Table of Contents

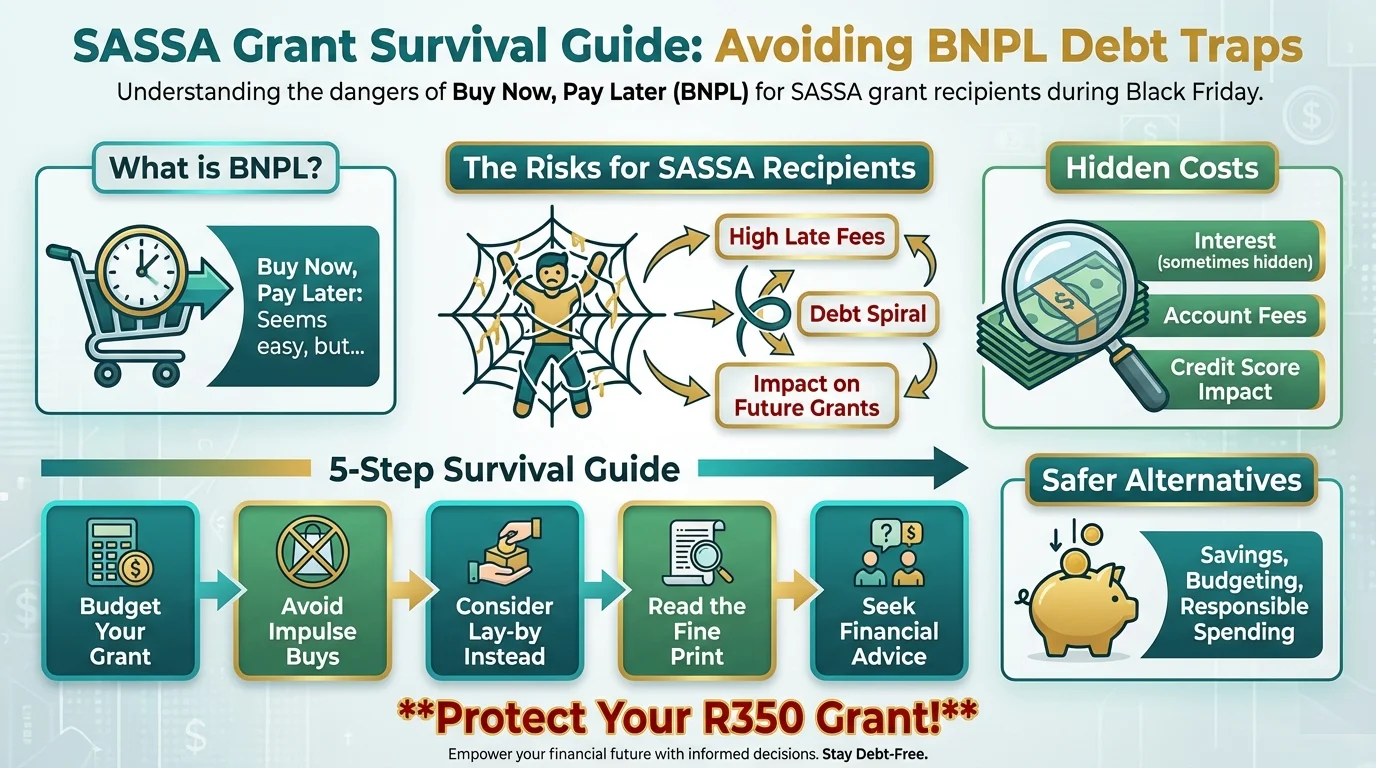

Black Friday 2025 is here, and so are the tempting ‘Buy Now, Pay Later’ offers from services like PayJustNow, Afterpay, and others. While they promise easy access to deals, they pose a significant risk to SASSA grant recipients. This investigative guide breaks down how BNPL schemes work, why they are particularly dangerous for those on a fixed income, the hidden costs they don’t advertise, and how to protect your grant money. Learn how to budget effectively, spot predatory offers, and utilize safer alternatives like lay-by to make the most of Black Friday without accumulating debt.

Black Friday Fever Hits: A Tempting Offer You Should Probably Refuse

The emails are flooding in. The SMS alerts are buzzing. Black Friday 2025 is upon us, promising once-in-a-year deals on everything from electronics to groceries. For millions of South Africans relying on the SASSA SRD R350 grant, it feels like a brief window to afford life’s necessities—or even a small luxury. But lurking behind the flashy promotions is a new, sophisticated financial trap: ‘Buy Now, Pay Later’ (BNPL). These services are masters of marketing, making it seem like you can have it all now for ‘3 easy payments’. This article is a critical warning: for a SASSA beneficiary, this ’easy’ path can lead directly to a debt spiral.

What is ‘Buy Now, Pay Later’ and Why is it Everywhere in 2025?

Buy Now, Pay Later is essentially a short-term, interest-free loan that allows you to purchase an item immediately and pay for it in several installments over a few weeks or months. Companies like PayJustNow, Afterpay, and MoreTyme have partnered with major retailers across South Africa. Their selling point is convenience and zero interest, which sounds perfect. The problem is, their business model relies on two things: merchant fees and, crucially, late payment penalties. They are designed to encourage impulse spending, and their approval processes are often far less stringent than traditional credit, making them easily accessible to vulnerable consumers.

