Table of Contents

A deep-dive analysis into the hidden financial burdens placed on SASSA grant recipients in January 2026. We uncover the truth about SASSA-friendly bank account fees, the dangers of high-interest loans marketed to beneficiaries, and the real cost of funeral cover. Learn how to audit your grant, identify costly debit orders, and secure your money with our 2026 financial survival guide.

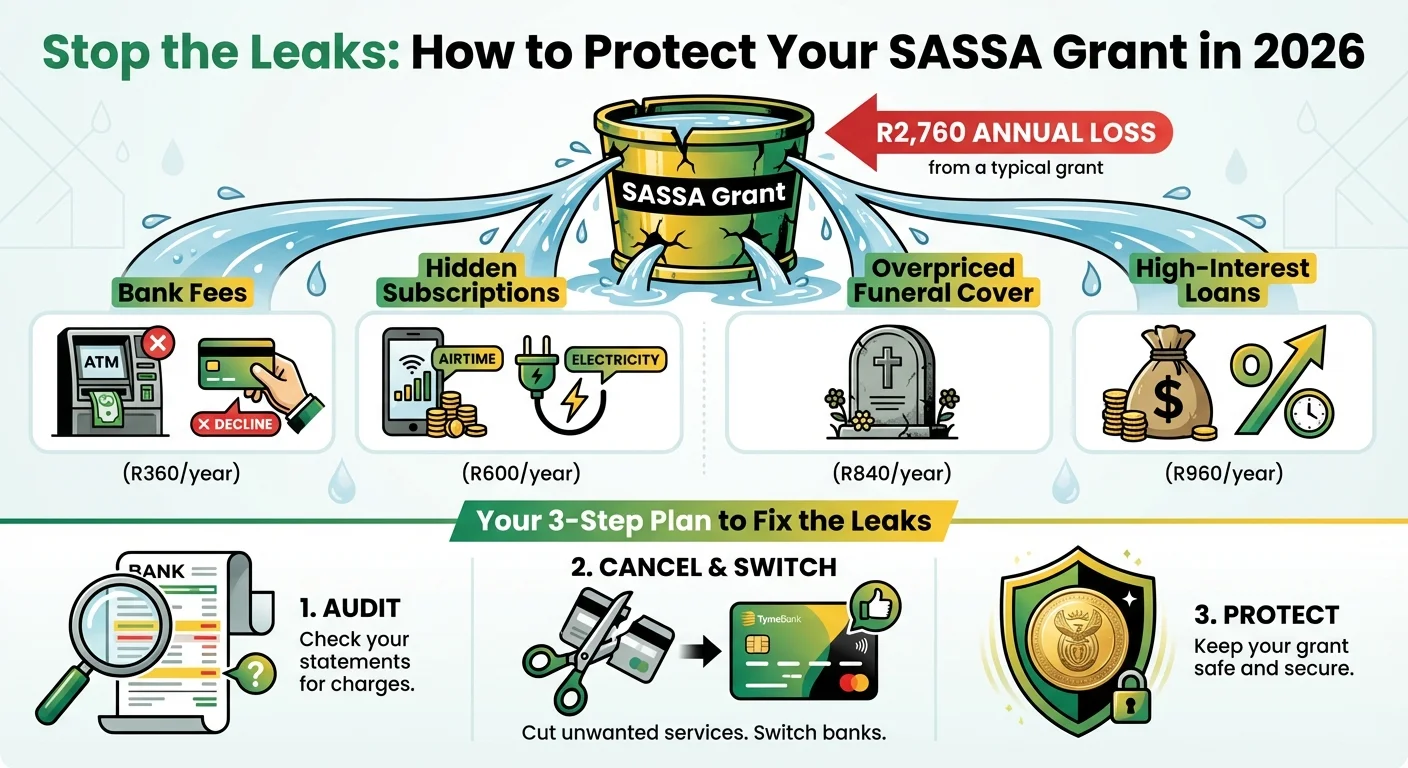

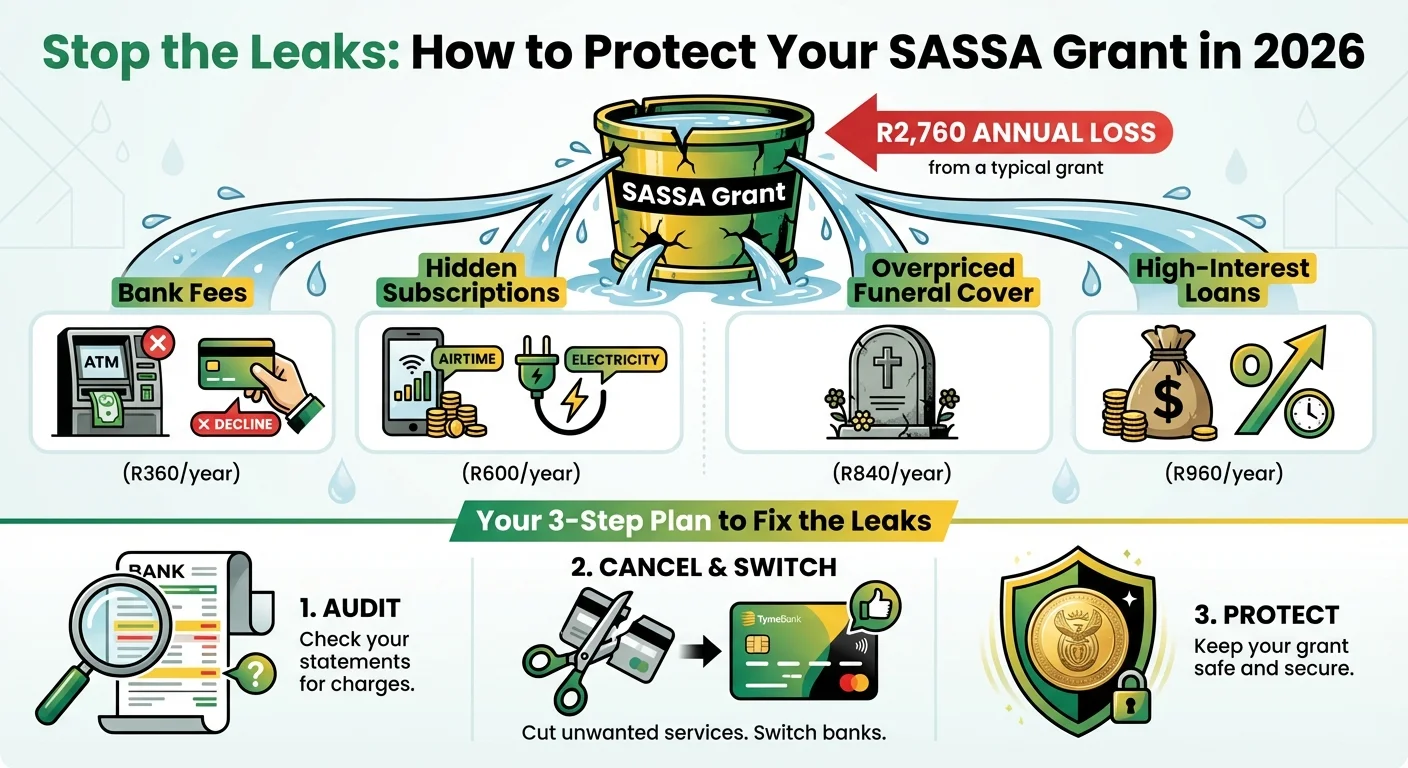

The Shocking Truth: How R2,500+ Vanishes From Your Grant Every Year

It’s January 2026, and for millions of South Africans, a SASSA grant is the only lifeline in a sea of rising costs. But what if that lifeline has holes? What if the very systems meant to deliver your money are quietly siphoning off a significant portion? The hard truth is that for many, a combination of seemingly small costs—bank fees, dubious debit orders, expensive funeral plans, and high-interest loans—are adding up. We’ve done the math, and the average beneficiary could be losing over R2,500 a year. This isn’t just a leak; it’s a flood, and it’s time to build a dam.

The 2026 Banking Minefield: Why Your ‘Free’ Account Isn’t Free

The transition away from the old SASSA Postbank Gold Card system, while necessary, has pushed millions into a complex banking world they were never prepared for. In 2026, banks are aggressively marketing ‘SASSA-friendly’ accounts. But are they truly on your side?

Common Traps to Watch For:

- Withdrawal Fees: That R10 fee to draw cash at another bank’s ATM might seem small, but if you do it twice a month, that’s already R240 a year.

- Decline Fees: Did you try to buy something with insufficient funds? Some banks charge you R8.50 or more for the ‘privilege’ of being declined.

- Statement Fees: Need a printed statement? That’ll be R25, please. Three of those in a year, and you’ve lost R75.

