Table of Contents

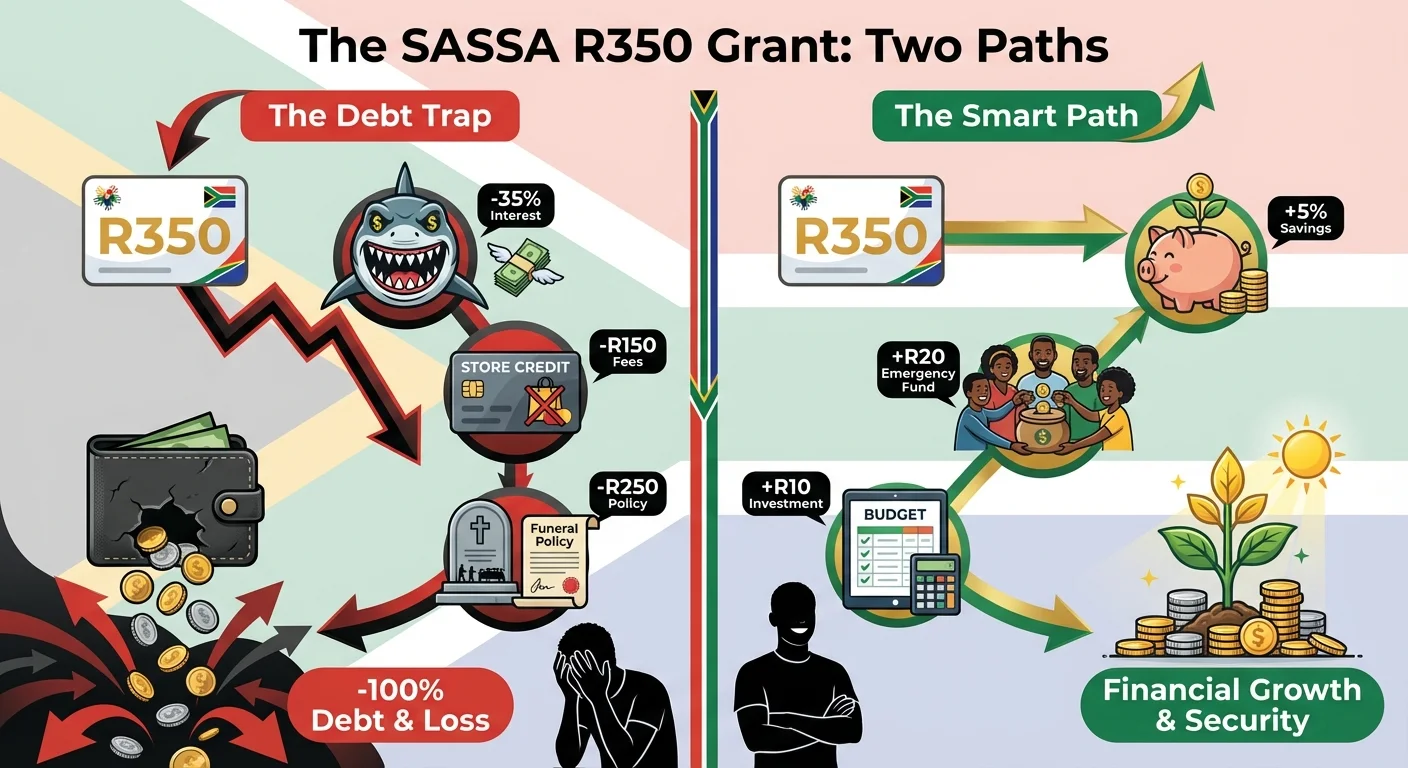

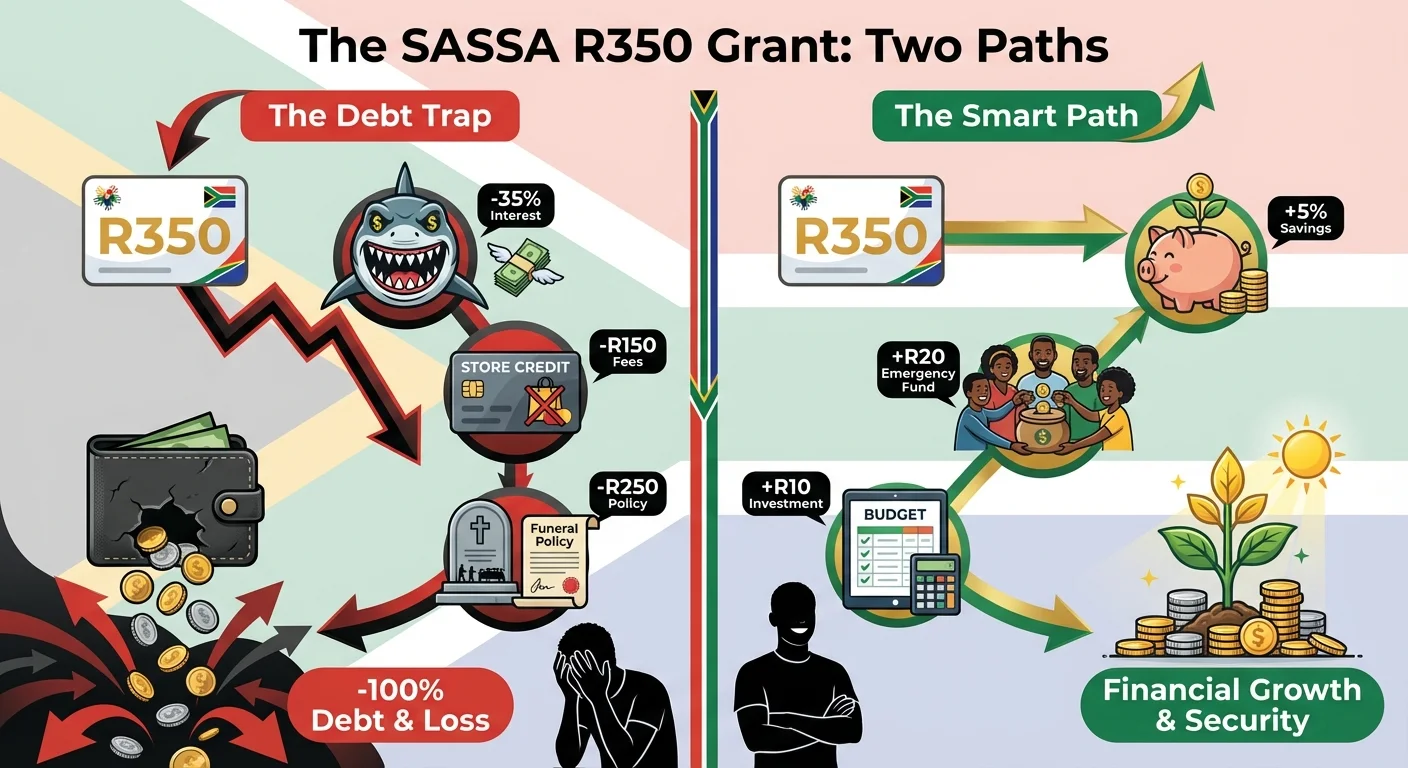

A deep dive into the predatory financial products targeting SASSA grant recipients in South Africa in 2026. We expose the tactics used by lenders, break down the true cost of ’easy credit’, and provide a step-by-step guide to protecting your grant, finding safer alternatives, and breaking the cycle of debt.

The Harsh Reality: Your R350 Grant is a Target in 2026

Let’s be brutally honest. The moment your SASSA grant lands in your account, a battle for it begins. For millions of South Africans relying on the R350 Social Relief of Distress (SRD) grant, this small amount is a lifeline. But for a growing number of financial institutions and informal lenders, it’s a guaranteed income stream they can tap into. In January 2026, the landscape is more aggressive than ever. Companies see your grant not as support, but as a reliable source to service high-interest loans, expensive funeral policies, and tempting store cards. This isn’t just business; it’s a system that can trap the most vulnerable in a cycle of debt, turning a helping hand into a financial burden.

