Table of Contents

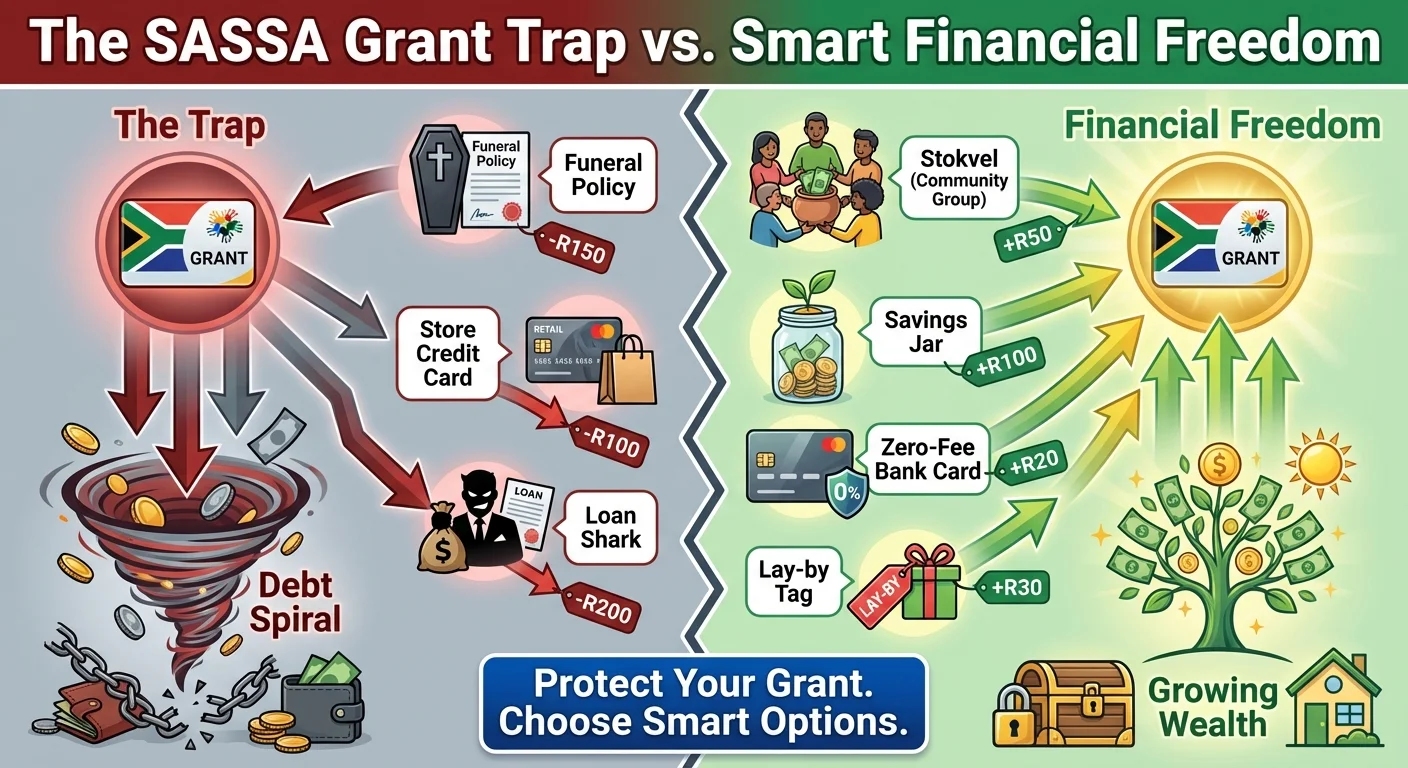

Are you losing hundreds of Rands from your SASSA grant each month? This investigative report for December 2025 unpacks the truth about predatory funeral policies, high-interest store cards, and other financial products targeting grant recipients. Learn your rights, how to stop illegal deductions, and how to make your grant work for you, not against you.

