Table of Contents

Are you losing a portion of your SASSA grant every month to mysterious fees and deductions? This 2025 guide exposes the tactics used by banks, lenders, and insurers to drain beneficiary accounts. Learn how to identify these traps, fight back against illegal debit orders, choose the right bank account, and secure your financial future.

The Silent Theft: Is Your SASSA Grant Disappearing?

It’s a story we hear far too often in December 2025. The notification arrives: your SASSA grant has been paid. But when you check your balance, a chunk of it is already gone. R50 vanished here, R99 there. This isn’t just bad luck; it’s a systemic problem. For millions of South Africa’s most vulnerable, the social grant system, designed as a lifeline, has become a feeding ground for opportunistic banks, predatory lenders, and shadowy companies making unauthorized deductions. The government’s push to move beneficiaries onto the formal banking system was meant to improve efficiency, but has it unintentionally opened the door for new forms of exploitation? This article is not just another guide. It’s a warning and an action plan. We will dissect the most common money traps of 2025 and give you the tools to fight back and protect every single Rand you are entitled to.

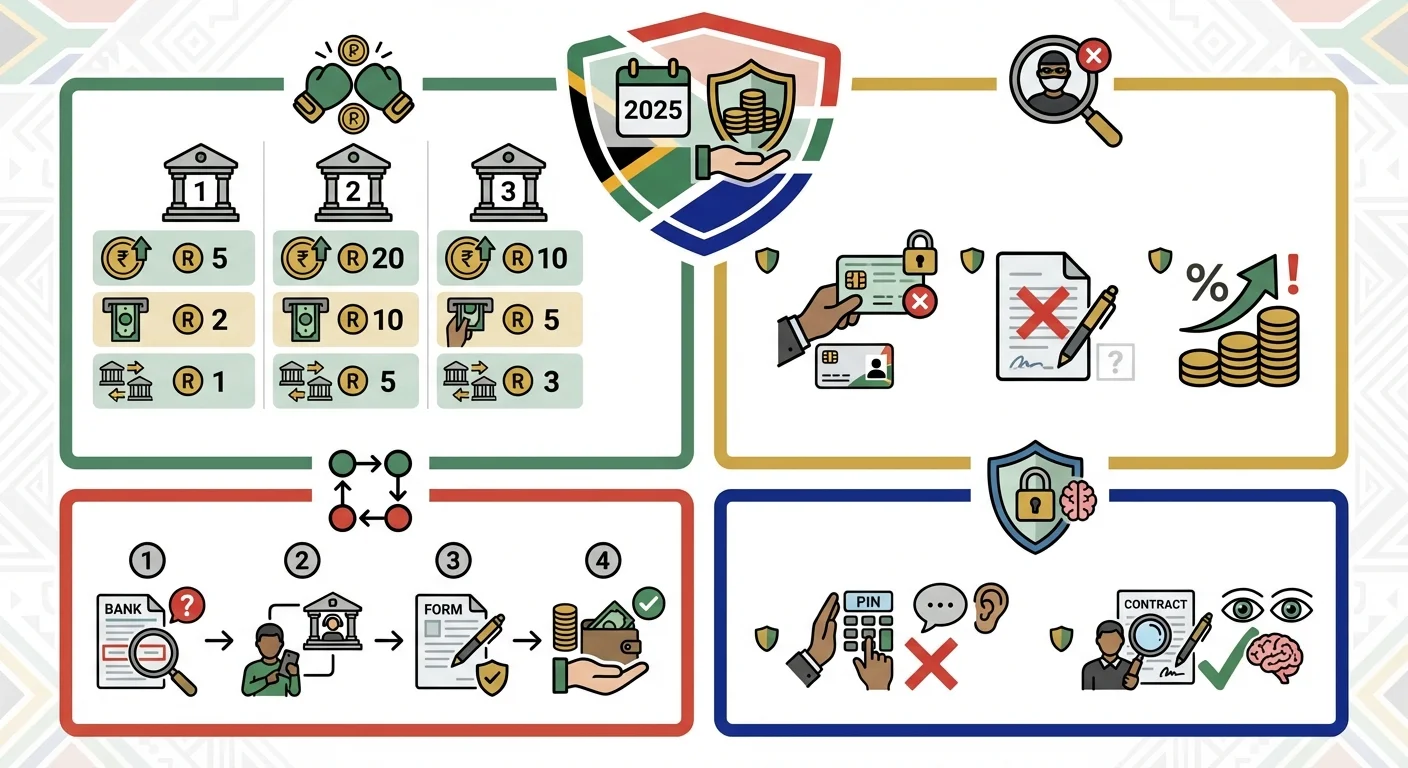

Trap 1: The Bank Account Bleed - Choosing Wrong Can Cost You

Not all bank accounts are created equal, especially for small, crucial payments like a SASSA grant. While moving away from the often-unreliable Postbank system seems like a smart move, rushing into the wrong bank account can be a costly mistake.

The High-Fee Nightmare: Many standard bank accounts are designed for salaried individuals, not grant recipients. They come with monthly administration fees, high cash withdrawal charges, and fees for every single transaction. A R10 monthly fee might not sound like much, but it’s nearly 3% of an R370 SRD grant. Add a few ATM withdrawals, and you could be losing R50-R80 of your grant to bank charges alone. That’s a week’s worth of bread or electricity.

The Solution - The Rise of Low-Cost Banking: The good news is that competition has forced banks to offer better options. In 2025, several banks offer accounts specifically designed for low-income earners:

- TymeBank: Often features no monthly fees and low transaction costs. You can withdraw cash at Pick n Pay or Boxer stores, which can be cheaper than a standard ATM.

- Capitec: Known for its accessible banking, it offers a global one account with a low monthly fee and transparent, pay-as-you-use transaction fees.

- Bank Zero: A digital-only option with no monthly fees, but you must be comfortable using a smartphone app for all your banking.

