Table of Contents

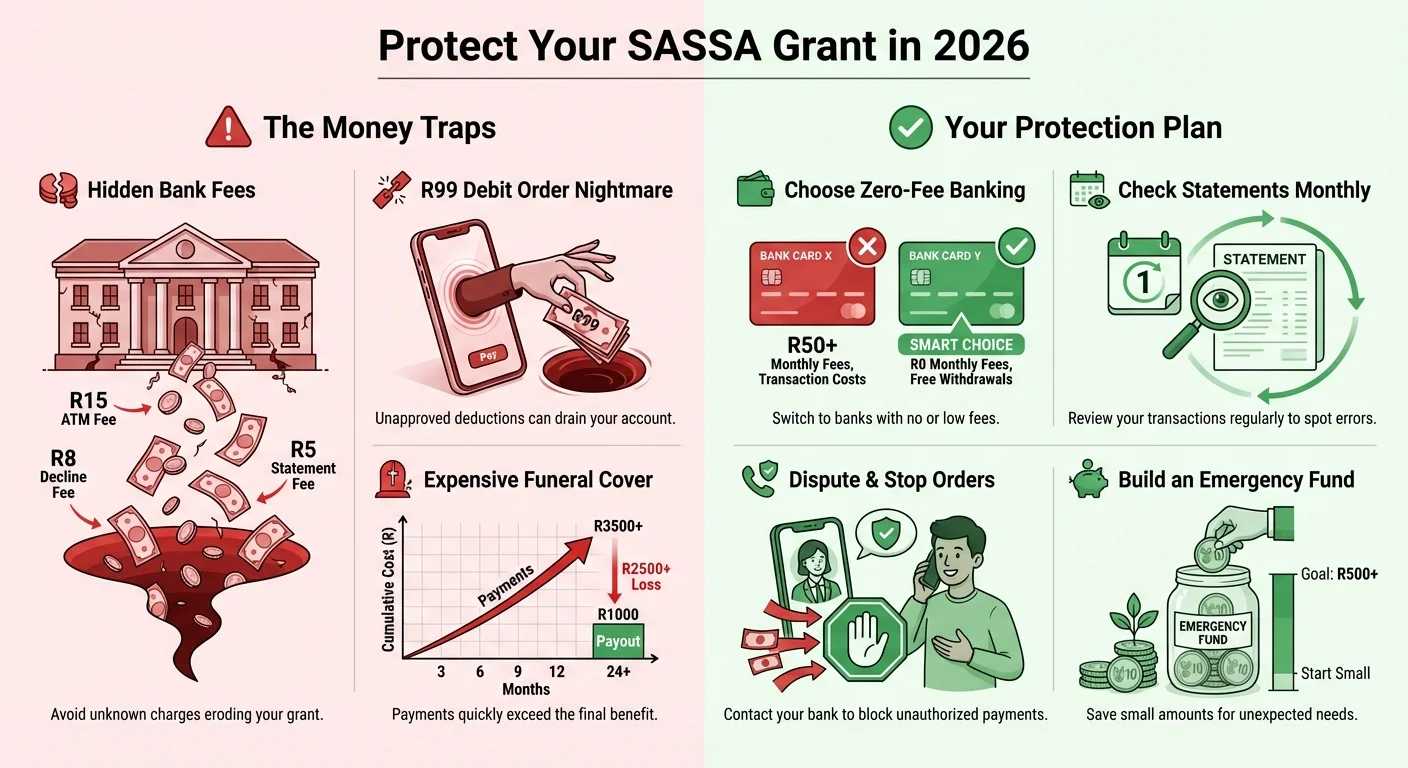

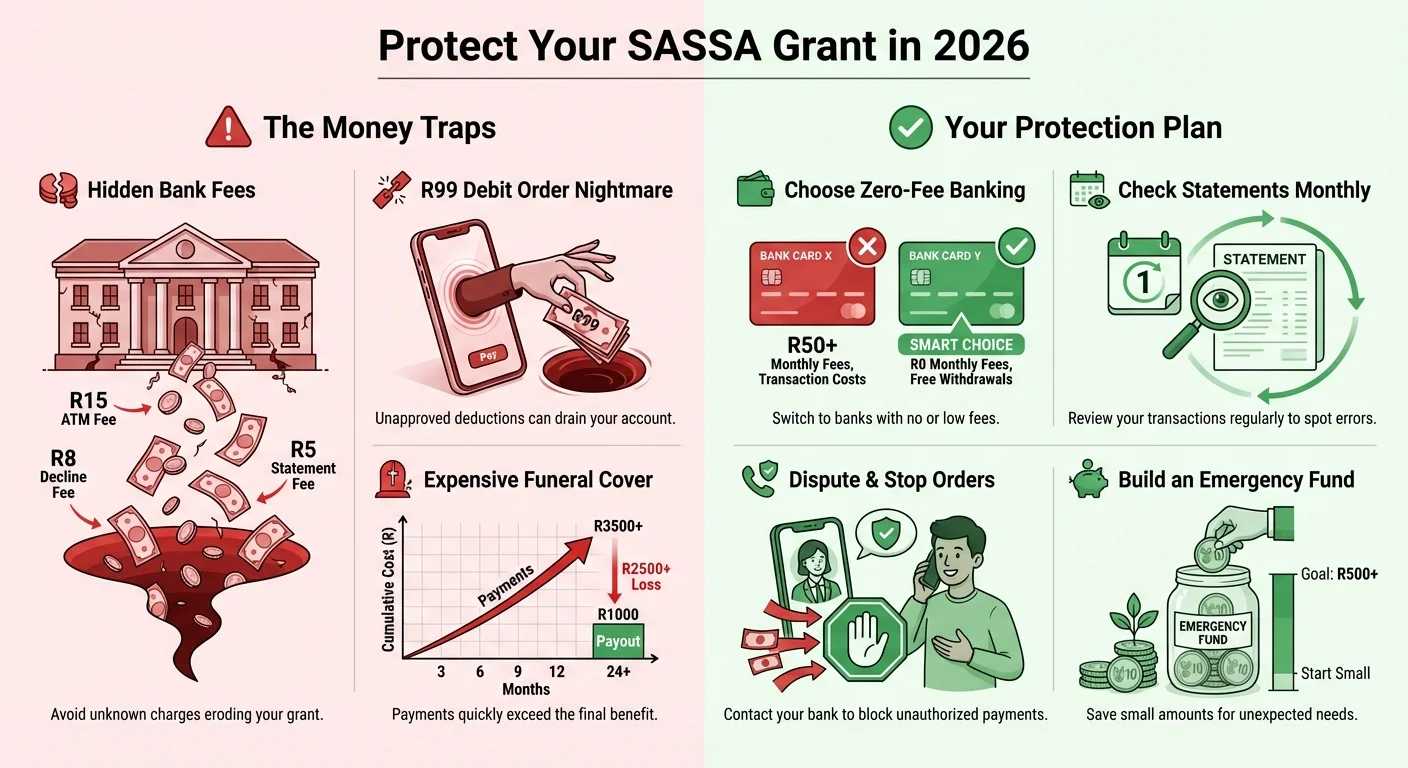

Are you wondering where your SASSA grant money goes each month? This in-depth 2026 analysis reveals the financial traps, from hidden bank fees to predatory R99 debit orders for services you never signed up for. We investigate the ‘SASSA-friendly’ bank accounts, funeral covers, and loans that are costing beneficiaries a fortune. Learn how to identify and fight back against these deductions, choose truly zero-fee banking options, and make your grant money work for you, not against you.

The Shocking Truth: How Your R350 Grant Becomes R250 Before You Even Touch It

It’s that time of the month. The notification arrives, and for a moment, there’s relief. But when you check your balance or get to the ATM, the number is smaller than you expected. A R15 ATM fee here, a R5 ‘service fee’ there, and a mysterious R99 debit order for ‘services’ you can’t remember agreeing to. Suddenly, your crucial R350 grant is barely R250. This isn’t just bad luck; it’s a system of financial traps deliberately targeted at South Africa’s most vulnerable. In 2026, these deductions are more aggressive than ever, turning the social safety net into a source of profit for unscrupulous companies. This article is not just another guide; it’s an exposé on the hidden financial war being waged on your SASSA grant and a battle plan for you to fight back.

Trap 1: The ‘Low-Cost’ Bank Account That Isn’t

Banks aggressively market ’easy-open’ or ‘SASSA-friendly’ accounts. They promise low monthly fees, but the real cost is in the fine print. As of January 2026, beneficiaries are reporting a spike in transaction-based fees that quickly erode their grants.

- ATM Withdrawal Fees: Drawing your cash can cost you. Some banks charge up to R20 for a single withdrawal at another bank’s ATM. Even at their own ATMs, multiple smaller withdrawals can accumulate significant charges.

- Decline Fees: Don’t have enough for a debit order to go through? You get hit with a ‘penalty’ or ‘unpaid transaction fee’, often between R8 and R15. You’re charged money for not having money.

- Statement Fees: Need a printed statement to dispute a charge? That’ll cost you. Some branches charge per page, making it expensive to even investigate where your money went.

The Solution: Scrutinize your bank’s fee structure. Banks like TymeBank and Capitec’s base account often have genuinely lower fee structures, but you must understand them. Always opt for digital statements (they’re usually free) and plan one single withdrawal to minimize ATM fees. To know exactly when your money is due, always check the official SASSA Payment Dates.

Trap 2: The R99 Debit Order Nightmare You Never Approved

This is the most common and devastating trap. A company you’ve never heard of starts taking R99 (a popular amount) from your account every month. These are often for services like airtime, data, ’legal services’, or even questionable insurance products. Getting these stopped is a nightmare by design.

How it Happens:

- Misleading Competitions: You enter a competition via SMS or online, and buried in the terms and conditions is an agreement for a monthly subscription.

