Table of Contents

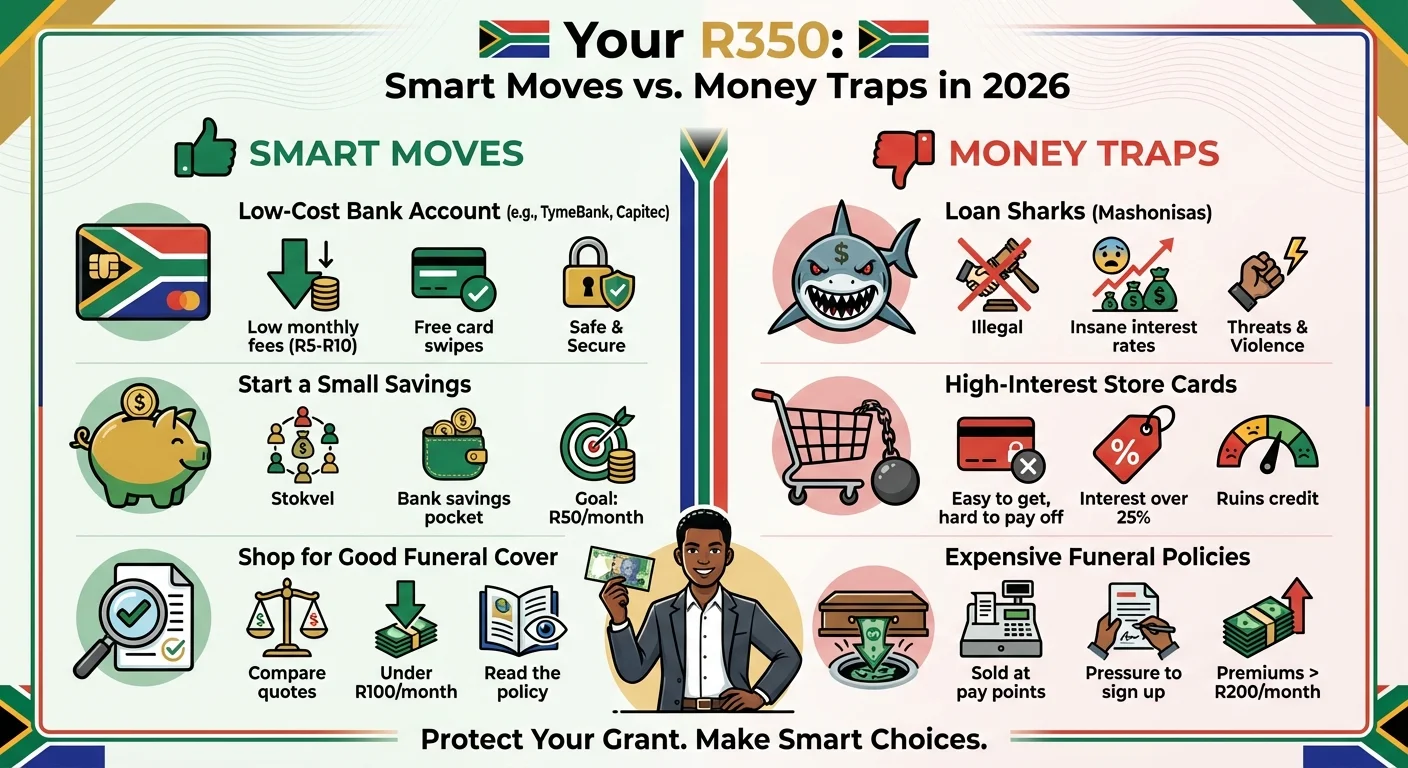

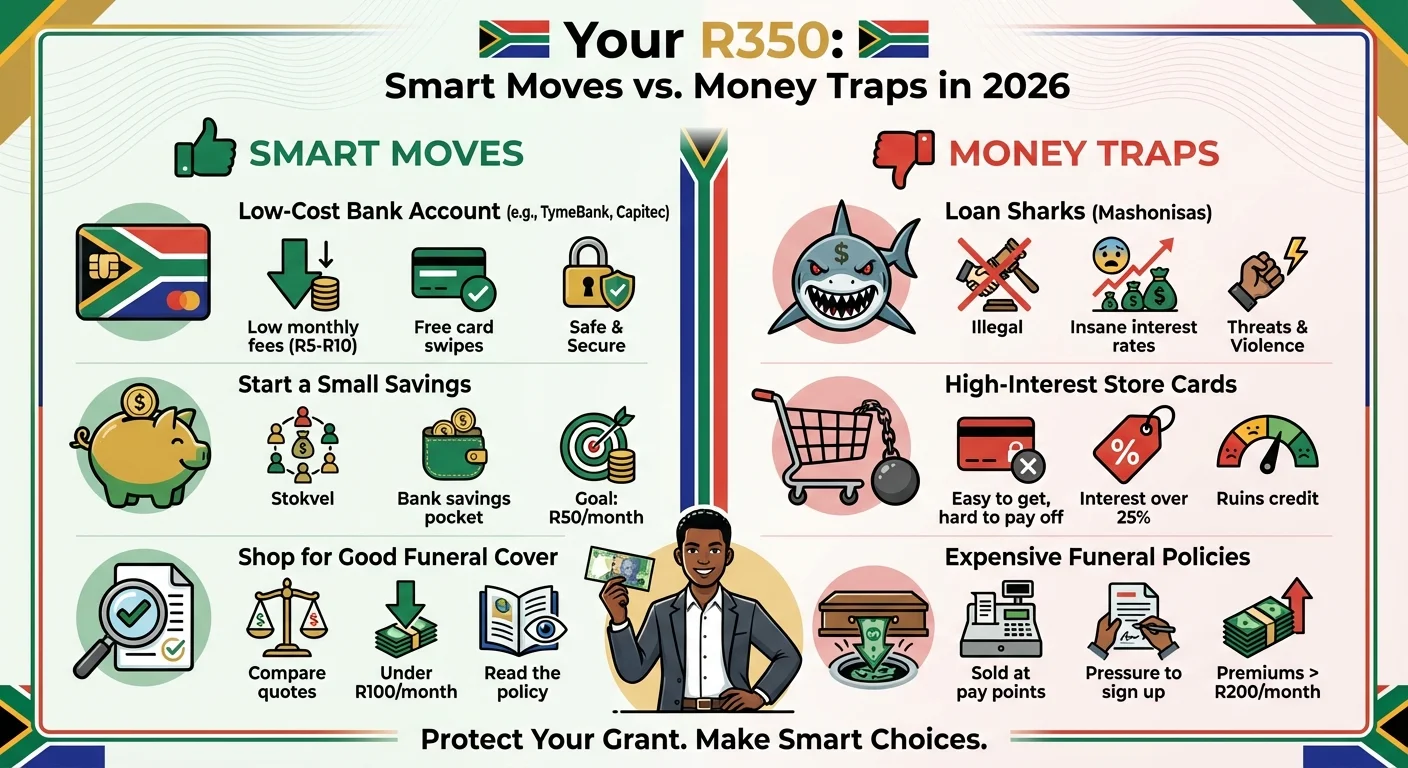

An in-depth financial guide for South African SASSA beneficiaries in January 2026. We investigate the hidden costs of banking, the dangers of predatory lenders and expensive funeral policies, and compare the best low-cost bank accounts from Capitec, TymeBank, and more. Learn how to switch your grant payment safely, avoid illegal deductions, and make your R350 work for you, not against you.

The New Reality of January 2026: Your Grant, Their Target

Welcome to January 2026. The era of the SASSA Gold Card, managed by Postbank, is officially over. While the government promised a smoother transition, the reality for millions is one of confusion and vulnerability. You’ve been pushed into the open waters of commercial banking, and let’s be blunt: banks, lenders, and insurers see your monthly grant as a guaranteed income stream they want a piece of. This isn’t just about finding a new card; it’s about navigating a system designed to extract fees and sell you products you may not need. The battle for your R350 (or more, depending on your grant) has begun, and if you’re not careful, a significant portion of your money could disappear before you even use it.

The Hidden Costs: How Your R350 Grant Shrinks Before Your Eyes

That grant money hits your account, and you breathe a sigh of relief. But how much of it are you actually taking home? The new banking system introduces a minefield of small deductions that add up to a significant loss.

- Monthly Account Fees: Some bank accounts charge a ‘monthly maintenance fee’ of anywhere from R10 to R50. That’s a huge chunk of an R350 grant.

- Withdrawal Fees: Every time you draw cash, it costs you. Withdrawing R100 might cost you R8 at one ATM and R15 at another. Four small withdrawals could cost you over R40 in fees alone.

- ‘Decline’ Fees: Did you try to buy something but didn’t have enough funds? Some banks charge you a fee for that failed transaction.