Your Action Plan: Before you switch your grant payment to a new bank, demand a full fee schedule. Ask them directly: ‘If I receive R370 and withdraw it twice, how much will I pay in fees?’ Their answer will tell you everything you need to know. Don’t be pressured into a ‘bundle’ account you don’t need.

Trap 2: The Green Goblin - Unmasking Illegal Debit Orders

This is the most infuriating trap of all. A company you’ve never heard of, for a service you never signed up for, starts taking money from your account every month. This is often called a ‘DebiCheck’ or debit order, and while legitimate ones exist for things like insurance, a fraudulent industry has sprung up around them.

How Does It Happen?

- Leaked Data: Your details might be sold or leaked illegally.

- Fine Print: You may have unknowingly agreed to it in the terms and conditions of a competition or loan application.

- Outright Fraud: Criminals simply use stolen identity information to create a debit order.

These deductions are often for small, seemingly insignificant amounts like R99, designed to fly under the radar. The companies behind them bet that you won’t have the time or resources to fight it. They are wrong. As soon as you see a transaction you don’t recognize, you must act. Your money is at stake. For the latest on your grant approval before checking for deductions, you can always perform a SRD Status Check.

Your Counter-Attack: How to Slay Illegal Debit Orders in 2025

Fighting back against these deductions is your right. You do not have to accept this theft. Follow these steps precisely:

Step 1: Get Your Bank Statement. Immediately get a printed statement from your bank or check your banking app. Find the name of the company taking your money and the transaction reference.

Step 2: Go to Your Bank Branch. Do not call the company directly first. Go to your bank with your ID and the statement. Tell the consultant, ‘I want to dispute and reverse an unauthorized debit order.’

Step 3: Fill Out the Dispute Form. The bank will give you a form. Fill it out accurately. Clearly state that you did not authorize the transaction. The bank is legally obligated to help you.

Step 4: Demand an Immediate Reversal. For recent transactions (usually within the last 40 days), the bank can often reverse the payment immediately. You should see the money back in your account within a few days.

Step 5: Block the Company. Insist that the bank puts a stop order on all future transactions from that company. This prevents them from trying to deduct money again next month. It is a free service.

Do not be intimidated. This is your money, and the banks have a responsibility to protect you from fraudulent activity.

Trap 3: The Loan Shark’s Vicious Cycle

Loan sharks, or ‘mashonisas’, are predators who thrive on desperation. They often hang around pay points on grant payment days, offering ’easy cash’ with no paperwork. This ’easy cash’ is a trap that can lead to a devastating cycle of debt.

