Table of Contents

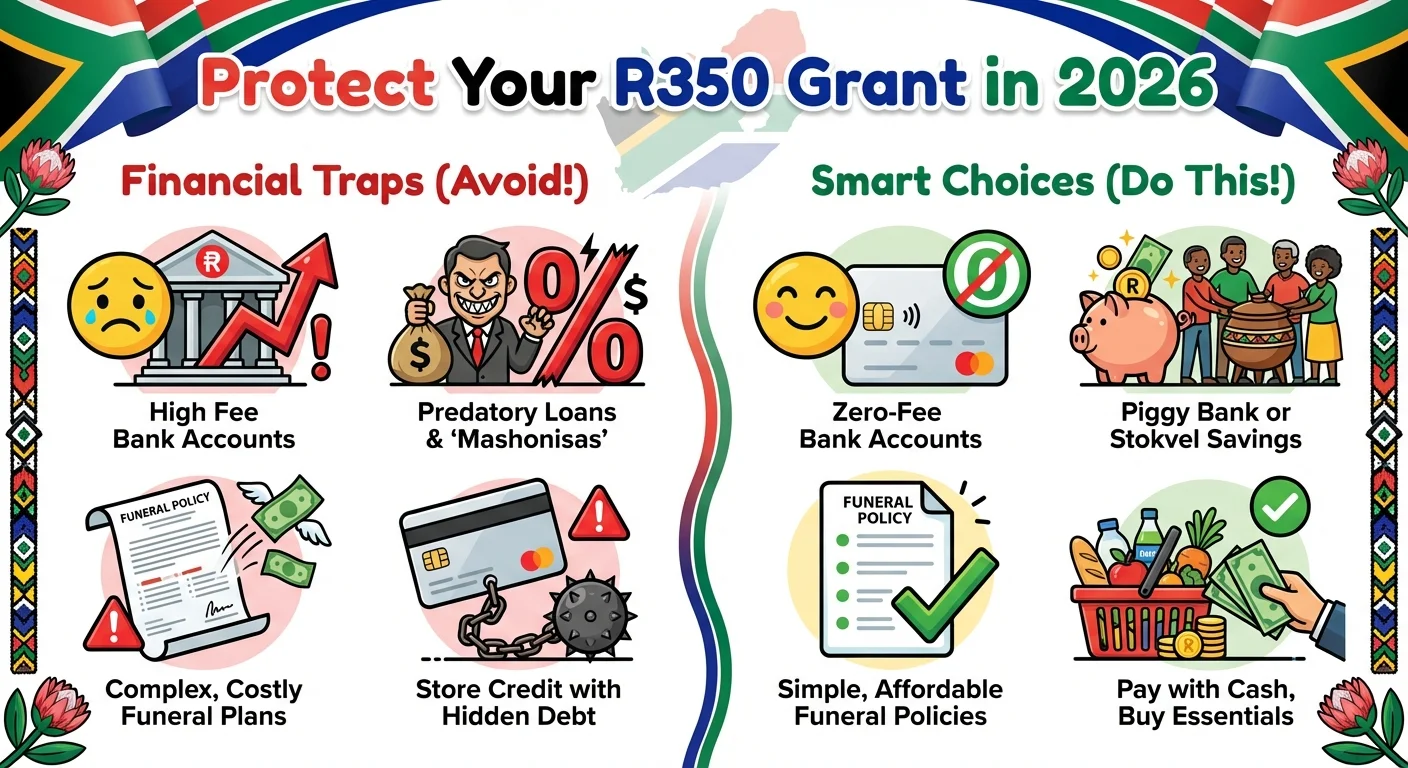

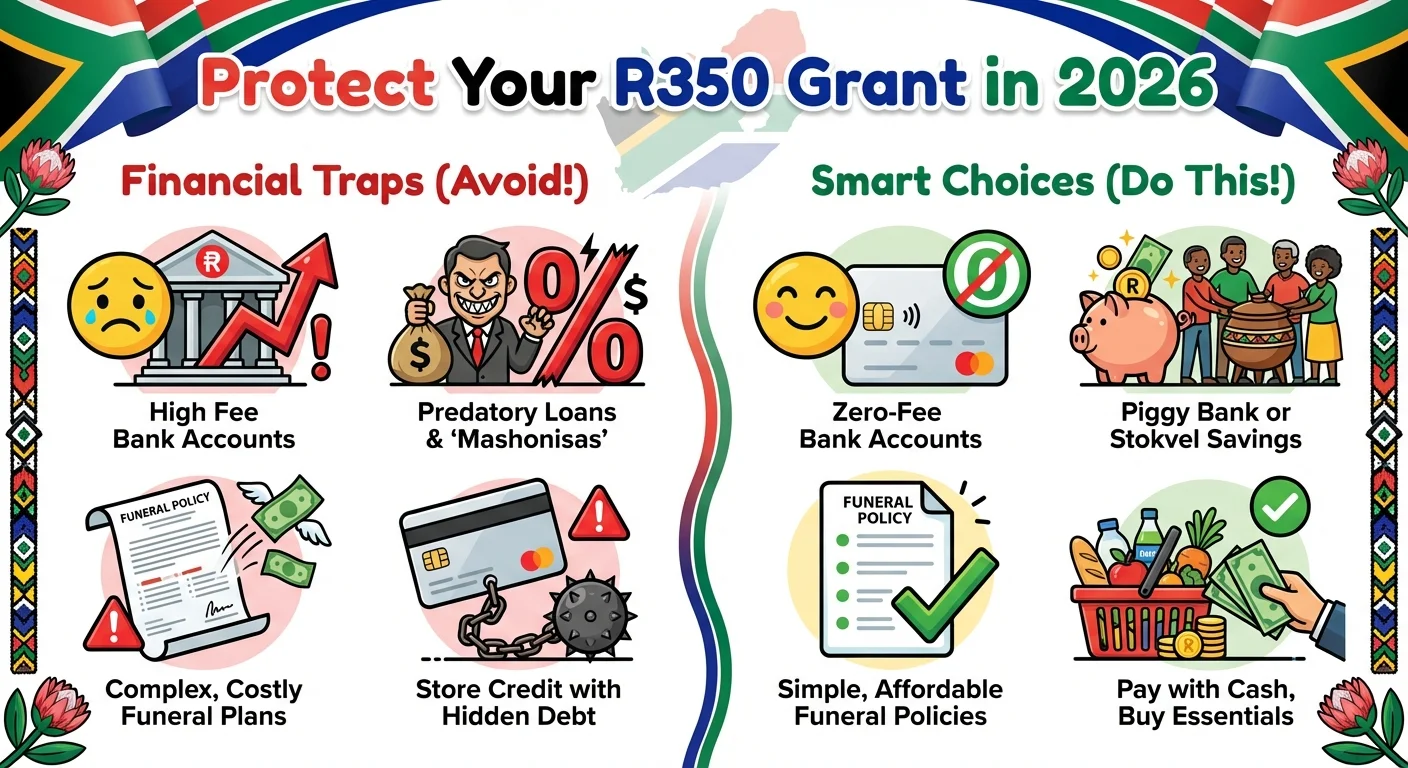

A deep-dive analysis into the financial products targeting SASSA grant recipients in January 2026. We expose the hidden costs of SASSA Gold Cards, high-fee bank accounts, predatory loans, and overpriced funeral cover. Learn how to protect your R350 grant, switch to low-cost banking options, and make your money work for you, not the banks.

The Shocking Truth: Your R350 Grant Isn’t R350

Let’s be brutally honest. For millions of South Africans, the R350 Social Relief of Distress (SRD) grant that arrives each month isn’t actually R350. By the time it hits your hand, it’s often R330, R315, or even less. Where does the rest go? It’s silently siphoned off by a system of bank fees, withdrawal charges, and predatory financial products that see grant recipients as a monthly revenue stream. In 2026, this financial bleed is no longer a secret; it’s a crisis. A R15 monthly bank fee and a R20 withdrawal charge might seem small, but that’s R420 a year. Add an overpriced R60 funeral policy, and you’ve lost over R1,140. That’s more than three full months of your grant, gone. This article isn’t just about pointing out the problem; it’s about giving you the weapons to fight back.