The Mathematical Trap: How R350 Becomes a R1000 Headache

Let’s be brutally honest about the numbers. The SRD grant is R350. It’s a lifeline, not a luxury fund. Now, imagine buying a R600 item on Black Friday using a BNPL service that splits it into three payments of R200.

- Payment 1 (At Purchase): R200. You now have only R150 left from your grant for the entire month.

- Payment 2 (Next Month): R200. This is automatically deducted, leaving you with just R150 of your next grant.

- Payment 3 (Month After): R200. Again, you’re left with R150.

Suddenly, over half of your grant is gone for three consecutive months before you can even buy food or data. And this assumes everything goes perfectly. What if one payment is late?

The Hidden Killer: The Truth About Late Fees and Penalties

This is where the BNPL business model shows its teeth. If a payment fails—perhaps your SASSA payment is delayed, or another expense comes up—the penalties kick in. A ‘small’ late fee of R70 or R100 might not sound like much, but it’s nearly a third of your R350 grant. Some services will continue to add fees for every week you are late. That R600 item can quickly balloon to R800 or R900. You are now using your entire grant just to pay off penalties for one single purchase, trapping you in a cycle of debt that is incredibly difficult to escape.

Case Study: How Nomvula’s Black Friday ‘Bargain’ Cost Her Two Months’ Grants

Nomvula, a SASSA beneficiary from Tembisa, wanted to buy her son a new pair of school shoes she saw on a Black Friday deal for R450. Using a BNPL app on her phone, she paid the first R150 installment. The next month, her SASSA payment was delayed by a few days due to a system issue. The BNPL service attempted to deduct the R150, but the funds weren’t there. She was immediately hit with a R90 late fee. The app froze her account. By the time her grant arrived, she owed R240. The stress and confusion made her miss the next payment window, adding another R90 penalty. The R450 shoes ended up costing her R630, almost two full SASSA grants.

Your 5-Step SASSA Grant Survival Guide for Black Friday 2025

1. Cash is King: The simplest rule. If you don’t have the cash in your hand (or your account), you cannot afford it. Withdraw your grant and use physical cash for shopping. It makes overspending much harder.

2. Make a ‘Needs’ List: Before you even look at deals, write down what you absolutely need. Food, toiletries, electricity, transport. Allocate your R350 to these items first. Only consider ‘wants’ with whatever is left, if anything.

3. Unsubscribe and Unfollow: For the week of Black Friday, unsubscribe from marketing emails and unfollow stores on social media. Reduce the temptation. The fear of missing out (FOMO) is a powerful marketing tool designed to make you spend.

4. Use the Old-School Alternative: Lay-By: If you must buy a bigger ticket item, use a traditional lay-by. There are no late fees, no credit checks, and no risk of a debt spiral. You pay it off when you can, and if you can’t, you often get your money back (minus a small cancellation fee).

5. Delay Gratification: The deals will come back. Christmas sales, New Year sales, Easter sales. A Black Friday ‘bargain’ that puts you in debt for three months is not a bargain at all. It’s a trap. Wait until you have saved the full amount.

Know Your Rights: The National Credit Act and BNPL

There is an ongoing debate in South Africa about whether BNPL services should be fully regulated under the National Credit Act (NCA). While some operate in a grey area, you as a consumer still have rights. You have the right to transparent information about all fees and charges. If a company is misleading you, you can report them to the National Credit Regulator (NCR). Don’t let these companies bully you with complex terms and conditions.

The Verdict: Is BNPL Ever a Good Idea for SASSA Recipients?

In our expert opinion, for anyone relying on a fixed, survival-level income like the R350 grant, mainstream Buy Now, Pay Later services present a far greater risk than a reward. The ‘convenience’ they offer is a slippery slope into a debt cycle that can have devastating consequences. The financial discipline required to manage BNPL payments perfectly, every single time, is immense when your income is unpredictable and barely covers essentials. This Black Friday, the smartest financial move you can make is to protect your grant and say a firm ’no’ to the ’easy payments’ trap.

Frequently Asked Questions

Can I use my SASSA card or bank account for Buy Now, Pay Later services in 2025?

Are services like PayJustNow or Afterpay safe for SASSA beneficiaries?

What happens if I miss a BNPL payment?

Are there really no interest charges with BNPL?

How can I get Black Friday deals without going into debt?

Does using 'Buy Now, Pay Later' affect my SASSA grant eligibility for 2025?

What is the difference between Buy Now, Pay Later and a lay-by?

Where can I get free financial advice in South Africa?

Read Next

SASSA Grant Declined in January 2026? The Hidden Reasons & Your 4-Step Fix

Received a shocking ‘Declined’ status for your January 2026 R350 …

The Real Reason SASSA's February 2026 Payment Dates Will Squeeze You Dry (And How to Survive)

This is the official SASSA payment schedule for February 2026. We expose why the …

Comments & Discussions