Table of Contents

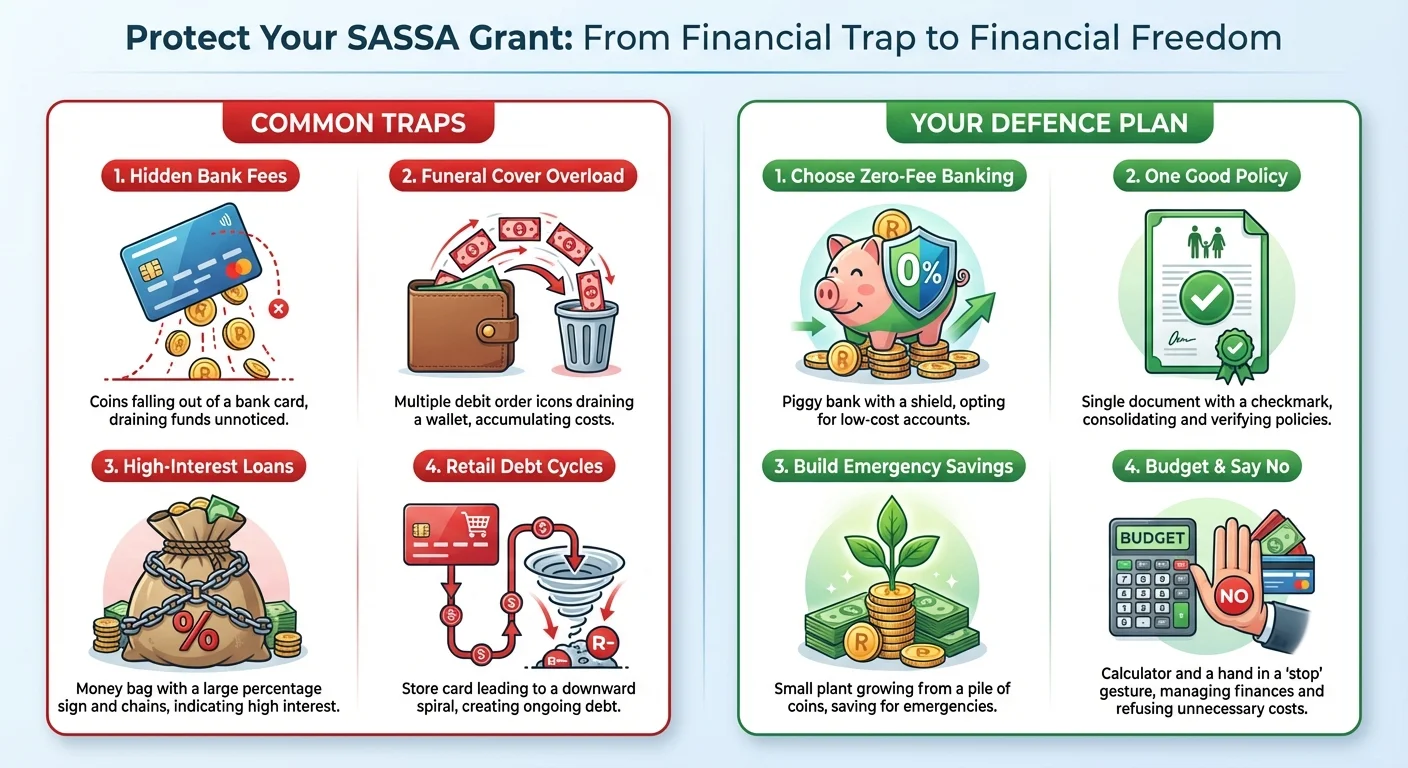

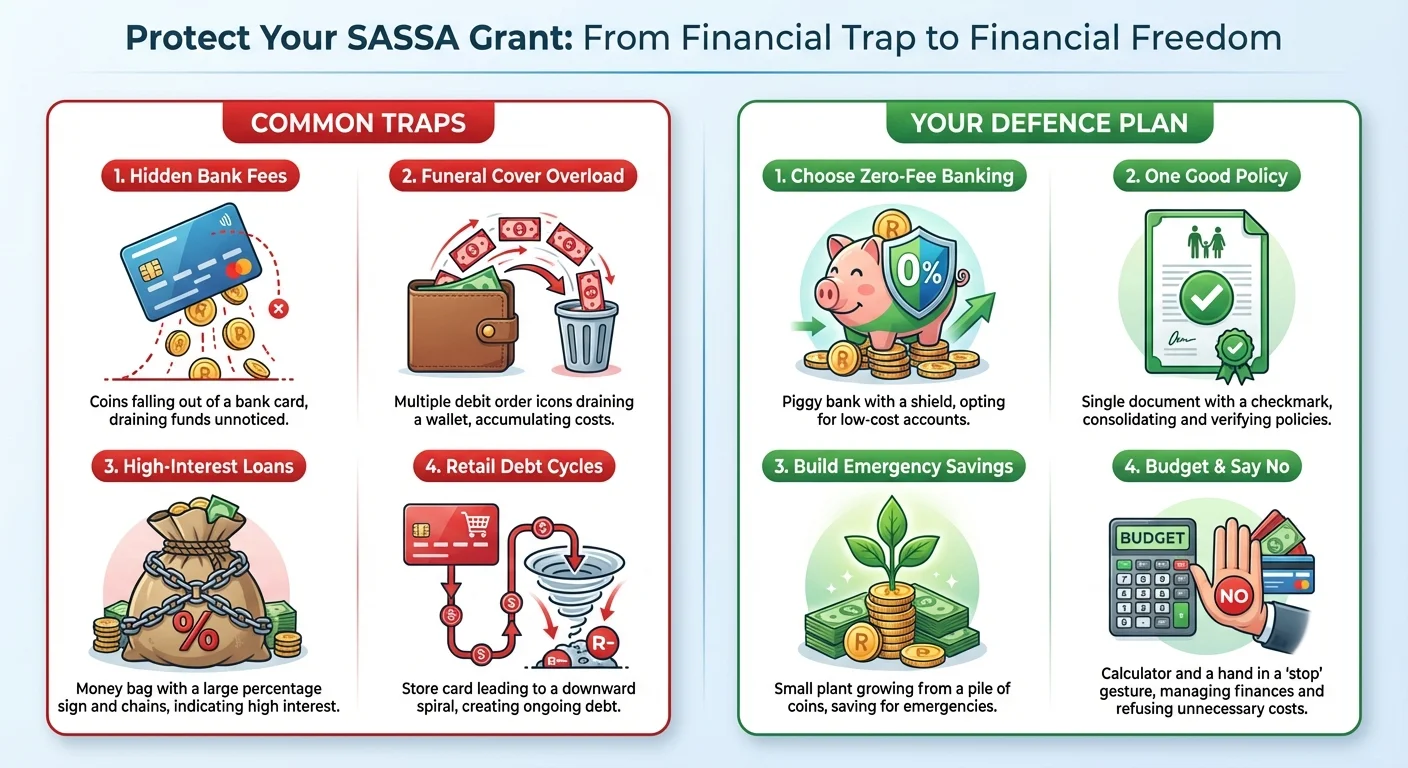

In 2025, receiving your SASSA grant is only half the battle. The other half is keeping it. Financial institutions are aggressively targeting grant recipients with products that seem helpful but are designed to drain your funds. We investigate the hidden fees in bank accounts, the truth about funeral cover, and the debt cycles caused by easy loans, giving you the strategies to fight back and make your R350 grant work for you.

The Great 2025 SASSA Money Heist: It’s Happening in Your Bank Account

Let’s be brutally honest. For millions in South Africa, the SASSA grant isn’t just a lifeline; it’s a target. While you’re waiting for your R350, a silent army of corporations is waiting too. They’re not trying to steal your grant illegally; they’ve found a way to take it legally, Rand by Rand, right from your account. It’s a sophisticated system of ‘SASSA-friendly’ products that often leaves beneficiaries with a fraction of what they’re owed. This isn’t just a problem; it’s a crisis unfolding in plain sight in December 2025, and it’s time we talked about why your grant money seems to vanish.

Trap 1: The ‘Free’ Bank Account That Costs a Fortune

The first deduction often happens at the bank. Many institutions market ’low-cost’ or ‘SASSA-friendly’ accounts, but the devil is in the details. While you might get free cash deposits, you could be paying R7 for a withdrawal at a different bank’s ATM, R2 for a balance inquiry, or a hefty ‘failed debit order’ fee of R50 or more. These small amounts add up. Over a year, these ‘minor’ fees can eat up an entire month’s R350 grant. They bank on the fact that you won’t read the fine print. Your first step to financial freedom is knowing exactly what your bank is charging you for every single transaction.

Trap 2: Drowning in Funeral Cover Debit Orders

Walk through any shopping centre near a SASSA payout point, and you’ll be swarmed by agents selling funeral cover. The pitch is emotional and effective: ‘Protect your family’s dignity.’ The result? Many beneficiaries are signed up for multiple policies, with debit orders for R50, R80, or even R120 coming off their account the second the grant lands. In many reported cases, individuals have three or four overlapping policies, paying for a benefit their family can only claim once. This is a massive waste of precious funds. It’s crucial to have one affordable, reliable policy, not a collection of costly debit orders that leave you with nothing to live on.

Trap 3: The ‘Easy-Access’ Loan That Leads to a Debt Prison

When the grant money runs out mid-month, the temptation of an ’easy’ loan is powerful. Loan sharks (mashonisas) and predatory micro-lenders thrive on this desperation. They offer quick cash with little paperwork, but at astronomical interest rates. A loan of R200 can quickly become a debt of R400 or more by your next payment date. This creates a devastating cycle: you use your next grant to pay off the old loan, leaving you short again and forced to take out another, bigger loan. It’s a prison built with high interest, and breaking free is incredibly difficult. Before you take any loan, you must understand the total cost of repayment.