Why Your SASSA Gold Card Could Be a Money Pit in 2026

The SASSA Gold Card, issued through Postbank, has been a cornerstone of grant distribution. However, the ongoing technical glitches and service issues reported throughout late 2025 and into 2026 have turned it into a source of frustration for many. While it offers some free transactions, the limitations are where the costs hide. After your free withdrawals, the fees start stacking up. Furthermore, the reliance on specific pay points can lead to additional costs in transport and time—money and hours you simply don’t have. The biggest trap is the illusion of it being the only option. It’s not. In 2026, the smart move is to take control and choose where your grant is paid. For a full schedule of when to expect your funds, always check the official SASSA Payment Dates.

The Bank Account Battle: Fee-Free vs. Fee-Heavy

The single most powerful financial decision a grant recipient can make in 2026 is choosing the right bank account. Let’s break down the battlefield.

The Old Guard (The Fee-Heavy Traps):

- Legacy Bank Accounts: Many traditional banks have ’entry-level’ accounts that are riddled with fees. Monthly admin fees, cash deposit fees, and high withdrawal fees at other banks’ ATMs can easily consume R30-R50 of your grant every month.

- Postbank Limitations: As mentioned, while the SASSA Gold Card has its purpose, exceeding its free transaction limits can be costly.

The New Challengers (The Fee-Free Champions):

- TymeBank: A game-changer for many. No monthly fees. You can open an account in minutes at a Pick n Pay or Boxer store. Withdrawing cash at these stores is significantly cheaper than at a traditional ATM.

- Capitec: Known for its low, transparent fees. The Global One account offers a simple fee structure, and its banking app is powerful for managing your money. You pay per transaction, which can be cheaper if you manage your withdrawals carefully.

- Bank Zero: A fully digital bank with no monthly fees, offering a modern, app-based approach to banking.

The bottom line: Paying a monthly fee for a bank account in 2026 is unnecessary. Switching to a zero-fee account can save you up to R600 per year. That’s nearly two full R350 grants back in your pocket.

How to Switch Your SASSA Payment to a New Bank Account

Ready to stop leaking money to fees? Switching your grant payment to a better bank account is a straightforward process designed to give you control. Don’t be intimidated; it’s your right.

- Open Your New Account: First, open an account with a low-cost bank like TymeBank or Capitec. Get your official, stamped proof of account letter.

- Visit the SASSA Website: Navigate to the official SRD website. You will need your ID number and the cell phone number you used to apply for the grant.

- Find the ‘Change Banking Details’ Section: Look for the option to update your personal information or payment method.

- Submit Your New Details: Carefully enter your new bank account number, branch code, and account type. Double-check every digit to avoid payment delays.

- Wait for Verification: SASSA will need to verify your new banking details. This can take some time, so it’s best to do this well before the next SASSA Payment Dates are announced.

Important Note: Only submit bank account details that are in your own name. SASSA will not pay grants into another person’s account. To ensure your grant is approved and ready for payment, you should regularly perform a SRD R350 Status Check.

Loan Sharks (‘Mashonisas’): The Debt Trap That Destroys Lives

When your grant runs out and there are still days left in the month, the offer of a quick loan can seem like a blessing. It’s not. It’s a trap.

Loan sharks, or ‘mashonisas’, prey on the desperate. They operate outside the law and charge outrageous interest rates—sometimes 50% or more per month. Borrowing R200 can quickly turn into a debt of R600 that you can never repay. They often demand your ID book or SASSA card as security, which is illegal and gives them total control over your life.

Warning Signs of a Predatory Loan:

- They ask for your SASSA card and PIN.

- There is no formal contract or paperwork.

