Table of Contents

This in-depth 2025 analysis exposes the hidden costs of relying on the SASSA Gold Card and Postbank. We break down exactly how much you could be losing and compare it with the benefits of modern, zero-fee bank accounts from providers like TymeBank and Capitec. Learn how to switch your payment method, avoid scams, and use your grant money smarter with digital banking tools.

The inconvenient Truth: Your ‘Free’ SASSA Card Isn’t Free

Let’s be brutally honest. For years, the SASSA Gold Card has been seen as a lifeline. But as we close out 2025, it’s becoming a financial trap for millions. The idea that it’s a completely ‘free’ way to get your grant is a myth. When you add up the taxi fare to a pay point, the inflated prices at local spaza shops on payout day, and the exorbitant fees for using another bank’s ATM because the Post Office one is offline again, the costs skyrocket. We estimate that many beneficiaries are losing between R100 and R200 every single month. Over a year, that’s over R2,000 of your grant money vanishing into thin air. It’s time to ask a hard question: is the old way still the best way? For most people in 2025, the answer is a resounding no.

The R2,000 Leak: A Breakdown of Hidden Gold Card Costs in 2025

Where does this R2,000 figure come from? It’s not just speculation; it’s based on the real-world experiences of beneficiaries. Let’s break it down:

- Transport Costs: A return taxi trip to a SASSA pay point or a functioning ATM can easily cost R30-R60. If you have to make two trips due to system issues, you’re already down R120.

- ATM Fees: Forced to use a different bank’s ATM? That’s another R10-R20 per withdrawal. If you draw cash twice a month, that’s another R40 lost.

- Inflated Local Prices: Shops near pay points notoriously increase prices on grant days. You could be paying 10-20% more for essentials, costing you an extra R50-R100 on your monthly shop.

- The Cost of Time: Standing in a queue for hours is time you could be spending on a side hustle, looking for work, or with your family. Your time has value.

- Security Risks: Carrying cash from a pay point makes you a target for criminals. The financial and emotional cost of being robbed is devastating.

When you add it all up, the ‘convenience’ of the Gold Card is an illusion that’s draining your precious grant money.

The 2025 Solution: Why SASSA Wants You to Use a Private Bank

It’s not a secret; SASSA itself has been encouraging beneficiaries to switch their grant payments to their personal bank accounts. Why? Because it’s more efficient, safer, and gives you, the beneficiary, more power and control. According to official SASSA communications, receiving your grant in your own bank account ensures the money is available to you on payment day without fail and reduces reliance on specific pay points. This shift empowers beneficiaries to join the formal banking sector, which is a critical step towards financial inclusion and independence. To find out the latest official payment schedule, you can always check the SASSA Payment Dates.