The Silent Thief: How R50 Here and R100 There Bleeds Your Grant Dry

It’s the end of the month, and you’re anxiously waiting for your SASSA payment notification. When it finally arrives, the amount is less than you expected. You check your slip and see it: a deduction for ‘funeral policy’, another for ‘airtime’, maybe one for a store account. Individually, they seem small, but together they represent a silent thief that’s robbing you of your lifeline. This isn’t just bad luck; it’s a calculated system targeting South Africa’s most vulnerable. As we head into December 2025, a time of high expenses, this problem is becoming a crisis. Millions are caught in the ‘SASSA Trap,’ where their grant is spent before it even hits their hands, leaving them with little to nothing for food, electricity, and transport.

Analysis: Why Are SASSA Beneficiaries a Prime Target?

Why do these companies focus so heavily on grant recipients? The answer is brutally simple: guaranteed income. Every month, the government ensures that millions of grants are paid on a predictable schedule. For lenders and insurance companies, this is a low-risk goldmine. They know the money will be there. Aggressive marketers often operate in areas near SASSA pay points or community centres, signing people up for products they don’t fully understand or can’t truly afford. They sell the dream of a ‘dignified burial’ or the convenience of a store card, but they conveniently omit the fine print: high premiums, escalating interest rates, and harsh penalties for missed payments. This isn’t sound financial planning; for many companies, it’s a predatory business model built on the backs of the poor.

The Funeral Cover Fallacy: Is Your R150 a Month Really Worth It?

In our culture, providing a dignified funeral is paramount. It’s a sign of respect and love. And it is this deep-seated cultural value that is being exploited. Companies sell policies for R100, R150, or even R250 a month, promising a payout of R10,000 or R15,000. Let’s do the maths for 2025. If you’re paying R150 per month, that’s R1,800 per year. Over five years, you’ve paid R9,000. If the policy only pays out R10,000, you’ve almost paid for the entire benefit yourself, and the insurance company has taken your money for years. Many of these policies have strict clauses, refusing to pay out for certain conditions or if a single payment is missed. Our analysis is clear: While funeral cover isn’t inherently bad, many plans sold to grant recipients offer terrible value for money. They are designed for profit, not for your peace of mind.

Smarter Alternative #1: The Power of Stokvels and Community Savings

Instead of giving R150 a month to a large corporation, consider the age-old tradition of a burial stokvel. A group of 20 trusted community members each contributing R150 per month creates a pool of R3,000 every single month. When a member passes away, the family can receive a significant, immediate cash injection—often far more than a cheap insurance policy would provide, and without the red tape. This method keeps the money within the community, builds social bonds, and offers a transparent, flexible alternative. It’s about community empowerment, not corporate profit.

The Store Card Debt Spiral: ‘30% Off’ Today, 300% Stress Tomorrow

That offer to open a store card seems tempting. You get a discount on your first purchase, and you can buy clothes for the kids or groceries on credit. But this is a dangerous door to walk through. Store cards often come with the highest interest rates in the credit market, sometimes exceeding 25% per annum. A R1,000 purchase can quickly balloon into R1,500 or more if you only make the minimum payments. The debit order is set up against your SASSA account, ensuring they get paid first, leaving you with the crumbs. It creates a cycle of debt that is nearly impossible to escape on a limited grant income. You end up paying a premium for basic goods and sacrificing your food budget to service high-interest debt.

Smarter Alternative #2: Lay-by and Zero-Fee Bank Accounts

Resist the urge for instant gratification. The old-fashioned lay-by system is your best friend. It’s interest-free and forces you to save for what you want. You own the item outright when you’ve finished paying, with no debt hanging over your head. Furthermore, instead of using the standard SASSA Postbank account, explore the zero-fee or low-cost bank accounts offered by major banks like Capitec, TymeBank, or FNB Easy Zero. These accounts give you more control, allow you to set up savings pockets, and make it easier to manage your money without incurring high bank charges. A proper bank account is the first step towards financial empowerment. Check your SASSA Payment Dates for 2025 and plan your budget using a dedicated savings pocket in one of these accounts.