Trap 4: Store Cards and ‘Buy Now, Pay Later’ Schemes

Retailers are increasingly targeting SASSA beneficiaries with store cards and ‘Buy Now, Pay Later’ (BNPL) offers. They make it seem like you’re getting free money to buy groceries or clothes. However, these are just another form of credit with high interest rates, account fees, and harsh penalties for late payments. Missing one payment can trigger a cascade of fees that inflate your debt exponentially. What started as buying R300 worth of groceries can turn into a R1000 debt you can’t escape.

Your 2025 Financial Defence Plan: How to Protect Your Grant

It’s time to fight back. You have the power to protect your money. Here’s a simple, actionable plan for 2025:

- Conduct a Bank Account Audit: Get your latest bank statement and a highlighter. Mark every single fee you were charged. Ask yourself: ‘Is this the right account for me?’

- Choose a Truly Low-Cost Account: Compare accounts from providers like TymeBank, Capitec, and the SASSA Postbank Gold Card. Look for accounts with low or zero monthly fees and affordable withdrawal costs. Make sure the ATM network is accessible to you.

- Consolidate Your Cover: Review all your funeral policies. You only need ONE. Choose the most reliable and affordable one and cancel the rest. Use the extra R100-R200 a month for savings or essentials.

- Build an Emergency Fund: This is your best weapon against loan sharks. Even saving R20 or R30 from each grant can build a small buffer. Having R200 saved for an emergency is infinitely better than taking on a R200 loan with 50% interest.

- Learn to Say NO: Saying ’no’ to aggressive salespeople and tempting credit offers is a superpower. Your financial well-being is more important than any product they’re selling.

The Best Bank Accounts for SASSA Beneficiaries in 2025: A Quick Comparison

Choosing the right bank is critical. Here’s a brief look at popular options:

- SASSA/Postbank Gold Card: No monthly fee. The primary benefit is free withdrawals at Post Office branches and select retailers (Pick n Pay, Boxer, etc.). However, ATM fees at other banks can be high.

- TymeBank ‘EveryDay’ Account: Zero monthly fees. You can withdraw cash cheaply at Pick n Pay and Boxer till points. This is a strong digital-first option.

- Capitec ‘Global One’ Account: Low monthly fee (around R7). It has a large branch and ATM network. Their app is user-friendly for tracking spending.

Our Analysis: For most R350 recipients, a zero-monthly-fee account like TymeBank is often the most cost-effective, provided you live near a partner store for withdrawals. The key is to minimize fixed monthly costs.

The Debit Order Debate: Can You Legally Stop Them?

You have rights. Under the National Payment System Act, you can dispute and reverse an unauthorized or fraudulent debit order. For legitimate contracts like funeral cover, you must follow the cancellation procedure with the provider first. If they refuse to cancel, you can instruct your bank to stop the debit order. This is called a ‘stop payment instruction.’ Banks may charge a fee for this service, but it’s a vital tool to regain control of your account. Before taking any action, ensure you understand if you are in a binding contract.

Beyond the R350: Building Wealth, One Grant at a Time

This might sound impossible, but it’s not. Once you’ve plugged the financial leaks, you can start using your grant as a tool. Consider joining a Stokvel (a community savings club) with trusted people. This allows you to save collectively for bigger goals. Even small-scale entrepreneurship, like buying goods to resell, becomes possible when you have the full value of your grant. Knowing your exact grant arrival from the official Payment Dates schedule allows you to plan these activities effectively. It begins by seeing the R350 not just as survival money, but as seed capital for a better future.

The Government’s Role: Is Enough Being Done to Protect Beneficiaries?

This is a critical question for 2025. While SASSA provides the funds, there’s a strong argument that more robust consumer protection is needed. Financial literacy campaigns, stricter regulations on the sale of financial products at pay points, and clearer communication about bank fees are essential. Beneficiaries shouldn’t have to become financial experts just to protect the small grant they are entitled to. The system needs to be safer by design. If your grant application was unfairly rejected, it’s vital to use the proper channels; our Appeals Guide can provide clarity on this separate but related issue.

Frequently Asked Questions

What is the cheapest bank account for a SASSA grant in 2025?

Can SASSA stop debit orders from my account?

How many funeral policies do I really need?

Are loans advertised for SASSA recipients safe?

How can I check my bank statement without going to the bank?

What should I do if I suspect a fraudulent debit order on my account?

Is it better to take my SASSA grant money out as cash all at once?

How do I start a small emergency fund with my R350 grant?

Read Next

Why Your SASSA Gold Card Is Secretly Costing You R2,000 a Year: The 2025 Banking Trap

As of December 2025, millions of SASSA beneficiaries are unknowingly losing up …

From R350 to R3,500: The Secret SASSA Side Hustles Dominating South Africa in December 2025

Stop seeing the R350 SRD grant as just survival money. This is your R350 seed …

Comments & Discussions