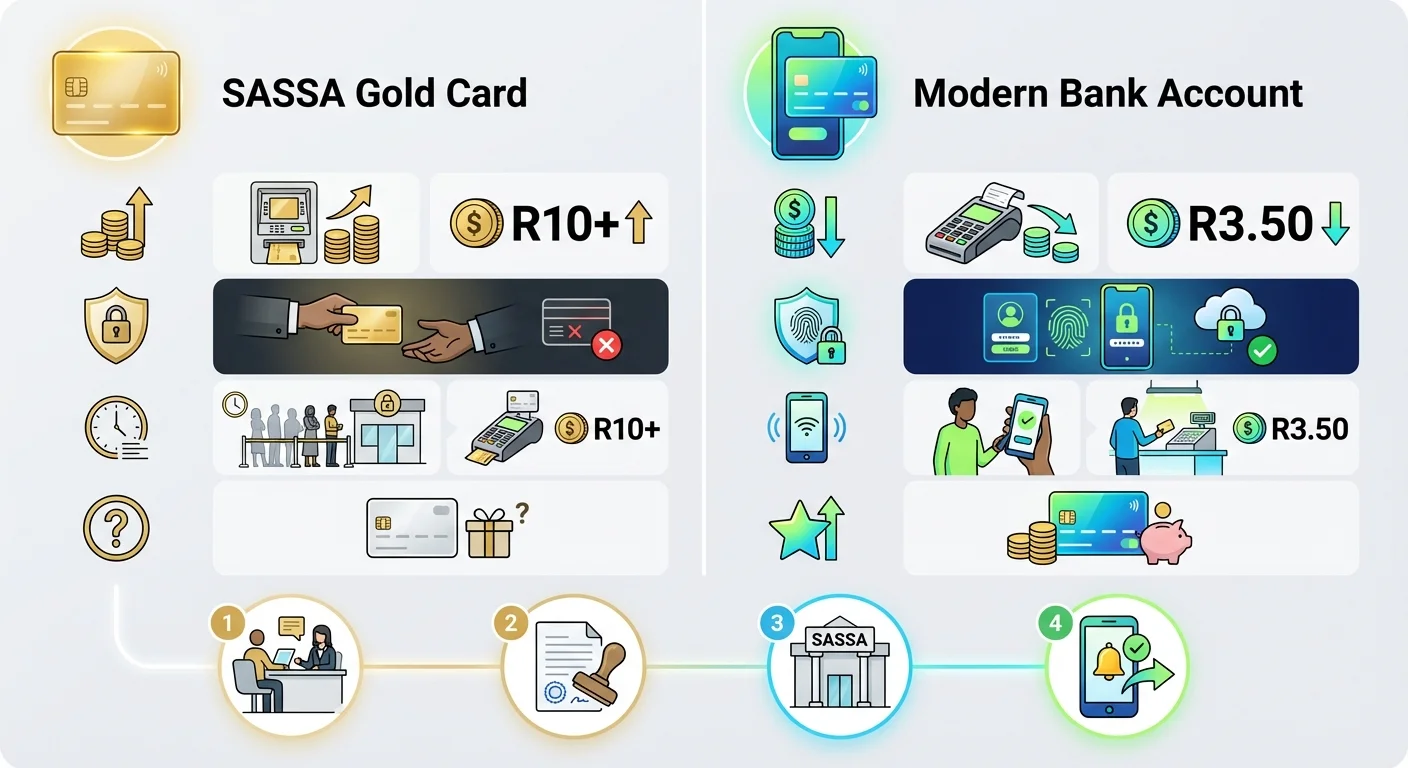

Head-to-Head: SASSA Gold Card vs. Modern Bank Accounts

Let’s compare the old with the new. The difference in 2025 is staggering.

| Feature | SASSA Gold Card (Postbank) | Modern Account (e.g., TymeBank, Capitec) |

|---|---|---|

| Monthly Fee | R0 | Often R0 |

| Cash Withdrawal | Limited to Post Office/specific retailers. High fees at other ATMs. | Withdraw at any ATM (standard fee) or for very low cost (e.g., R3.50) at major retailers. |

| Safety | High risk of card cloning, scams, and theft when carrying cash. | PIN-protected, ability to freeze card instantly on an app, bank-level fraud protection. |

| Convenience | Dependent on physical pay points, long queues, system downtime. | Access your money 24/7 via app, USSD, or any ATM. Buy airtime, electricity, and pay accounts from your phone. |

| Extra Features | Basic transactions only. | Savings pockets, budgeting tools, international money transfers, QR code payments. |

| Building a Future | Does not build a credit history. | Can be used as proof of income for store accounts or micro-loans from reputable sources, helping to build a financial record. |

Step-by-Step Guide: How to Switch Your SASSA Payment in December 2025

Ready to make the switch? It’s easier than you think. Here is the updated process for 2025:

- Open a Bank Account: Go to a bank like Capitec, TymeBank (at a Pick n Pay or Boxer kiosk), or FNB with your green bar-coded ID book or Smart ID card and proof of residence. Most entry-level accounts can be opened in under 15 minutes.

- Get Proof of Account: Ask the bank for an official, stamped letter that confirms you own the account. It must show your full name, ID number, and bank account details. This is non-negotiable.

- Complete the SASSA Form: Obtain the ‘Consent Form for Bank Payment’ (SASSA Form 1) from a SASSA office or download it from the official SASSA website. Fill it out carefully, ensuring your details match your ID and bank letter exactly.

- Submit Your Documents: Take the completed form, the original stamped bank letter, and your ID to your nearest SASSA office. Do NOT send someone else on your behalf. You must do this in person.

