Table of Contents

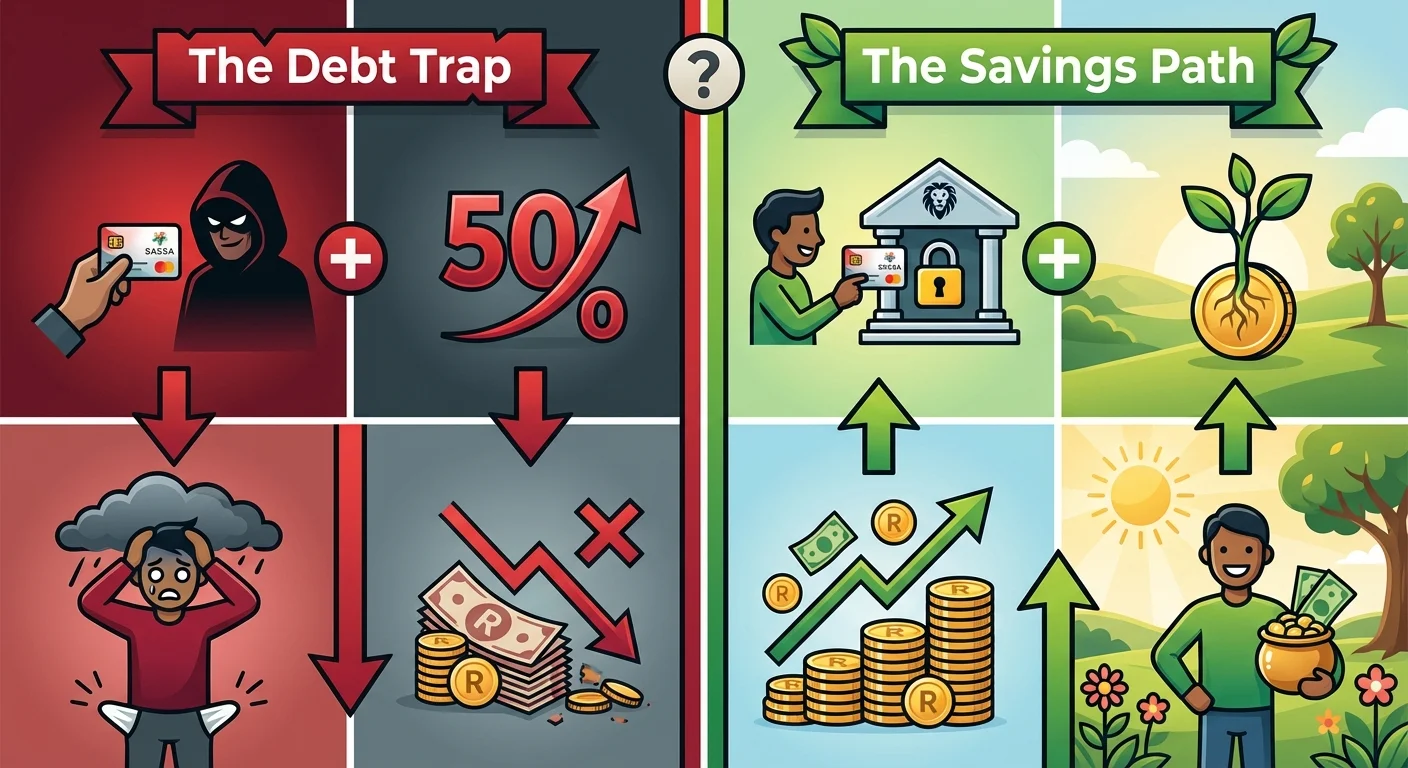

An in-depth analysis of the growing problem of predatory lending targeting SASSA grant recipients in South Africa for 2025. We uncover the dark side of ’easy loans’, explain the dangers of loan sharks, and provide a clear guide to safer alternatives like secure bank accounts, building savings, and understanding funeral cover to avoid the devastating R5,000 debt trap.