Know Your Rights: The Law is On Your Side (But You Have to Act)

The Social Assistance Act and the National Credit Act offer you protection. It is illegal for lenders to grant you a loan that you cannot afford—this is called reckless lending. Furthermore, according to SASSA’s regulations, only one deduction (for a funeral policy from an approved provider, not exceeding 10% of the grant value) is legally permissible directly from your grant. All other debit orders for loans, airtime, water, or electricity are not allowed to be deducted before the money reaches your personal bank account. If you see multiple deductions or suspect you’re a victim of reckless lending, you have the right to fight back.

Steps to Dispute Deductions:

- Get Bank Statements: Obtain a clear statement showing the unauthorized or disputed deductions.

- Contact the Company: Call the company deducting the money and formally request they stop. Keep a record of the call.

- Submit a Dispute Form: Go to your bank branch and fill out a debit order dispute form. They are legally obligated to help you reverse unauthorized debits.

- Report to SASSA: Call the SASSA toll-free helpline at 0800 60 10 11 to report the illegal deductions from your account.

The Danger of ‘Easy’ Loans: A Fast Track to Poverty

When an emergency strikes, a quick loan seems like the only option. But the ‘mashonisas’ (loan sharks) and payday lenders that pop up around pay points are financial predators. Their interest rates are astronomical, and their collection methods can be ruthless. Taking a R500 loan could mean you owe R1000 by the next grant payment. Defaulting can lead to threats and the seizure of your ID book or SASSA card—which is illegal. No legitimate lender will ever ask to hold your card or ID. These loans are a trap designed to enslave you in a permanent cycle of debt.

Smarter Alternative #3: Building an Emergency Fund, R50 at a Time

The only real defence against loan sharks is to have your own emergency savings. It sounds impossible on a grant, but it’s not. Start small. Commit to saving just R50 from your grant each month. Put it in a separate savings pocket in your low-fee bank account. After one year, you will have R600. It might not seem like much, but it’s R600 that you don’t have to borrow at a crippling interest rate when the school shoes break or you need emergency medicine. This discipline builds a buffer between you and financial disaster. It’s the difference between control and desperation. If you’re on the SRD grant, you can use our SRD R350 Status Check guide to confirm your payment and then immediately transfer a small portion to savings.

Conclusion: Reclaim Your Grant, Reclaim Your Power

Your SASSA grant is a lifeline, not a revenue stream for predatory companies. It is your constitutional right, intended to provide a basic level of dignity. Allowing it to be chipped away by high-cost funeral policies, store cards, and loans is a surrender of your financial power. The system is challenging, but not unbeatable. By understanding your rights, choosing smarter community-based alternatives like stokvels, embracing budgeting tools like low-fee bank accounts, and building a small emergency fund, you can break the cycle. This December 2025, make a resolution to own your grant fully. Question every deduction. Say no to tempting but toxic credit offers. Your financial freedom depends on it.

Frequently Asked Questions

Is it legal for a company to deduct money from my SASSA grant for a loan?

How can I stop an unauthorized debit order from my SASSA account in 2025?

Is taking out a funeral policy a bad idea if I am on a SASSA grant?

Can I get a loan from a bank if I only receive a SASSA grant?

What is the best bank account for a SASSA beneficiary in 2025?

Should I use my grant money to open a store card for groceries?

What is a 'DebiCheck' and how does it affect my grant?

My grant was declined this month, what can I do?

Read Next

SASSA's Early December 2025 Payments: Your Guide to Avoiding the 'Janu-worry' Financial Trap

SASSA has confirmed early payment dates for December 2025 due to the holidays. …

Why Thousands of SASSA R350 Grants Failed in December 2025: The Investigation

An in-depth investigation into the widespread SASSA R350 payment failures of …

Comments & Discussions