Table of Contents

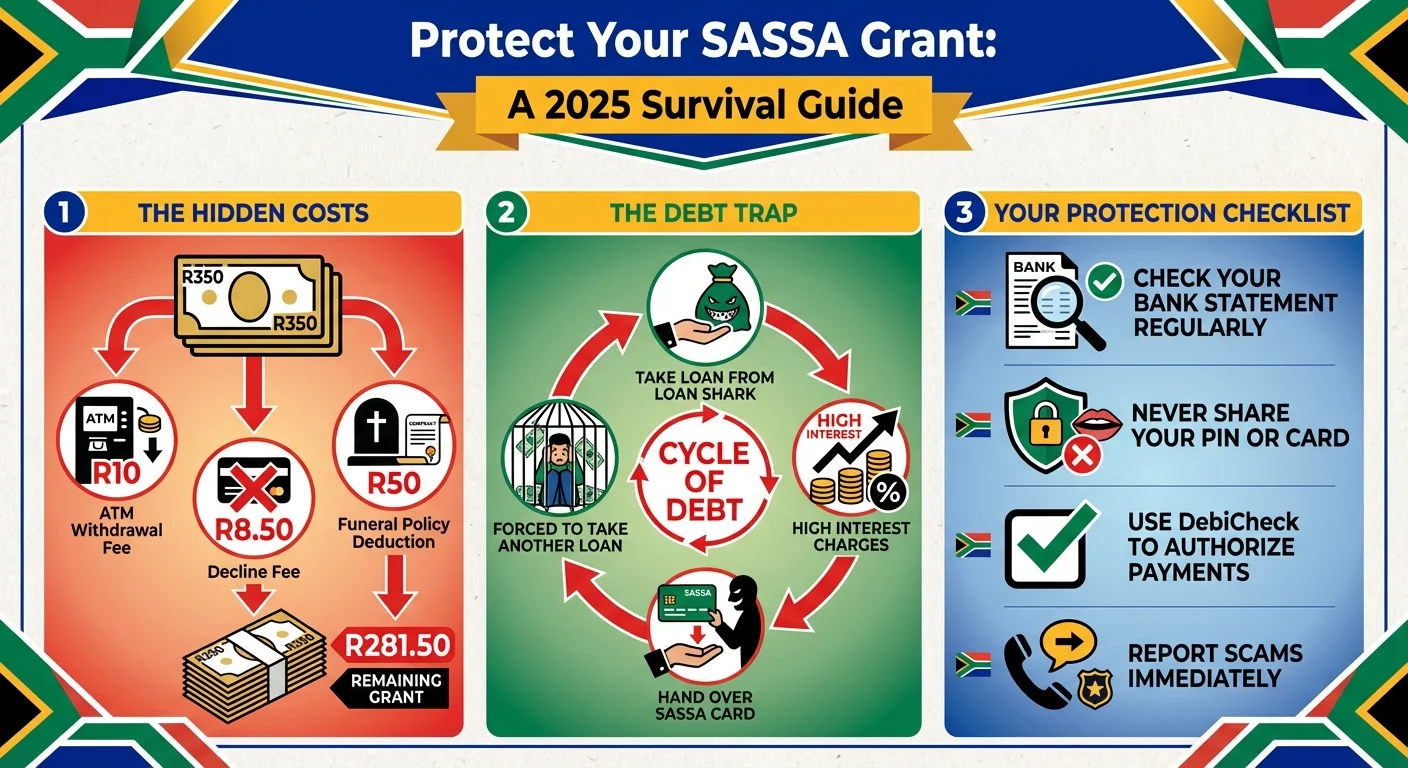

Are you a SASSA grant recipient who finds your R350 or other grant money disappearing faster than it arrives? You’re not alone. This 2025 guide exposes the dark side of ‘SASSA-friendly’ financial products, from bank accounts with hidden fees to loan sharks and illegal debit orders for funeral cover and airtime. We uncover the truth and provide a step-by-step plan to protect your grant, stop the leaks, and take back control of your finances.