Why SASSA Beneficiaries are Prime Customers for Lenders

Why the intense focus on grant recipients? It’s simple: reliability. A SASSA grant is one of the most consistent forms of income in the country. Lenders know that on a specific day each month, funds will be available. You can see the official SASSA payment dates schedule for 2026 yourself; it’s a predictable calendar that creditors love.

This reliability makes you a ’low-risk’ client for certain types of credit, even if you have no other formal income. They know they can secure a debit order that will run the moment your grant is paid, taking their cut before you even have a chance to buy groceries. This system preys on desperation, offering instant cash for immediate needs while obscuring the long-term cost that can cripple your finances for months, or even years.

The Triple Threat: Unpacking the Most Common Grant Traps

Three main products are consistently marketed to SASSA beneficiaries, each with its own set of dangers. Understanding them is the first step to protecting your money.

1. Payday Loans and ‘Easy-Access’ Micro-Loans

These are the most notorious. Often advertised with promises of ‘instant approval’ and ’no credit checks’, they offer small amounts of cash (e.g., R500) to be paid back on your next grant payment date. The catch? Exorbitant interest rates and fees. The National Credit Act (NCA) caps interest, but many lenders, especially informal ‘mashonisas’, operate outside these laws. A simple R500 loan can easily require a R700 or R800 repayment within a month, a crippling blow to a R350 budget.

2. The Temptation of Store Cards

Major retailers offer store cards that seem like a great way to buy clothing, electronics, or groceries on credit. While they can be useful if managed perfectly, they are a significant risk. The interest rates are often high (20% or more), and the minimum payments are designed to keep you in debt for as long as possible. A R1,000 purchase on a store card can end up costing you over R2,000 in the long run if you only make minimum payments, with the monthly debit order eating into your grant.

3. Overpriced Funeral Policies

Having a dignified farewell is a deep-seated cultural need, and insurers know this. Unfortunately, many policies sold to grant recipients are either overpriced for the cover they provide or loaded with confusing clauses that can lead to a claim being denied. You might be paying R100-R150 a month from your grant for a policy that offers minimal payout or has a three-year waiting period for natural death. That’s almost half your grant gone for a product that may not even deliver when your family needs it most.

The Math of the Trap: How R350 Becomes a R2,000+ Annual Loss

Let’s break down a common scenario for a SASSA beneficiary in 2026.

- Initial Grant: +R350

- The Situation: An emergency strikes. You need R500 for medicine.

- The ‘Solution’: You take a micro-loan for R500, agreeing to a R700 repayment next month. You also have a R120 monthly debit order for a funeral policy.

On Your Next Payment Day:

- Your R350 grant comes in.

- A R700 debit order for the loan is waiting. Since you only have R350, it fails, but the lender might try to take the full R350.

- Your R120 funeral policy debit order runs.

Let’s assume the lender agrees to take R230 and roll over the rest. You are left with R0 from your grant. The cycle of borrowing continues. If you have just one store card with a R100 monthly payment and a R120 funeral policy, that’s R220 gone immediately. That’s 62% of your grant vanishing before you see it.

The Annual Cost: A R120 monthly funeral policy costs you R1,440 per year. A small, persistent debt on a store card could easily cost you R600-R800 in interest per year. Together, these ‘small’ deductions can easily exceed R2,000 a year – the equivalent of nearly six full SRD grants, completely lost.

Know Your Rights: Red Flags of a Predatory Lender

The law provides some protection. The National Credit Act (NCA) is there to ensure lending is fair. Here are the red flags to watch for in 2026:

- They demand your ID book, passport, or SASSA card: This is illegal. A lender can never take your personal documents as security.

- They force you to sign blank forms: Never sign an incomplete contract. All costs, terms, and repayment amounts must be filled in.

- Lack of clear paperwork: A legitimate credit provider must give you a pre-agreement quote and a final contract detailing all costs, including the interest rate (as a percentage) and the total amount you will repay.

- High-pressure tactics: If they rush you or say ‘sign now or the offer is gone,’ walk away.

- Refusal to disclose fees: They must be transparent about initiation fees, service fees, and any other charges.

Smarter, Safer Alternatives to High-Cost Debt

Breaking free from the debt trap requires finding better ways to manage financial shocks and build wealth, even on a small income.