- The interest rate is not clearly explained or is impossibly high.

- They use intimidation or threats to collect payments.

In 2026, you must make a vow: never, ever give your SASSA card or PIN to a lender. There are no ‘quick fixes’ in finance, only dangerous traps.

Funeral Cover: A Necessity That Can Be a Scam

In our culture, a dignified burial is non-negotiable. This has created a massive market for funeral cover, and unfortunately, many providers exploit this need by targeting grant recipients with expensive, low-value policies.

The Funeral Cover Trap:

- High Premiums, Low Payout: You might be paying R80-R120 per month for a policy that only pays out R10,000. For the same price, a reputable insurer could offer R20,000 or more in cover.

- Aggressive Sales Tactics: Debit orders are set up over the phone with confusing terms and conditions.

- Hidden Exclusions: Many policies have long waiting periods for natural death or won’t pay out for certain conditions.

How to Find a Good Policy:

- Shop Around: Don’t accept the first offer. Compare quotes from at least three well-known, reputable insurance companies.

- Read the Fine Print: Ask about waiting periods and exclusions. Make sure you understand exactly what is covered.

- Check the Payout Amount: A good rule of thumb is to aim for at least R20,000 in cover. Ensure the monthly premium is something you can comfortably afford without fail.

- Buy from a Trusted Name: Stick to major banks and insurance companies, not unknown sellers who call you out of the blue.

The Store Card Temptation: Is ‘On Credit’ Worth It?

Buying groceries or clothing on a store card can feel like a lifeline when your cash runs low. But it’s one of the most expensive ways to shop. Store cards often come with high interest rates (sometimes over 20% per year) and account fees.

Let’s do the maths. You buy R300 worth of groceries on your store card. With interest and fees, you might end up repaying over R360 over the next few months. You’ve just paid R60 extra for the same food. Doing this consistently creates a cycle of debt where a portion of your next SASSA grant is already spent before you even receive it.

The 2026 Alternative: Instead of relying on store credit, focus on a strict budget. If possible, join a community savings group (‘stokvel’) to build a small emergency fund. This provides a safety net without the crippling cost of interest.

Your 2026 Financial Action Plan: 3 Steps to Protect Your Grant

Feeling overwhelmed? Don’t be. Taking back control starts with three simple but powerful steps.

- Conduct a ‘Fee Audit’: Get your bank statement. Circle every single fee you were charged last month. Add them up. This number is what the system is costing you. Let that anger motivate you.

- Switch to a Zero-Fee Bank Account: This is your top priority. Walk into a TymeBank kiosk or a Capitec branch this week. Make the switch. It’s the biggest financial ‘raise’ you can give yourself.

- Adopt the ‘Cash Envelope’ Budget: When you withdraw your grant, divide the cash into envelopes for different needs: ‘Groceries’, ‘Transport’, ‘Airtime’, ‘Emergency’. When an envelope is empty, it’s empty. This simple physical act forces discipline and stops overspending.

Remember, the R350 grant is a tool. In the wrong hands, it gets whittled down to nothing. In your hands, used wisely, it can be a foundation for stability.

Frequently Asked Questions

Can SASSA pay my grant into my TymeBank or Capitec account in 2026?

What are the cheapest bank accounts for SASSA beneficiaries in 2026?

How do I cancel a funeral policy debit order that I can't afford?

Is it illegal for a lender to keep my SASSA card?

How much should I be paying for funeral cover with my R350 grant?

What happens if I enter the wrong banking details on the SASSA website?

Can I use my SASSA grant to get a loan from a major bank?

Are store cards from places like Pep or Ackermans a good idea?

Read Next

The R370 Grant Reality: Why SASSA's 2026 'Increase' Forces a Side Hustle Revolution

A critical analysis of the recent minor SRD grant increase to R370 in January …

The Hidden R100: Why Your SASSA Grant is Shrinking in 2025 (And Who's Taking It)

An investigative deep dive into the hidden deductions eating away at SASSA …

Comments & Discussions