The Agony of the Disappearing Grant: A December 2025 Reality

It’s a story we hear every single month. The notification arrives: your SASSA grant has been paid. You’ve checked the official payment dates for December 2025 and waited patiently. A wave of relief washes over you. But when you get to the ATM or check your balance, the relief turns to confusion, then anger. The amount is less than you expected. R20 is gone. Sometimes R50. Sometimes more. Where did it go? This isn’t just bad luck; for millions of South Africans in 2025, it’s a calculated system of deductions, fees, and predatory offers designed to chip away at the very social support meant to provide a lifeline.

The Myth of the ‘Free’ SASSA Bank Account

Banks aggressively market ’low-cost’ or ‘SASSA-friendly’ accounts. They promise zero monthly fees, but the devil is in the details. The truth is, these accounts are often a minefield of charges that penalize the very people they claim to help.

Common Hidden Fees in 2025:

- Withdrawal Fees: While your first withdrawal might be free at the bank’s own ATM, subsequent withdrawals or using another bank’s ATM can cost you anywhere from R7 to R25 per transaction. Two withdrawals could cost you R50 of your R350 grant.

- Decline Fees: Don’t have enough money for a debit order or a swipe? The bank charges you a ‘penalty fee’ for the failed transaction, often around R8.50. You lose money for not having money.

- Statement Fees: Need a printed statement? That’ll cost you. Checking your balance at an ATM? That’s another fee.

- Cash Deposit Fees: If a family member deposits cash into your account, the bank takes a percentage. It’s a fee on money you haven’t even used yet.

These small amounts add up, and by the end of the year, a significant portion of your grant has been paid straight back to the bank in fees.

The Loan Shark Trap: How ‘Easy Cash’ Creates a Debt Prison

When the grant money runs out, desperation sets in. This is when the loan sharks and predatory lenders, both formal and informal, pounce. They send SMSes, advertise on community boards, and promise ‘instant cash’ with ’no credit checks’ specifically for SASSA grant recipients. They make it easy to get the loan, but impossible to get out of the debt.

Here’s their predatory model:

- Sky-High Interest: They charge exorbitant interest rates, far exceeding the legal limits set by the National Credit Regulator. A R300 loan can easily require a R450 repayment next month.

- They Take Your Card: Many require you to hand over your SASSA card and PIN as ‘security’. This gives them complete control. On payment day, they withdraw their repayment (and often extra ‘fees’) before you can even access your funds.

- The Debt Spiral: Because the repayment takes such a large chunk of your next grant, you’re forced to take out another loan just to survive, trapping you in a cycle of debt you can never escape. This isn’t a helping hand; it’s financial enslavement.

The Silent Thieves: Unmasking Unauthorized Debit Orders

This is perhaps the most infuriating problem. Mysterious debit orders for ‘services’ you never knowingly signed up for. The most common culprits are:

- Funeral Cover: While having a funeral policy is wise, many companies use deceptive tactics to sign up grant recipients. A simple ‘please call me’ or responding ‘YES’ to a confusing SMS can be twisted into a binding contract. Suddenly, R50-R100 is being deducted monthly.

- Airtime & Data Subscriptions: These are often bundled with other services or hidden in terms and conditions. Small, daily deductions of R2 or R5 can go unnoticed but quickly drain your balance.

- ‘Value-Added’ Services: These can be anything from coupon services to questionable legal advice plans, all deducting small amounts that add up over time.

These companies prey on the vulnerable, knowing that the process to dispute and reverse these debit orders is often complicated and intimidating. Before you can even begin the process, you have to successfully run a SRD R350 Status Check to confirm the funds were even paid in.

Store Cards: Is That Grocery Credit Really Worth It?

Major retailers are now key players in the financial lives of grant recipients. They offer store cards right at the till point, promising you can buy groceries today and pay on your next grant day. While it sounds helpful, it’s a business model designed to create reliance and debt.

The Dangers:

- High Interest: Store credit often comes with high interest rates. If you can’t pay the full balance, the amount you owe quickly grows.

- Initiation & Service Fees: There are often monthly service fees and once-off initiation fees that are added to your balance.