- Start a Stokvel: Pooling money with a trusted group of people is a traditional and powerful South African way to save. It provides access to a lump sum for emergencies without any interest.

- Open a Low-Cost Bank Account: Move away from accounts with high monthly fees. Some banks offer pay-as-you-transact accounts or accounts with zero monthly fees that are perfect for grant recipients.

- Build a Micro-Emergency Fund: Even saving R20-R30 per month from your grant can make a difference. After a few months, you’ll have a small buffer for emergencies, reducing the need for a loan. Keep it in a separate savings pocket if your bank offers one.

- Community and Family Support: Before turning to a lender, explore support from your community, church, or family. While not always possible, it’s an interest-free option.

- Seek Financial Counselling: Organizations like the National Debt Mediation Association (NDMA) offer free advice to over-indebted consumers.

How to Cancel Unwanted Debit Orders from Your SASSA Grant

You have the right to control who takes money from your account. If you have a debit order for a service you no longer want or can’t afford, you can act.

- Contact the Company Directly: The first step is to call the company (e.g., the insurance provider) and follow their cancellation process. Get a reference number.

- Go to Your Bank: Visit your bank branch with your ID. You can issue a stop payment order on a specific debit order. There might be a small fee for this service.

- Dispute the Debit Order: If you don’t recognize a debit order or believe it’s fraudulent, you can dispute it with your bank. They can investigate and potentially reverse the funds.

It is crucial to act quickly. Don’t let unauthorized or unwanted deductions drain your grant month after month. If you’re struggling, checking the status of your grant application is also a good first step to ensure everything is in order. You can do your SRD R350 Status Check online.

The Government’s Role: Is Enough Being Done to Protect Beneficiaries?

This is a critical question for 2026. While SASSA’s mandate is to distribute grants, there’s a strong argument that more needs to be done to protect the funds from being immediately siphoned off by third parties. Financial literacy campaigns, stricter enforcement of the NCA against predatory lenders targeting beneficiaries, and partnerships with banks to offer truly ‘beneficiary-friendly’ accounts could make a massive difference.

The system cannot simply be about payment distribution; it must also be about ensuring the grant achieves its purpose of relieving distress. Until then, the responsibility falls heavily on you, the recipient, to be vigilant and informed.

Your Action Plan for January 2026: Take Back Control

Feeling overwhelmed? Here are three concrete steps you can take today:

- Get Your Bank Statement: Go to your bank or use their app to get a statement for the last three months. Circle every single debit order. Ask yourself: ‘What is this for? Do I still need it? Is it worth the cost?’

- Make One Call: Choose one debit order you want to question or cancel. Call the company or your bank today to start the process.

- Start a R20 Savings Jar: Literally. Take a jar and put R20 in it from your next grant payment. This is the start of your emergency fund and a powerful psychological step towards financial control.

Conclusion: Your R350 is Power, Don’t Give It Away

The R350 grant isn’t just money; it’s a tool. It can be a tool for survival, a stepping stone, or, if mismanaged, a link in a chain of debt. The financial services industry has created a system that makes it easy to lose that power. But by understanding the traps, knowing your rights, and embracing smarter alternatives, you can transform that R350 from a target for creditors into a foundation for your financial well-being in 2026 and beyond. The choice, and the power, ultimately rests with you.

Frequently Asked Questions

Can a loan company take my SASSA card as security in 2026?

How can I check which debit orders are on my SASSA account?

What is the maximum interest rate for a small loan in South Africa?

Is funeral cover paid from a SASSA grant a good idea?

Can I get a loan from SASSA directly?

What should I do if I am a victim of a predatory lender?

Are store cards a safe way to build a credit history?

Can I change my SASSA payment method to a different bank account?

Read Next

SASSA's R100 Mistake: Why Your Gold Card Is Secretly Costing You Money in 2026

In 2026, millions of South Africans are losing up to R100 or more per month from …

SASSA January 2026 Payment Dates CONFIRMED: Why You Must Check Before You Collect

The official SASSA grant payment dates for January 2026 are here. This guide …

Comments & Discussions