- Wait for Confirmation: The switch can take up to 90 days to process. Do not close your old Postbank account or throw away your Gold Card until you have received your first SASSA payment in your new bank account. Continue to check your SRD Status Check portal for any updates on your payment method.

Unlocking Your Bank’s Superpowers: More Than Just Receiving Money

Your new bank account is not just a place to receive your grant; it’s a powerful financial tool. Here’s what you can do in 2025:

- Savings Pockets: Create separate ‘pockets’ or ‘goals’ to save for school fees, a new appliance, or an emergency fund. Automate a small transfer of R50 each month.

- Pay Bills from Your Phone: Avoid queues to pay for DStv or other accounts. Use the banking app to pay directly and save the receipt digitally.

- Buy Airtime & Electricity: Purchase electricity and airtime for yourself or your family directly from the app, often with no extra fees. This saves you a trip to the store.

- Send Money Safely: Send money to family members in other provinces for a fraction of the cost of using money market services.

The Dark Side: How a Bank Account Protects You From Scams and Loan Sharks

One of the biggest dangers for grant beneficiaries is predatory lending and debit order scams. Having your grant paid into a secure bank account gives you a powerful line of defense:

- Dispute Unauthorized Debits: If you see a debit order you don’t recognize, you can immediately dispute it with your bank. This is much harder to do with the Postbank system.

- Avoid Loan Sharks: Loan sharks thrive on cash. By having your money in a bank, you create a barrier. You can also build a transaction history that could help you get a small, safe loan from the bank itself in a real emergency, instead of turning to a predator.

- SMS Alerts: Most banks send you an SMS for every transaction. You’ll know instantly if money leaves your account, allowing you to act fast. If you’ve been unfairly declined for a grant and need to fight back, our Appeals Guide can provide critical information.

Funeral Cover & Insurance: The Smart Way to Protect Your Family

Many beneficiaries are targeted by aggressive salespeople selling expensive and often useless funeral policies. A reputable bank offers a safer alternative. Banks like Capitec, FNB, and others offer affordable funeral cover as an optional add-on to your account. The premiums are often lower, the terms are clearer, and the money is debited safely from your account. This is a far better option than giving your details to a stranger on the street. Always read the terms and conditions carefully before signing up for any financial product.

No Smartphone? No Problem! USSD Banking is Your Friend

A common worry is, ‘What if I don’t have a fancy smartphone?’ You can still manage your money effectively. Every major bank in South Africa offers USSD banking. This lets you use a basic feature phone to perform essential banking tasks.

You can typically:

- Check your balance

- Buy airtime and electricity

- Pay beneficiaries

- Get a mini-statement

Simply dial the unique code for your bank, like Capitec’s *120*3279# or TymeBank’s *120*543#. Save this number in your phone. It’s a simple, low-data way to stay in control of your finances.

Your Money, Your Power: Take Control This December 2025

The end of the year is the perfect time to review your finances and make a change for the better. Moving your SASSA grant to a modern bank account is not just about convenience; it’s a revolutionary act of taking back control. It’s about protecting your money from scams, saving on hidden costs, and opening the door to a more secure financial future. Don’t let the old system dictate your financial life. In 2025, the power is in your hands, and it starts with choosing the right bank account. If you’re new to the system and need to begin, our guide on How to Apply for the SRD Grant has all the foundational information you need.

Frequently Asked Questions

Will I be charged to open a new bank account for my SASSA grant?

How long does it take for SASSA to switch my payment to my new bank account?

Is it safer to have my grant paid into a bank account?

Can SASSA take money from my bank account?

What happens to my SASSA Gold Card after I switch?

Which bank is the absolute best for SASSA grants in 2025?

Can I use any bank account for my SASSA grant?

What if SASSA rejects my bank details?

Read Next

The SASSA Money Traps of 2025: Are Banks & Lenders Draining Your Grant?

An in-depth 2025 investigation into the hidden fees, illegal debit orders, and …

SASSA Grant Declined? The 5 Real Reasons Winners Get Approved in 2025

Feeling stuck with a ‘Declined’ SASSA SRD grant status? This …

Comments & Discussions