Table of Contents

A deep-dive investigation into the hidden financial traps targeting SASSA grant recipients in 2026. We expose the common bank fees, funeral cover schemes, and loan sharks that are draining your R350 SRD grant and provide actionable strategies to switch to a zero-fee account, manage your money, and fight back against illegal deductions.

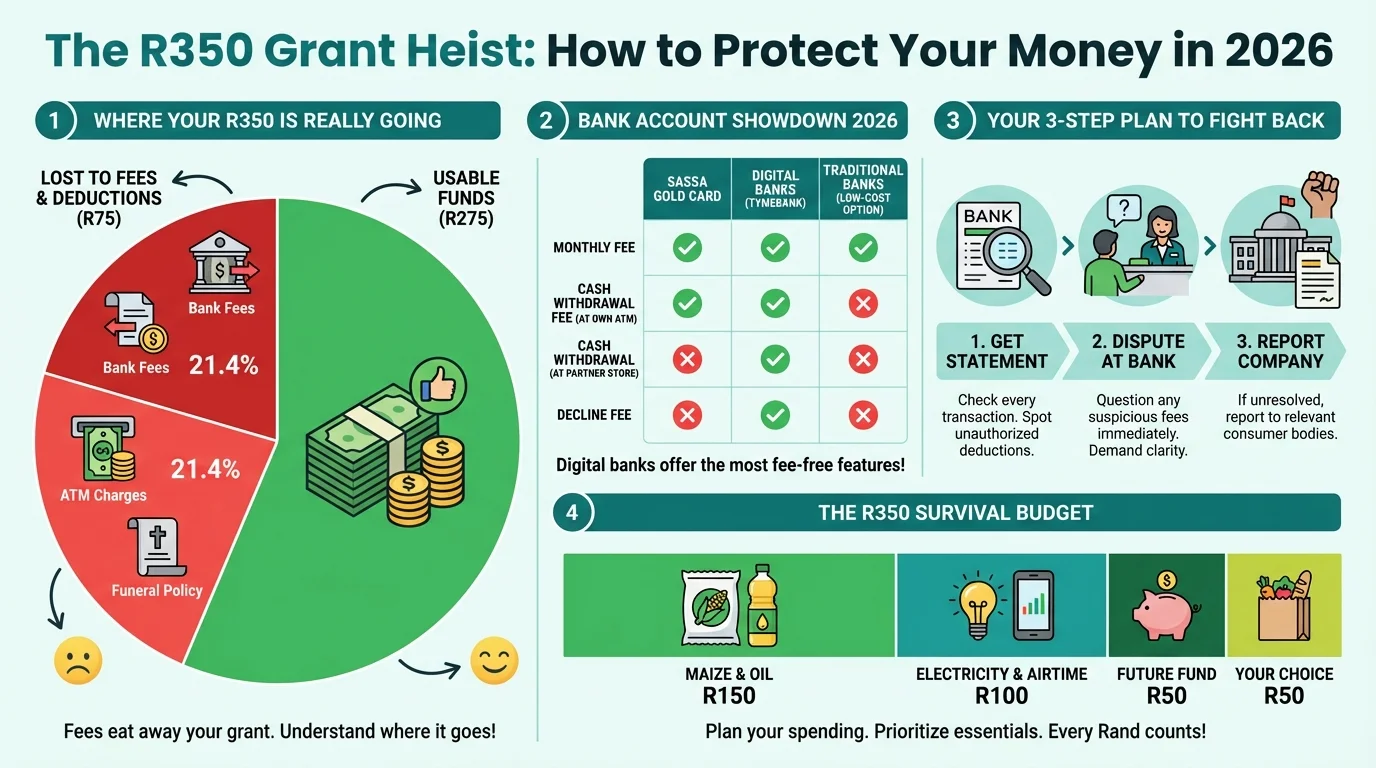

The Silent Theft: Losing R75 of Your Grant Before You Even Spend It

For millions, the SASSA grant is a lifeline. But what if a significant portion of that lifeline was being secretly siphoned off before you even touch it? In January 2026, this isn’t a hypothetical question; it’s a harsh reality. Our investigation reveals that the average beneficiary on a low-cost account can lose up to R75 per month—over 20% of the R350 SRD grant—to a combination of seemingly small bank fees, withdrawal charges, and dubious debit orders. It’s a silent financial heist happening in plain sight, and it’s time to expose how it works and how you can stop it.