The Unseen Crisis: Your Grant is Their Goldmine

As we head into the festive season of December 2025, a hidden crisis is unfolding in communities across South Africa. For millions, the SASSA grant is a lifeline. But for a growing number of predatory lenders, that consistent government payment isn’t a lifeline; it’s a guaranteed revenue stream. They see your grant not as R350 for survival, but as collateral for a loan that can spiral into R5,000 of inescapable debt. This isn’t just about borrowing money; it’s about a system designed to trap the most vulnerable. This article is not another boring guide; it’s a warning and a strategy guide to protect the little you have and turn it into something more.

Why Your SASSA Grant is a Prime Target in 2025

Why are lenders so interested in grant recipients? The answer is simple: consistency. Unlike a job that can be lost, a government grant is one of the most reliable forms of income. Lenders, especially informal ‘mashonisas’ or loan sharks, know this. They know that on a specific day each month, money will be deposited. To them, this makes you a ’low-risk’ client, not because you can afford the debt, but because they have a high chance of getting their money back, often by holding onto your SASSA card and PIN—an illegal but common practice.

This reliability has created a feeding frenzy. They offer ’easy cash’ with no credit checks, targeting people in moments of desperation. But this ’easy cash’ comes with devastating strings attached in the form of impossibly high interest rates.

Red Flags: How to Spot a Predatory Loan Shark

Recognizing a dangerous loan is the first step to avoiding it. Here are the clear warning signs for 2025:

- They Ask for Your SASSA Card and PIN: This is illegal and their number one tactic. Never, ever give your card or PIN to anyone. It is your direct line to your money, and giving it away means they have total control.

- No Paperwork or Affordability Check: A legitimate lender, registered with the National Credit Regulator (NCR), must do an affordability check. Loan sharks don’t care if you can afford it. They want you in debt.

- Insanely High Interest Rates: They might say ‘only 30% interest’, but fail to mention that’s per week or per month. This practice, known as ‘juicing’, can mean you pay back double or triple what you borrowed in a very short time.

- Vague Terms and Conditions: If they can’t give you a clear document explaining the total amount repayable, the interest rate, and the repayment schedule, run away.

- Intimidation and Threats: Their business model relies on fear. They use threats of violence or public shaming to collect payments. A real credit provider has legal channels for collection; they don’t resort to intimidation.

The R350 to R5,000 Debt Spiral: A Real-World Example

Let’s see how quickly things can go wrong.

- The Need: It’s mid-December, and you need an extra R500 for groceries and a child’s school shoes.

- The Offer: A local mashonisa offers you R500 instantly. All they need is your SASSA card ‘for security’. They charge 50% interest per month.

- The First Payment: When your next grant of R350 comes in, they take the entire amount. You still owe them R400 (R250 principal + R150 interest, minus the R350 they took).

- The Re-loan: Now you have no money for the month. You’re forced to borrow another R500 just to survive. Your debt is now R900, and the interest is compounding.

Within three to four months, that initial R500 loan has ballooned to over R5,000 through re-borrowing and crippling interest. You’re now working for the loan shark, with your entire grant disappearing before you even see it. It’s a modern form of slavery.

The Safer Alternative Part 1: Your Bank Account is Your Shield

The most powerful weapon you have against loan sharks is controlling your own money. The best way to do this is to have your SASSA grant paid directly into a bank account that only you can access.

- Why a Bank Account is Crucial: It prevents anyone from taking your card. You can use your bank card to withdraw cash or pay at shops, keeping your money secure.

- Recommended Accounts for Grant Beneficiaries:

- Postbank: Specifically designed for SASSA grants, it has low costs and is widely accessible at any Post Office.

- Entry-Level Bank Accounts: Banks like Capitec, TymeBank, and FNB have ‘Pay-as-you-use’ or low-cost accounts that are affordable. They often have mobile banking apps that help you track every Rand.

Switching is simple. You can visit your local SASSA office with your ID and proof of your bank account to fill out a form to change your payment method. You can find out the exact SASSA Payment Dates to plan your budget effectively.

The Safer Alternative Part 2: Building a ‘Stokvel’ of One

Getting out of the debt mindset requires a new plan. Instead of borrowing, focus on saving. Even small amounts can build a powerful emergency fund.