- Data Leaks: Your personal information is sold or leaked, and companies use it to create fraudulent debit orders.

- Aggressive Telesales: A fast-talking agent confuses you into verbally agreeing to something over the phone, which is then used as consent.

Your 2026 Action Plan:

- Get Your Statement: Check your bank statement every single month without fail. Question every single deduction you don’t recognize.

- Contact Your Bank Immediately: Instruct your bank to reverse the debit order (if it’s within 40 days) and place a stop payment on all future transactions from that company.

- Use the USSD Service: Some banks allow you to manage debit orders via USSD. For example, you might be able to view and stop them by dialing your bank’s service code.

- Lodge a Complaint: Report the company to the Payments Association of South Africa (PASA) and the National Consumer Commission.

Trap 3: Is Your Funeral Cover a Rip-Off?

Having a dignified burial is deeply important, and companies exploit this fear. They sell funeral policies with low premiums (e.g., R50-R100 per month) that seem affordable. However, many of these plans offer poor value for money.

The Red Flags for 2026:

- Low Payouts: You might pay R600 a year for a policy that only pays out R5,000. Over a decade, you’ve paid more than the benefit is worth.

- Strict Waiting Periods: Many policies have a 6-month waiting period for natural death. If the policyholder passes away before this, you get nothing back.

- Exclusions in the Fine Print: Some policies won’t pay out for specific causes of death or if the person was over a certain age when they took out the policy.

Smarter Alternatives:

- Reputable Insurers: Look at policies from well-known, established insurance companies. Compare their premiums and payout amounts.

- Family Savings Stokvel: Pool money with trusted family members. This keeps the money within the community and avoids feeding corporate profits.

- Bank Savings Pocket: Create a separate ‘savings pocket’ in your bank account and label it ‘Funeral Fund’. Automate a small transfer into it every month. You are in control, and the money earns interest.

Trap 4: The Path from a Bank Account to a Loan Shark

Once predatory lenders know you have a bank account with a regular SASSA deposit, you become a prime target. They offer quick, easy loans but at astronomical interest rates. They often demand your SASSA card and PIN as ‘security’—which is illegal.

Giving them your card means:

- They withdraw your entire grant the moment it lands.

- They give you what’s left after taking their exorbitant repayment.

- You are trapped in a cycle of debt, needing another loan just to survive the month.

The Law is on Your Side: It is a criminal offense for anyone to force you to hand over your SASSA card and PIN. Report any lender who demands this to the South African Police Service (SAPS) and the National Credit Regulator (NCR). If your R350 SRD grant is your main source of income, check its status regularly using the official SRD Status Check tool to ensure there are no issues with your payments.

Your 2026 SASSA Money Protection Checklist

Feeling overwhelmed? Don’t be. Here are simple, powerful steps you can take today to secure your grant.

- Switch to a Zero-Fee Account: Do your research. Ask directly at the bank: ‘What is the fee to withdraw cash at another ATM? What is the fee for a declined debit order?’ Choose the account with the fewest fees for the way you use it.

- Never Share Your PIN: Your PIN is your secret. Not for the shopkeeper, not for a ‘helper’ in the queue, not for anyone.

- Turn on SMS Notifications: Activate notifications on your bank account. You’ll get an immediate SMS for any transaction, allowing you to spot fraud instantly.

- Create a ‘Dispute’ Folder: Keep all your bank statements and any communication with your bank or companies regarding faulty debit orders.

- Consider Cash Collection: If banking fees and debit orders are a persistent problem, consider collecting your grant from a Post Office or a designated pay point like Shoprite or Pick n Pay. While it can involve queues, you receive the full cash amount, safe from deductions.

Conclusion: Your Grant is Your Lifeline, Not Their Profit

The SASSA grant system is a lifeline for millions, but it has also created a feeding frenzy for companies that see beneficiaries as easy targets. The R99 debit order, the hidden bank fee, and the overpriced funeral policy are not just transactions; they are attacks on your dignity and survival. Taking control is not easy, but it is essential. By being vigilant, questioning every deduction, and knowing your rights, you can turn the tables in 2026. Your grant is your right, and every single Rand of it belongs to you.

Frequently Asked Questions

What is the cheapest bank account for SASSA grants in 2026?

How can I stop an illegal debit order from my SASSA account?

Can a company take money from my SASSA grant without my permission?

Is it safer to collect my SASSA grant in cash?

I was declined for a grant. Can a bank account affect this?

What is a DebiCheck debit order and is it safer?

Can I use my SASSA grant to get a loan?

My SASSA gold card is expiring. What should I do?

Read Next

From R350 to R3,500: The Secret SASSA Side Hustles Dominating South Africa in 2026

In 2026, the R350 SRD grant is no longer just for survival; it’s becoming …

Why SASSA’s R20 Increase for the SRD Grant is an Insult to South Africans in 2026

In January 2026, the South African government announced a mere R20 increase to …

Comments & Discussions