- Unauthorised Debit Orders: The most dangerous trap. Predatory lenders and unscrupulous companies can get you to sign up for services (like airtime or electricity) that deduct money from your account automatically, often without your full understanding.

Suddenly, your R350 grant is effectively R280. This isn’t an accident; it’s a business model. We’ll show you how to fight back.

EXPOSED: The Top 3 Financial Traps Targeting You in 2026

Financial predators are more sophisticated than ever in 2026. They know when you get paid and they know you’re often in desperate need. Here are the three biggest traps to watch out for:

The ‘Friendly’ Loan Shark (Mashonisa): They offer quick cash with no paperwork, often right near pay points or on WhatsApp. The catch? The interest rates are illegal and astronomical. A R500 loan can become a R1,500 debt in a single month. They often demand your bank card and PIN as ‘security,’ emptying your account the moment your grant arrives. They are not your friends; they are criminals profiting from your hardship.

The High-Pressure Funeral Policy: A dignified burial is important to everyone, and salespeople know this. They’ll use emotional pressure to sell you expensive funeral policies with premiums of R150-R300 per month. For many grant recipients, this is simply unaffordable and leaves little money for food and necessities. There are much cheaper, more effective options available if you know where to look.

The ‘Easy’ Store Card: Retailers make it incredibly simple to get a store card. It feels like free money until the first statement arrives. With interest rates often exceeding 25%, that R400 grocery purchase can quickly spiral into a debt of R1000 or more if you only make minimum payments. They are designed to keep you in a cycle of debt.

Your Banking Shield: 2026’s Best Low-Cost Bank Accounts for SASSA Grants

Choosing the right bank account is your single most important defence. You need an account with minimal costs that protects your money. Here is a comparison of the top contenders for January 2026.

Do your own research as fees can change, but here’s a general guide:

| Bank | Typical Monthly Fee (Approx.) | Key Benefit for Grant Recipients |

|---|---|---|

| TymeBank | R0 | No monthly fees. Cash withdrawals are cheap at Pick n Pay or Boxer. |

| Capitec | ~R7 | Low fees, great app, and ‘PayShap’ for instant payments. |

| FNB Easy Zero | R0 | No monthly fee, but withdrawals at other banks’ ATMs can be expensive. |

| Standard Bank MyMo | ~R6.95 | Established bank with a wide ATM network. |

Our Verdict: For most SRD R350 recipients, TymeBank and Capitec offer the best combination of low fees and accessibility. They are designed for the digital age and have fewer of the legacy costs that burden older banks. Your goal is to keep as much of your grant as possible, and that starts with minimising bank charges.

Step-by-Step Guide: How to Switch Your SASSA Payment to Your New Bank Account

Once you have chosen your new, low-cost bank account, you must inform SASSA. It is critical that you do this yourself to prevent fraud. Do not give your details to anyone promising to do it for you.

- Get Your Documents Ready: You will need your 13-digit South African ID number and the mobile phone number you used in your application. Most importantly, you need proof of your new bank account. This can be a bank statement or a letter from the bank, clearly showing your name and account number.

- Go to the Official SASSA Website: Visit the official SASSA SRD website. Look for the option ‘How do I change my banking details’.

- Follow the Secure Link: You will be prompted to enter your ID number. An SMS with a secure link, unique to you, will be sent to your registered mobile number.

- Click the Link and Enter Details: Open the link in the SMS and carefully follow the instructions. You will be asked to submit your new bank account details (Bank Name, Account Number, Branch Code). Double-check that every digit is correct.

- Wait for Verification: SASSA will take some time to verify your new banking details. This can take several days. It’s best to do this right after you’ve received a payment, not just before the next one is due. You can keep an eye on your application status using the SRD Status Check tool.

Warning: The process can be slow. Be patient and never share that secure SMS link with anyone.

The Funeral Cover Dilemma: Necessary Protection or Expensive Trap?

Funeral cover is not inherently bad, but the way it’s sold to grant recipients often is. You should never feel pressured into a policy that takes up 40% of your monthly grant.

Smart Questions to Ask Before Signing Anything:

- What is the total monthly premium? Get the final Rand amount.

- What is the waiting period? Most policies have a waiting period for death by natural causes (e.g., 6 months). You are usually only covered for accidental death immediately.

- Who exactly is covered? Is it just you, or your spouse and children too? How much does adding people cost?

- Can I get a better deal? Shop around! Do not sign up with the first person you meet. Ask for quotes from at least three different reputable providers.

