Table of Contents

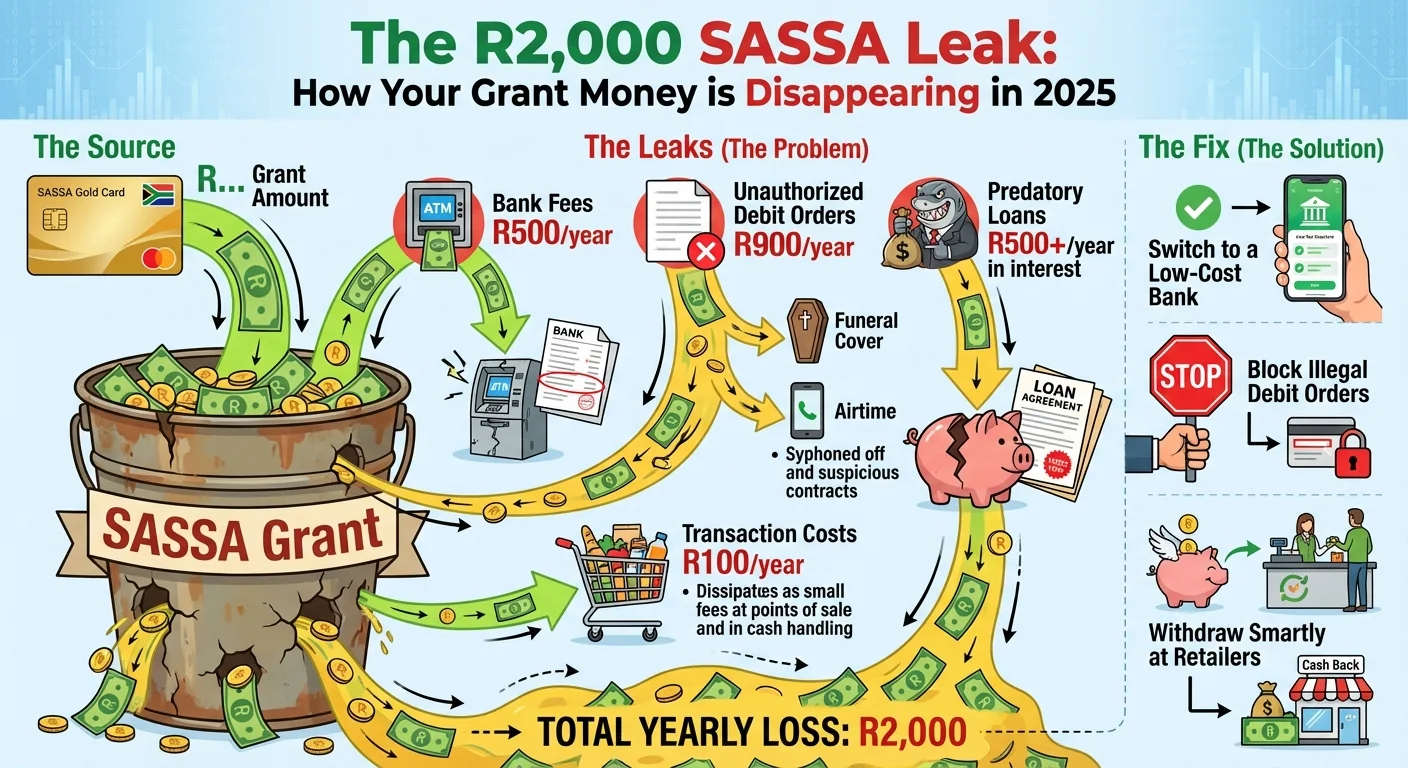

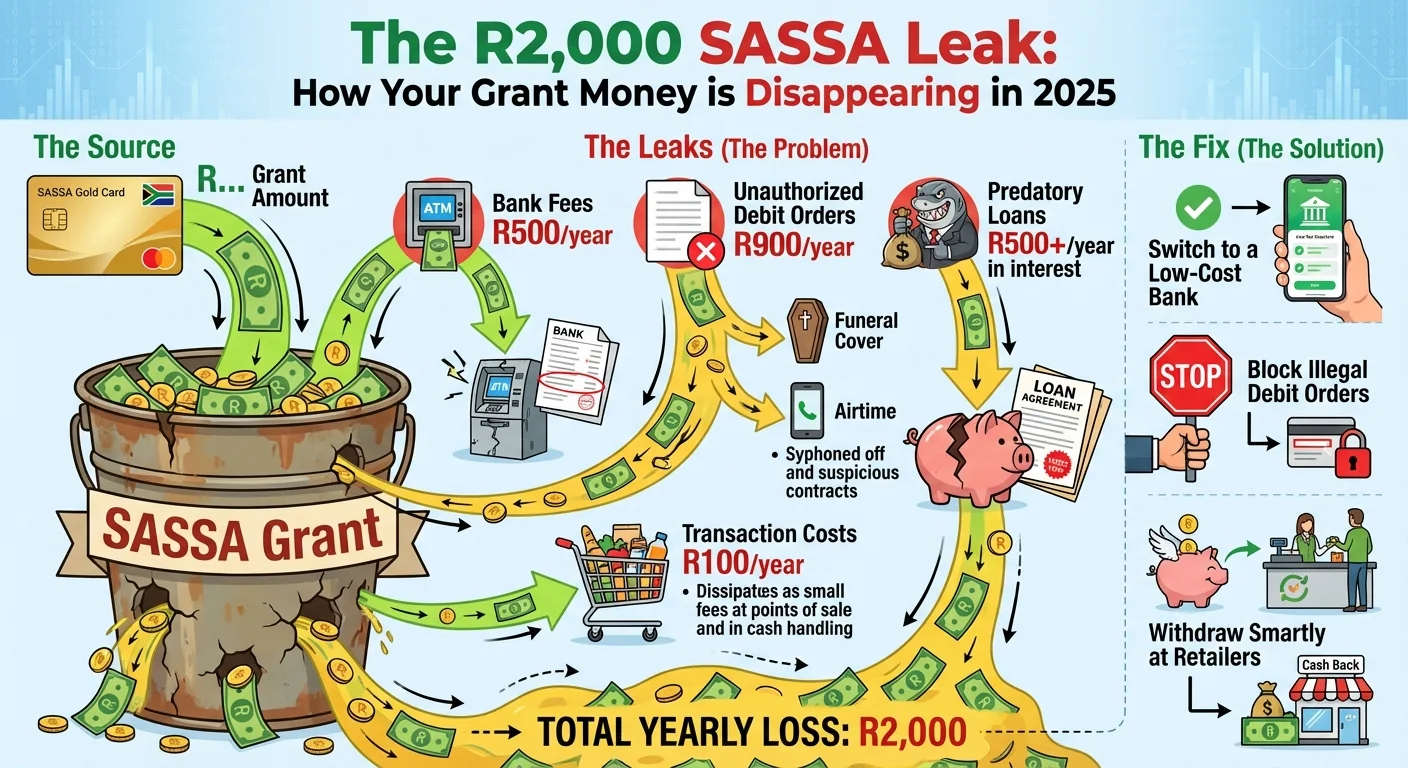

This in-depth 2025 analysis breaks down the hidden financial traps associated with SASSA grants and bank accounts in South Africa. We uncover how monthly fees, ATM charges, questionable funeral policies, and high-interest loans erode your grant money. Learn how to identify these costs, switch to better banking options, and reclaim control of your finances.

The R2,000 Question: Is Your ‘Free’ SASSA Grant Actually Free?

Let’s be brutally honest. For millions, the SASSA grant is a lifeline. But what if I told you that a significant chunk of that lifeline—potentially R150 to R200 every single month—is vanishing before you even spend it? That adds up to over R2,000 a year. This isn’t a government cut; it’s a silent tax imposed by a system of hidden bank fees, confusing funeral policies, and predatory lenders that specifically target grant recipients. As we close out 2025, it’s time to expose this banking trap and show you how to get your money back.

Deconstructing the Gold Card Myth in 2025

The SASSA Gold Card, issued through Postbank, was intended to be a secure and low-cost way to access your funds. While it has no monthly fee for the account itself, the way it’s used incurs a cascade of charges that many are unaware of. The problem isn’t just the card; it’s the entire ecosystem built around it. Retailers, banks, and lenders see grant pay-out days, which you can track on our SASSA Payment Dates page, not as social support, but as a monthly business opportunity.

The Slow Bleed: How Bank and ATM Fees Drain Your Grant

This is where the costs begin. Let’s break down the common charges that seem small but add up disastrously:

- ATM Withdrawal Fees: Withdrawing your grant from another bank’s ATM can cost you anywhere from R10 to R30 per transaction. If you withdraw cash twice a month, that’s up to R60 gone.

