disguise: ‘Easy-Qualify’ Loans and Their True Cost

When an emergency strikes, an ‘instant loan’ advertised via SMS or a flyer can seem like a godsend. These lenders often target SASSA recipients because they have a guaranteed income. But the cost is astronomical. While registered micro-lenders have caps on interest rates, illegal loan sharks (mashonisas) and many online lenders operate in a grey area.

A R1,000 loan can easily require a R1,500 repayment by your next grant payment date—a 50% interest rate in just one month. Defaulting leads to a spiral of debt that is nearly impossible to escape. They often illegally demand to keep your SASSA card and PIN as ‘security’, giving them complete control over your grant.

Never, under any circumstances, give your SASSA card and PIN to anyone. It is illegal and gives them total power over your livelihood.

Smarter Choices: The Best Banking Options for SASSA Grants in 2025

Choosing the right bank account is your first line of defense. Here’s a look at the popular options for December 2025:

- Capitec Global One: Highly popular due to its low monthly fee (around R5) and user-friendly app. Withdrawals at Capitec ATMs are cheap, but more expensive at other banks. Good for those who are comfortable with technology.

- TymeBank EveryDay Account: A strong contender with no monthly fees. It partners with Pick n Pay and Boxer stores for cash withdrawals, which can be cheaper than traditional ATMs. A great digital-first option.

- Postbank SASSA Account: Specifically designed for grants and has no monthly fee. The primary advantage is free withdrawals at Post Office branches and select retailers. However, it has been plagued by system downtime and long queues, which can be a significant drawback.

- Major Banks (FNB, Absa, Standard Bank, Nedbank): All offer entry-level accounts. They may have slightly higher fees but offer a much larger ATM network. Compare their ‘basic’ or ‘access’ accounts carefully.

The verdict: There is no single ‘best’ account. The right choice depends on your needs. If you live near a Pick n Pay, TymeBank might be cheapest. If you prefer a physical branch, Capitec or another major bank might be better, despite slightly higher fees. Check your SRD R350 Status Check to ensure your details are updated once you choose a new bank.

The Power of Stokvels: A Community-Based Alternative

Before turning to a loan shark, consider the power of your community. Stokvels, or community savings clubs, have been the financial backbone of South African communities for generations. By pooling a small amount of money (e.g., R100) from your grant each month with a group of trusted friends or neighbours, you create a collective fund that can be used for emergencies, school fees, or even starting a small business. It’s a system built on trust, not credit scores, and there’s no interest to pay back. It’s a powerful, traditional solution to the modern problem of financial exclusion.

Conclusion: Take Back Control of Your Grant

Your SASSA grant is your constitutional right and a tool for your survival and well-being. It is not a passive income for financial institutions. The system may seem complex and rigged against you, but knowledge is power. By choosing the right bank account, scrutinizing every debit order, being cautious about loans and insurance, and leveraging community-based savings, you can protect your grant. In 2025, the call to action is clear: be vigilant, ask questions, and be the master of your own money. Your financial dignity depends on it.

Frequently Asked Questions

What is the cheapest bank account for my SASSA grant in 2025?

Can I get a loan if I receive a SASSA grant?

How do I stop an illegal debit order from my SASSA account?

Is funeral cover sold on the street or over the phone legitimate?

Why are there so many deductions from my child support grant?

Can a shop keep my SASSA card if I owe them money?

What happens if a debit order fails because I have no money?

Should I change my SASSA payment method to a bank account?

Read Next

Why Your SASSA Grant Is Secretly Costing You R500 a Month in 2025

Millions of SASSA beneficiaries are losing hundreds of Rands from their grants …

Why Your SASSA Grant is a Gamble in December 2025: The Truth They Won't Tell You

Official SASSA payment dates for December 2025 are out, but a perfect storm of …

Comments & Discussions