Why Your Bank Account Choice is the Most Important Financial Decision You’ll Make in 2026

In the past, receiving your grant was simple. Today, your choice of bank account is a battleground for your money. While the SASSA Gold Card from Postbank was the standard, its persistent technical glitches and fees have opened the door for other banks. However, not all bank accounts are created equal. Some modern digital banks offer truly zero-fee options that can save you hundreds of Rands a year. Others lure you in with low monthly fees but punish you with high charges for things you do every day, like withdrawing cash or checking your balance. This section is a wake-up call: the bank you use for your SASSA grant could be your biggest financial ally or your worst enemy.

The Anatomy of the Heist: Unmasking the Top 5 Hidden Fees

These fees are designed to be small and confusing, but they add up fast. Here’s what to watch out for in 2026:

- Withdrawal Fees (The ATM Tax): Many accounts charge you for taking out your own money. Withdrawing R350 in two smaller amounts could cost you R10-R20 in fees alone.

- Decline Fees (The Penalty for Being Poor): This is the most insulting fee. If a debit order tries to go off and you have insufficient funds, the bank charges you a penalty fee, often between R8 and R15. You get charged money for not having money.

- SMS Notification Fees: That helpful SMS telling you your grant has landed? It could be costing you R1 per notification, adding up over the month.

- Balance Inquiry Fees: Checking your balance at an ATM or via a USSD code isn’t always free. Some banks charge over R2 for a simple inquiry.

- Inter-account Transfer Fees: Need to send money to a family member? That simple transfer could be costing you, chipping away at your grant.

The SASSA Gold Card (Postbank) vs. Digital Banks: A 2026 Showdown

The debate is raging: should you stick with the Postbank-issued SASSA Gold Card or switch to a modern digital bank like TymeBank, Capitec, or Bank Zero? Here’s our honest breakdown for 2026.

SASSA Gold Card (Postbank):

- Pros: Directly linked to SASSA, widely accepted, no monthly fee.

- Cons: Prone to nationwide system outages, high withdrawal fees at non-Post Office ATMs, customer service can be slow, and as of late 2025, the future of the card system remains under constant review, causing uncertainty.

Digital Banks (TymeBank, Bank Zero):

- Pros: Genuinely zero monthly fees, free card swipes, free notifications (often via app), and free cash withdrawals at partner retailers (like Pick n Pay or Boxer for TymeBank). They are built for the digital age.

- Cons: Fewer physical branches, requires a smartphone for full functionality which can be a barrier for some.

Hybrid Banks (Capitec):

- Pros: Low monthly fee (around R7), massive ATM and branch network, excellent app.

- Cons: Fees are low, but not zero. Cash withdrawals at other banks’ ATMs are expensive. You must be vigilant.

Our Verdict for 2026: For the majority of R350 recipients, a digital bank like TymeBank offers the best value proposition, potentially saving you over R500 a year in fees compared to other options. If you’re having issues with your grant payment, it’s crucial to first perform a SRD Status Check to ensure the issue isn’t with your approval status before blaming the bank.

The Funeral Cover & Airtime Debit Order Trap

Beyond bank fees, a more sinister threat exists: unsolicited debit orders. Agents and companies aggressively market low-cost funeral cover, airtime subscriptions, and even store accounts to grant recipients. They make it sound essential, but often the premiums are inflated, the cover is poor, and the contracts are confusing. Suddenly, R40-R99 is disappearing from your account every month for a service you barely understand or need. In 2026, you must be your own financial protector. Never give your bank details or ID number over the phone to someone you don’t know and scrutinize every debit order on your account.

How to Fight Back: Your 3-Step Plan to Stop Illegal Deductions

Are you seeing deductions you don’t recognize? Don’t just accept it. Fight back. Here’s how:

- Get Your Bank Statement: Immediately request a 3-month bank statement. You are entitled to this. Go through it line by line and highlight every single deduction you did not authorize.

- Dispute with Your Bank: Go to your bank branch with the highlighted statement and your ID. Tell them you want to dispute these specific debit orders. They are legally required to help you reverse unauthorized debits (DebiCheck has made this harder, but you still have rights).

- Report the Company: If the bank is unhelpful, report the company making the deduction to the Payments Association of South Africa (PASA) and the National Consumer Commission. This puts pressure on them to stop this behaviour.