- Minimum Balance Penalties: Some accounts require a minimum balance to qualify for free transactions. Dip below it, and the charges begin.

The key is to understand that ’low-cost’ doesn’t mean ’no-cost’. We analyze the real costs of popular options later in this guide.

Analysis: Deconstructing the R2,500 Annual Loss

Where does this staggering number come from? Let’s break down a realistic scenario for a pensioner receiving their grant in 2026:

- Bank Fees: R30/month for withdrawals, statements, and decline fees = R360/year

- ‘Value-Added’ Subscriptions: Airtime, electricity, or other services automatically debited, often with a markup. A conservative R50/month = R600/year

- Overpriced Funeral Cover: A common policy sold at pay points can be R150/month for minimal cover, when better options exist for R80. The difference is R70/month = R840/year

- Loan Shark/High-Interest Loan Repayments: Even a small R500 loan can have repayments that cost an extra R80 per month in interest and fees. That’s R960/year in pure cost.

Total Annual Leakage: R2,760. This is more than a full month’s Older Persons Grant. This is money that belongs in your pocket, not in the coffers of corporations.

The Funeral Cover Trap: Paying for Peace of Mind You Can’t Afford

Ensuring a dignified burial is a deep-seated cultural value. Sadly, predatory companies exploit this. They set up tables near SASSA pay points, using high-pressure tactics to sell funeral policies that are often overpriced and offer poor value. They make it easy to sign up with just your ID and grant details, but incredibly difficult to cancel. Beneficiaries report being locked into policies they don’t understand, with debit orders that eat the first chunk of their grant money each month. Our advice for 2026: Never sign up for financial products under pressure at a pay point. Always go home, compare options from reputable insurers, and read the fine print.