- Decline Fees: Not enough money in your account for a debit order or a swipe? That’s another R8 to R15 fee for nothing.

- Balance Enquiries: Checking your balance at an ATM isn’t always free. It can cost R2 to R5 each time. Do this weekly, and you’re losing another R20 a month.

- Retailer Cash Back: While often cheaper than ATMs, some retailers are now charging a ‘service fee’ for cash withdrawals. It’s crucial to ask before you transact.

Over a year, these ‘minor’ fees can easily cost you R500-R800 of your grant money.

Debit Order Hell: The Unauthorised and Unwanted Deductions

This is the biggest source of financial pain for beneficiaries in 2025. Unscrupulous companies get your details and slap your account with debit orders for services you never agreed to or don’t understand.

- Funeral Cover: The most common culprit. While having a policy is wise, many are sold policies with premiums of R99-R150 that are overpriced or fraudulent. Multiple policies are often sold to the same person without their clear consent.

- Airtime and Data Subscriptions: These small, daily, or weekly deductions of R5 or R10 are designed to fly under the radar but can amount to R100-R200 per month.

- ‘Legal’ and ‘Credit’ Services: Vague services you never signed up for that deduct R89 or R99 monthly.

These deductions are timed to hit your account the moment your SASSA payment lands. Before you can even get to the ATM, your money is already gone.

The Loan Shark Trap: A Vicious Cycle of Debt

When unexpected costs arise, the temptation to turn to ‘mashonisas’ or predatory lenders is strong. They often operate outside grant pay points, offering instant cash. The catch? Exorbitant interest rates. They may take your ID and SASSA card as collateral, ensuring they get paid first on grant day, with interest that can be as high as 50% per month. A loan of R500 can quickly become a debt of thousands, trapping you in a cycle that’s almost impossible to escape.

Switching to a Smarter Bank: Your 2025 Action Plan

The good news is you are not stuck with the Gold Card or Postbank if it’s not working for you. You have the right to choose where your grant is paid. Consider these low-cost alternatives that are popular in 2025:

- TymeBank: No monthly fees. Free cash withdrawals at Pick n Pay and Boxer tills. You can open an account in minutes at a kiosk.

- Capitec: A low, fixed monthly fee (around R7). Offers some free transactions and a user-friendly app to track every cent.

- Bank Zero: A fully digital bank with no monthly fees and transparent pricing on transactions.

To switch, you need to get a ‘Proof of Account’ letter from your new bank. Then, you must take it to a SASSA office to complete a form to change your banking details. It may take a month or two to process, so don’t close your old account immediately. Always ensure your details are correct by performing a SRD Status Check to see if your banking details have been updated.

How to Fight Back Against Illegal Debit Orders

You don’t have to accept fraudulent deductions. Here’s how to reclaim your money:

- Step 1: Identify the Culprit: Check your bank statement or transaction history to find the name of the company deducting money.

- Step 2: Go to Your Bank: Visit a branch immediately. Tell them you want to dispute and reverse an unauthorized debit order. They are legally obligated to help you.

- Step 3: Put a Stop Order: For a small fee, you can place a stop order on a specific company, preventing them from deducting money in the future.

- Step 4: Report Them: Report the company to the Payments Association of South Africa (PASA) and the National Consumer Commission. This helps prevent them from scamming others.

The Verdict: Taking Control of Your Financial Future

The SASSA grant system is complex, and it’s clear that beneficiaries are vulnerable to financial exploitation. Simply receiving the grant is not enough; protecting it is the real battle. By being vigilant, questioning every deduction, and choosing the right banking partner, you can stop the silent theft of your R2,000 a year. It’s your money. It’s time to fight for every Rand.

Frequently Asked Questions

Can SASSA deduct money from my grant for a funeral policy?

Is the SASSA Gold Card expiring in 2025?

How can I switch my SASSA grant to my new bank account?

What is the cheapest way to withdraw my SASSA grant money?

I have an unauthorized debit order. Can I get my money back?

Why do loan sharks take my SASSA card?

Is it safer to get my grant paid into a personal bank account instead of the Gold Card?

What should I do if my application for a new bank account is rejected?

Read Next

From R350 to R3,500: The Secret SASSA Side Hustles Dominating South Africa in December 2025

Stop seeing the R350 SRD grant as just survival money. This is your R350 seed …

The R150 SASSA Bank Fee Trap: How Banks Are Secretly Draining Your Grant in 2025

While a bank account seems like a safe place for your SASSA grant, hidden fees, …

Comments & Discussions