- The R20 Challenge: The moment your grant arrives, before you spend anything else, withdraw R20 and put it somewhere safe. Do this every month. After a year, you’ll have R240. It’s a start.

- Use Bank Savings Tools: Many banking apps have ‘savings pockets’ or ‘goal save’ features. Automatically move R30 or R50 into one of these pockets the day you get paid. Out of sight, out of mind.

- Community Savings Groups (Stokvels): Joining a reputable stokvel with people you trust can be a fantastic way to save. It creates discipline and a support system.

This isn’t about becoming rich overnight. It’s about creating a small buffer, maybe R300-R500, that can cover a small emergency without having to turn to a loan shark.

The Funeral Cover & Insurance Trap: Are You Paying for Nothing?

Another area where beneficiaries lose money is through unnecessary or predatory insurance deductions. You’ll get calls offering ‘great’ funeral cover for just R50 a month. While having a plan for funeral expenses is wise, be extremely careful.

- The Problem: Many of these policies are overpriced and have tricky clauses. Sometimes, unauthorized debit orders are added to your account.

- What to Do:

- Check Your Slips: Always look at your payment slip or bank statement. Do you see deductions you don’t recognize?

- Never Give Banking Details Over the Phone: Don’t consent to policies from cold-callers.

- Compare Reputable Providers: If you need funeral cover, get quotes from established companies like Avbob, Doves, or those offered by your bank. Read the terms carefully.

- Cancel Unwanted Policies: You have the right to cancel any policy. Contact the provider and instruct your bank to block the debit order if necessary. Protecting your R350 is the priority.

Store Accounts: A Tool or a Trap?

Stores like Pep, Ackermans, or Shoprite often offer store accounts. Can they be useful? Yes, but with caution.

- The Upside: They can help you buy essential items like school uniforms or a small appliance on credit from a regulated provider.

- The Downside: The interest rates can still be high. It’s very easy to overspend and end up with a monthly installment that eats a significant chunk of your grant.

Our Advice: If you absolutely must use a store account, use it for a single, planned purchase. Pay it off as quickly as possible and avoid using it for day-to-day groceries. Treat it as a one-time tool, not a way to live.

Your Legal Rights: Fighting Back Against Predatory Lenders

You are not powerless. The law is on your side. If you are being harassed or have given your card to a loan shark, here’s what you can do:

- Report them: Contact the South African Police Service (SAPS) to report illegal card-retention and threats. It is a crime.

- Lodge a Complaint: File a complaint with the National Credit Regulator (NCR) about any unregistered lender charging excessive interest.

- Cancel Your Card: Immediately go to the Post Office or your bank and report your card ’lost’ or ‘stolen’. They will issue you a new one, cutting off the loan shark’s access.

If you’re unsure about your grant application status while dealing with these issues, you can always perform a SRD Status Check online to get clarity.

Conclusion: Your Grant, Your Power, Your Future

The R350 or other SASSA grants are not a ticket to wealth, but they don’t have to be a ticket to a debt prison either. The financial predators of 2025 are sophisticated, but their tactics are predictable. By taking control of your payment method, questioning every deduction, spotting the red flags of a loan shark, and committing to saving even the smallest amount, you reclaim power. Your grant is your money. In 2025, make the decision to keep it that way.

Frequently Asked Questions

Is it illegal for someone to keep my SASSA card in South Africa?

Can I get a legitimate loan as a SASSA grant recipient in 2025?

What is the maximum interest a lender can legally charge in 2025?

How can I change my SASSA payment method to a bank account?

Are funeral policies worth it if I'm on a grant?

My SASSA application was declined, can I still get a loan?

What is the safest bank for a SASSA grant?

How do I start a savings plan with only R350 a month?

Read Next

Why Your R350 SASSA Payment Failed in December 2025: The Investigation

Millions of South Africans rely on the R350 SRD grant, but payment failures are …

Your R350 Grant Isn't R350: The Hidden Bank Fees & Funeral Cover Traps of 2025

An in-depth investigation into how bank fees, predatory funeral cover, and …

Comments & Discussions