The Debt Spiral: How ‘Easy’ Loans Enslave Grant Recipients

When an emergency strikes, a quick loan can seem like a blessing. But for SASSA beneficiaries, it’s often the start of a debt spiral. Unregistered lenders (‘mashonisas’) and even some registered credit providers charge exorbitant interest rates, knowing they have a guaranteed source of repayment: your monthly grant. They often demand your ID book or SASSA card as security, which is illegal. Getting caught in this trap means a large portion of your grant is gone before you even see it, forcing you to take another loan to survive the month. This cycle is designed to keep you indebted.

Your 2026 Financial Health Checklist: A Step-by-Step Guide to Taking Back Control

Feeling overwhelmed? Don’t be. You have the power to stop these leaks. Follow these steps this month:

- Get Your Bank Statement: Go to the bank and request a 3-month statement. Yes, it might cost R25, but it’s the best investment you’ll make.

- Audit Every Debit: Sit down with a pen. For every single transaction that isn’t you withdrawing cash or buying something directly, ask: ‘What is this for?’ and ‘Did I authorise this?’

- Identify the Leaks: Circle all the bank fees, the R99 debit order for a ‘service’ you don’t remember, and the funeral policy payment.

- Dispute and Cancel: Go to your bank branch and tell them you want to dispute unauthorised debit orders. They are legally required to help you. To cancel a service like a funeral policy, you must contact the company directly, but you can also place a stop order at the bank to prevent the money from leaving your account.

- Use the National Credit Regulator (NCR): If you are dealing with a predatory lender, report them to the NCR. Visit their website at www.ncr.org.za for help.

Switching Banks in 2026: The Smartest Move You Can Make

If your current bank is costing you too much, it’s time to move. In 2026, several low-cost, digital-first banks are excellent for SASSA grants.

Top Contenders:

- TymeBank: A popular choice with a kiosk in most Pick n Pay and Boxer stores. Transactions are very cheap, and withdrawals at PnP/Boxer tills are free.

- Capitec: Known for its low fees and user-friendly app. Their SASSA grant account has specific benefits.

- Shoprite Money Market Account: This is not a full bank account but allows you to receive your grant and spend it in-store with no fees. Withdrawals are also very low-cost.

After opening a new account, you must update your details with SASSA. Do not close your old account until you have received your first payment in the new one. You can find official information on the process, including the latest Payment Dates, on verified websites.

How to Change Your SASSA Banking Details Online (The 2026 Method)

SASSA is pushing beneficiaries to manage their grants online to reduce queues and fraud. Here is the general process for 2026:

- Visit the Official SASSA Website: Go to the SRD or grants portal.

- Find the ‘Change Banking Details’ Section: You will need your ID number and the cell phone number you used to apply.

- Receive an OTP: An SMS with a one-time pin will be sent to your registered number to verify your identity.

- Enter Your New Banking Details: Carefully type in your new bank name, account number, and branch code. The account MUST be in your name.

- Submit and Wait for Confirmation: It can take up to one payment cycle for the change to take effect. It’s crucial to regularly perform a SRD Status Check to see if the changes have been approved.

The Power of USSD: Managing Your Money Without Data

Not everyone has a smartphone or data. Banks know this, and most offer USSD banking services. This allows you to check your balance, buy airtime, and pay for electricity using a simple code. For example, Capitec’s USSD code is *120*3279#. Find out your bank’s USSD code, save it on your phone, and use it to keep track of your money without having to go to an ATM. Remember to always wrap USSD codes in backticks, like *134*7737#, when writing them down.

Conclusion: Your Grant is Your Power - Don’t Give It Away

The R2,500+ you could be losing each year is not just money. It’s food, it’s electricity, it’s school shoes, it’s your dignity. The system may be complex, but it’s not unbeatable. By becoming an active manager of your own finances—by questioning every fee, rejecting every predatory offer, and choosing the right banking partner—you are not just saving money. You are reclaiming your power. Make 2026 the year you plug the leaks for good.

Frequently Asked Questions

Can SASSA deduct money from my grant for loans or airtime?

What is the best and cheapest bank account for a SASSA grant in 2026?

How can I stop an illegal debit order from my SASSA grant?

Is the SASSA Postbank Gold Card still valid in January 2026?

Someone offered me a loan and wants to keep my SASSA card as security. Is this legal?

How do I change my SASSA payment method from a cash pay point to a bank account?

My grant was approved but I have not received payment in my new bank account. What should I do?

What happens if I fail the bank verification process with SASSA?

Read Next

SASSA's R100 Mistake: Why Your Gold Card Is Secretly Costing You Money in 2026

In 2026, millions of South Africans are losing up to R100 or more per month from …

SASSA January 2026 Payment Dates CONFIRMED: Why You Must Check Before You Collect

The official SASSA grant payment dates for January 2026 are here. This guide …

Comments & Discussions