Rule of Thumb for 2026: A reasonable funeral policy for a single grant recipient should not cost more than R80-R120 per month. If you are being quoted more, you are likely being overcharged.

The R50 Savings Challenge: How to Build a Financial Cushion, Bit by Bit

Saving money on a grant feels impossible, but building even a small emergency fund can be life-changing. It’s the difference between being at the mercy of a loan shark and being able to handle a small crisis yourself.

Here’s a realistic plan:

- Automate It: Use your new banking app to set up an automatic transfer of just R50 into a savings pocket the day your grant arrives. Don’t even give yourself the chance to spend it.

- Use ‘Round-Up’ Features: Some banks, like FNB, have features that round up your purchases to the nearest Rand and save the difference. It’s a painless way to save small amounts every time you swipe your card.

- Join a Trusted Stokvel: Stokvels are a powerful, traditional way for communities to save together. Join one with people you know and trust, where the rules are clear.

After one year, saving just R50 a month gives you R600. That might not seem like a fortune, but it’s R600 you have for an emergency, without having to go into debt. It’s financial power.

Warning Signs: How to Spot a Financial Predator in 2026

Scammers and predatory lenders rely on you being desperate and uninformed. Here are the red flags to watch for:

- They promise ‘instant approval’ for loans without any credit checks.

- They ask for your ID book, SASSA card, or bank PIN as ‘security.’ NEVER give these to anyone.

- They rush you to sign documents you haven’t had time to read.

- Their ‘office’ is a street corner, a WhatsApp message, or an unofficial social media page.

- They don’t have a registered FSP (Financial Services Provider) number.

Trust your gut. If a deal feels too good to be true, or if you feel pressured, walk away immediately. Your financial safety is more important than any ‘quick cash’ offer.

Opinion: SASSA and Government Are Failing to Protect the Vulnerable

Forcing millions of South Africa’s most vulnerable citizens into a commercial banking system without a massive, accompanying financial literacy campaign is irresponsible. It’s like teaching someone to swim by pushing them into the deep end. SASSA and the Department of Social Development have a moral obligation to do more than just distribute funds. They must actively work with banks to enforce fee caps for grant accounts, run campaigns to expose loan sharks, and provide accessible education on budgeting and debt. Simply transferring the payment responsibility to commercial banks and washing their hands of the consequences is not good enough. This policy shift, without proper safeguards, risks enriching financial institutions and predators at the direct expense of the poor. We need action, not just a new payment method. For updates on when payments are disbursed, which is the most critical time for beneficiaries, always check the official SASSA Payment Dates schedule.

Your Financial Self-Defence Checklist for January 2026

Take control of your grant money today. Here is your action plan:

- Review Your Bank Account: Log into your app or get a mini-statement. Do you see any fees you don’t understand? If your monthly fees are over R10, switch to a cheaper option.

- Guard Your PIN: Your PIN is your secret. Treat it like cash. Cover your hand when entering it at an ATM or till point.

- Check Your Debit Orders: Get a list of all debit orders on your account. If you see one you don’t recognise or want to cancel, go into your bank branch and file a dispute form immediately.

- Say NO to Pressure: Whether it’s a loan, a phone contract, or an insurance policy, never sign up for something on the spot. Always say, “I need to think about it and will come back to you.”

- Report Scams: If you are targeted by a loan shark or a scammer, report them to the South African Police Service (SAPS) and the National Credit Regulator (NCR).

If your grant application has been unfairly rejected and you are struggling financially, remember you have the right to challenge the decision. Follow our comprehensive SASSA Appeals Guide to understand the process.

Frequently Asked Questions

Which bank is the absolute best for SASSA grants in 2026?

Can I still use the old SASSA Gold Card in January 2026?

I took a loan from a mashonisa and they have my bank card. What can I do?

How can I stop illegal debit orders from taking my grant money?

Is it safe to get my grant paid into a digital-only bank like TymeBank?

Can I get a loan from a proper bank if I only receive a SASSA grant?

What is the cheapest way to withdraw my SASSA cash?

My grant was approved but the money is not in my new bank account. What's wrong?

Read Next

The R99 SASSA Debit Order Trap: Why Your Grant is Disappearing in 2026

Discover the hidden bank fees, unauthorized debit orders, and expensive funeral …

From R350 to R3,500: The Secret SASSA Side Hustles Dominating South Africa in 2026

In 2026, the R350 SRD grant is no longer just for survival; it’s becoming …

Comments & Discussions