The Warning Signs in 2025:

- They Keep Your SASSA Card/ID: This is their ‘security’. It’s illegal and gives them total control over your grant. They will withdraw your entire grant and give you what’s left after their ‘repayment’, trapping you into borrowing again.

- Insane Interest Rates: They charge interest rates of 30%, 50%, or even 100% per month. A R200 loan can become a R400 debt by your next payment date.

- No Paperwork: A legitimate lender, registered with the National Credit Regulator (NCR), must provide you with a credit agreement that clearly states the loan amount, interest rate, and repayment terms.

- Threats and Intimidation: If you are late with a payment, they will resort to threats of violence against you or your family.

If you are in financial trouble, a loan shark is never the answer. You are better off seeking help from family, community organizations, or approaching a registered micro-lender who must abide by the law.

Trap 4: The ‘Peace of Mind’ That Costs a Fortune - Funeral Cover & Insurance

Providing a dignified funeral is deeply important in our culture. Unscrupulous salespeople know this and use high-pressure tactics to sell funeral policies that are either overpriced or unsuitable for grant beneficiaries.

They will set up tables near SASSA pay points, promising ‘peace of mind’ for a ‘small’ monthly fee. The problem is that these small fees add up, and often the policies have so many exclusions that they are worthless when you need them. Some will even try to sell you cellphone contracts or other services you don’t need, bundled with the promise of airtime.

Your Defence:

- Never Sign on the Spot: Take the paperwork home. Read it carefully. Ask a trusted family member to read it with you.

- Ask Hard Questions: ‘What is the total I will pay over a year?’ ‘What exactly does this cover?’ ‘What situations would cause you not to pay out?’

- Compare Quotes: Don’t buy from the first person you meet. Get quotes from at least three different reputable providers.

Remember, a legitimate financial advisor will never pressure you into making an instant decision.

Is SASSA Doing Enough to Protect Beneficiaries?

This is a critical question we must ask in December 2025. While SASSA’s primary mandate is to distribute grants, it has a moral obligation to ensure that money reaches the people it’s intended for. Simply telling beneficiaries to ‘be careful’ is not enough.

SASSA could be doing more. They could be running more aggressive public awareness campaigns on TV, radio, and social media, specifically naming and shaming fraudulent companies. They could work more closely with the banking sector and the NCR to create a blacklist of companies that repeatedly target beneficiaries with illegal debit orders. They could also provide clearer, simpler guides on how to choose a safe, low-cost bank account.

The current system places too much of the burden on the individual beneficiary – people who are often elderly, have low financial literacy, or live in remote areas without easy access to bank branches. It’s time for SASSA and its partners in government to take a more proactive, protective stance. If you’re still waiting for your grant and need to file an appeal, our SASSA Appeals Guide can help you navigate the process.

Conclusion: Take Back Control of Your Money

Your SASSA grant is a lifeline, not a lottery prize for predatory companies. Losing even R50 to fees or scams can mean the difference between having electricity or sitting in the dark. In 2025, financial self-defence is not optional; it is essential. Be vigilant. Check your statements every single month. Question every single deduction you don’t recognize. Do not be afraid to walk into your bank and demand answers. By understanding these traps and using the strategies outlined here, you can build a financial shield around your grant and ensure that every Rand works for you and your family, not for a faceless corporation.

Frequently Asked Questions

What is the cheapest bank account for a SASSA grant in 2025?

Can I stop a debit order myself using my phone?

Is it safe to give my bank details to SASSA?

How do I report a loan shark (mashonisa)?

My SASSA grant was paid, but the money is gone. What happened?

Will changing my bank account delay my SASSA payment?

Someone offered me a loan on WhatsApp using my SASSA grant as security. Is this legitimate?

What is 'DebiCheck' and how is it different?

Read Next

Why Your SASSA Gold Card is Secretly Costing You R2,000 a Year: The 2025 Banking Switch You Must Make

As of December 2025, countless South Africans are losing money to hidden fees, …

SASSA Grant Declined? The 5 Real Reasons Winners Get Approved in 2025

Feeling stuck with a ‘Declined’ SASSA SRD grant status? This …

Comments & Discussions