The Loan Shark Menace: Why ‘Easy Cash’ Will Cost You Everything

When the grant money runs out, the temptation of a quick loan is strong. Unregistered lenders (mashonisas) and predatory digital loan apps target SASSA beneficiaries specifically because they have a guaranteed income. They offer R200 and demand R400 back on payment day. This is not help; it’s a debt trap that can swallow your entire grant, leaving you with nothing. No legitimate lender will charge 100% interest. Avoid them at all costs. Building a small emergency fund, even just R50, is a better long-term strategy.

Switch and Save: A Step-by-Step Guide to Changing Your SASSA Bank Details in 2026

Ready to move to a zero-fee account? The process is now entirely online and simpler than ever. Don’t let fear of admin stop you from saving money.

- Open Your New Account: First, open your new account with a bank like TymeBank or Bank Zero. Get your official account confirmation letter. It MUST be in your own name. SASSA will not pay into someone else’s account.

- Go to the SASSA SRD Website: Visit the official SASSA SRD website: https://srd.sassa.gov.za.

- Find the Banking Details Link: Look for the section titled ‘How do I change my banking details’.

- Enter Your ID Number: You will be prompted to enter your South African ID number.

- Follow the SMS Link: An SMS with a secure link, unique to you, will be sent to the mobile number you registered with.

- Submit Your New Details: Click the link and carefully enter your new bank name, account number, and branch code. Double-check everything before submitting.

Important Note: The change can take up to a month to process. Do not close your old account until you have received your first successful payment in the new one. Always keep an eye on the official SASSA Payment Dates to know when to expect your funds.

The R350 Budget Makeover: A Realistic Plan for 2026

Budgeting with R350 seems impossible, but having a plan gives you power. Forget complex spreadsheets. Try the ‘Survival Stacking’ method:

- Stack 1: Non-Negotiables (R150): This is for your absolute core survival. A bag of maize meal, cooking oil, soap, and transport to collect the grant. This is the foundation.

- Stack 2: Essentials (R100): This covers electricity, airtime for job searching, and perhaps a small contribution to the household.

- Stack 3: The Future Fund (R50): Pay yourself first, even if it’s just R50. Put this into your savings pocket or a separate account. This is your buffer against emergencies and the seed for future opportunities.

- Stack 4: Discretionary (R50): This is the remainder. What you do with it is your choice.

This isn’t about becoming rich; it’s about taking control and ensuring that hidden fees don’t eat into your ‘Non-Negotiables’ stack.

The Verdict: Reclaiming Your Financial Power in 2026

The ‘SASSA Heist’ is not a formal conspiracy, but a systemic failure where financial institutions profit from the vulnerability of grant recipients. In 2026, the solution lies not in waiting for the government to fix everything, but in taking decisive, individual action. By choosing a zero-fee bank account, fiercely guarding your personal information, disputing every wrongful deduction, and creating a simple budget, you are not just managing money. You are reclaiming your dignity and your power. Your grant is your right, and you deserve to keep every single Rand of it. If your grant has been declined and you believe it’s an error, don’t just give up; use our comprehensive Appeals Guide to fight for what you are owed.

Frequently Asked Questions

What is the best and cheapest bank account for the SASSA R350 grant in 2026?

Can SASSA pay my grant into someone else's bank account?

I saw a debit order for R99 that I don't recognize. What should I do?

Is the SASSA Gold Card from Postbank being discontinued in 2026?

How can I check if my SASSA banking details have been updated successfully?

Are funeral cover policies sold over the phone to SASSA beneficiaries legitimate?

Why does my bank charge me a fee when a debit order fails?

Can I get a loan from a store like Shoprite or Pep using my SASSA grant?

How do I use a USSD code to check my bank balance without paying high fees?

*120*3279#. However, some charge for this service. The best way to avoid fees is to use the bank’s mobile app, which uses a small amount of data but is free to use for banking functions like balance checks. Check with your specific bank what their free options are.My SASSA status is 'approved' but there is no pay date. Is this a bank problem?

Read Next

The R20 Bread Scandal: Is Price-Fixing Making Your SASSA Grant Worthless in 2026?

A shocking Competition Commission investigation into alleged price-fixing of …

SASSA's R370 'Work-for-Grant' Scheme for 2026: The End of 'Money for Nothing'?

In a major policy shift proposed in January 2026, the South African government …

Comments & Discussions