- Overspending: It encourages spending money you don’t have. The R350 grant is for survival essentials, but a store card can tempt you to buy non-essentials, digging a deeper financial hole.

This system effectively funnels social grant money directly into the pockets of large retail corporations, often leaving the beneficiary in a worse financial position.

Your 2025 SASSA Protection Plan: How to Fight Back and Keep Your Money

You are not powerless. It’s time to take control of your grant money. Here are the actionable steps you MUST take in 2025:

1. Choose the Right Bank Account:

- Postbank: The Postbank SASSA/Post Office account is often the most basic and has the fewest charges. It is specifically designed for grant payments.

- Compare Low-Cost Accounts: Carefully compare accounts from banks like Capitec, TymeBank, and others. Ask for a full list of fees in writing. Ask specifically: ‘How much does it cost to withdraw R350 at a Shoprite till?’ ‘What is the fee if a debit order fails?’

2. Scrutinize Your Bank Statement:

- Get a statement every single month. Go through it line by line. Question every single deduction you don’t recognize.

3. How to Stop Illegal Debit Orders (DebiCheck):

- Thanks to the DebiCheck system, you must now electronically approve any new debit order. DO NOT approve anything you are unsure about.

- For old, unauthorized debit orders, go to your bank branch immediately. Tell them you want to dispute and reverse the debit order. They are legally required to help you.

- You can also report the company to the Payments Association of South Africa (PASA).

4. NEVER Give Your SASSA Card or PIN to Anyone:

- Your card and PIN are your keys. Do not give them to loan sharks, shop owners, or even family members. You are responsible for any transactions made with them.

5. Say NO to Easy Credit:

- Avoid loan sharks at all costs. If you need a small loan, speak to registered microfinance institutions and demand to see their registration certificate with the National Credit Regulator (NCR). If you believe you have been treated unfairly in your application process, you might consider the steps outlined in our SASSA Appeals Guide.

6. Create a Simple Budget:

- As soon as your grant arrives, write down your absolute essentials: food, transport, electricity. Allocate money to these first before anything else. Knowing where your money needs to go is the first step to controlling it.

Our Analysis: Is SASSA Doing Enough to Protect Beneficiaries?

While SASSA’s primary role is to distribute grants, we argue that their responsibility doesn’t end once the money leaves their account. The agency is aware of the rampant exploitation of beneficiaries. In our opinion, more needs to be done in 2025.

SASSA should be running aggressive, continuous education campaigns on financial literacy, the dangers of loan sharks, and how to identify and stop illegal debit orders. They should work more closely with the NCR and the Banking Ombudsman to simplify the dispute process for grant recipients. Simply telling people to be ‘careful’ is not enough. The system allows this exploitation to thrive, and the system needs to be fixed. It’s a failure of consumer protection for the most vulnerable members of our society.

Conclusion: Your Grant is Your Lifeline - Defend It

Your social grant is a right, not a privilege. It is the government’s commitment to your well-being. Letting it be eaten away by hidden fees and predatory practices undermines its very purpose. In December 2025, make a resolution to become the guardian of your grant. Question every fee, reject suspicious offers, and report misconduct. Your financial survival depends on it. Before you even think about how to manage the funds, ensure you’ve completed the first step by learning how to apply for the SRD grant correctly and securely.

Frequently Asked Questions

Which bank is the best and cheapest for my SASSA grant in 2025?

Can I get a loan if I am on a SASSA grant?

How can I stop a funeral policy from deducting money from my account?

I saw a deduction on my statement called 'NAEDO'. What is this?

Why did the ATM charge me R10 to withdraw my SASSA money?

Someone offered me cash now if I give them my SASSA card. Is this a good idea?

How can I check if a lender is registered and not a loan shark?

What is the difference between a funeral policy and a life insurance policy?

Read Next

Why Thousands of SASSA R350 Grants Failed in December 2025: The Investigation

An in-depth investigation into the widespread SASSA R350 payment failures of …

SASSA Confirms Early Payment Dates for December 2025: Your Complete Holiday Grant Guide

It’s official: SASSA has announced early payment dates for all social …

Comments & Discussions