Table of Contents

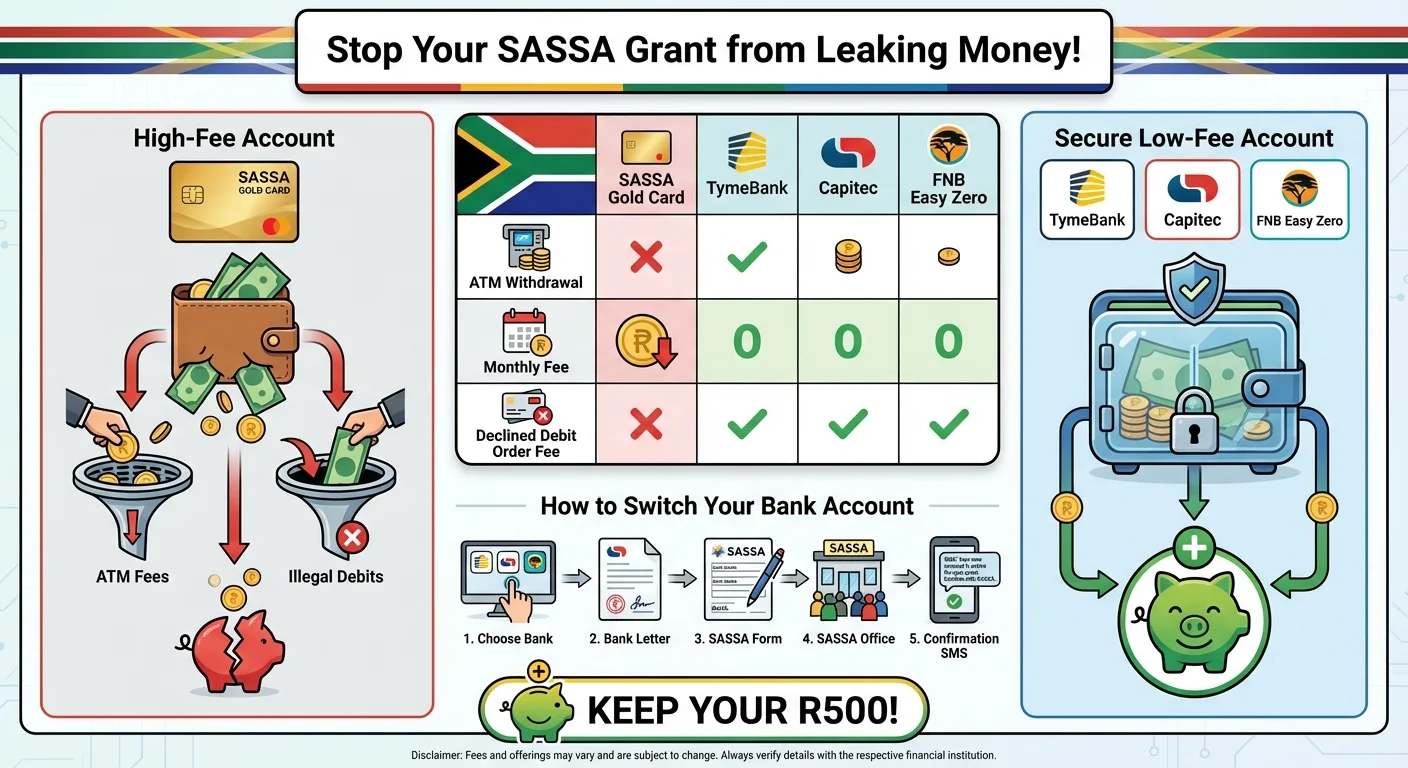

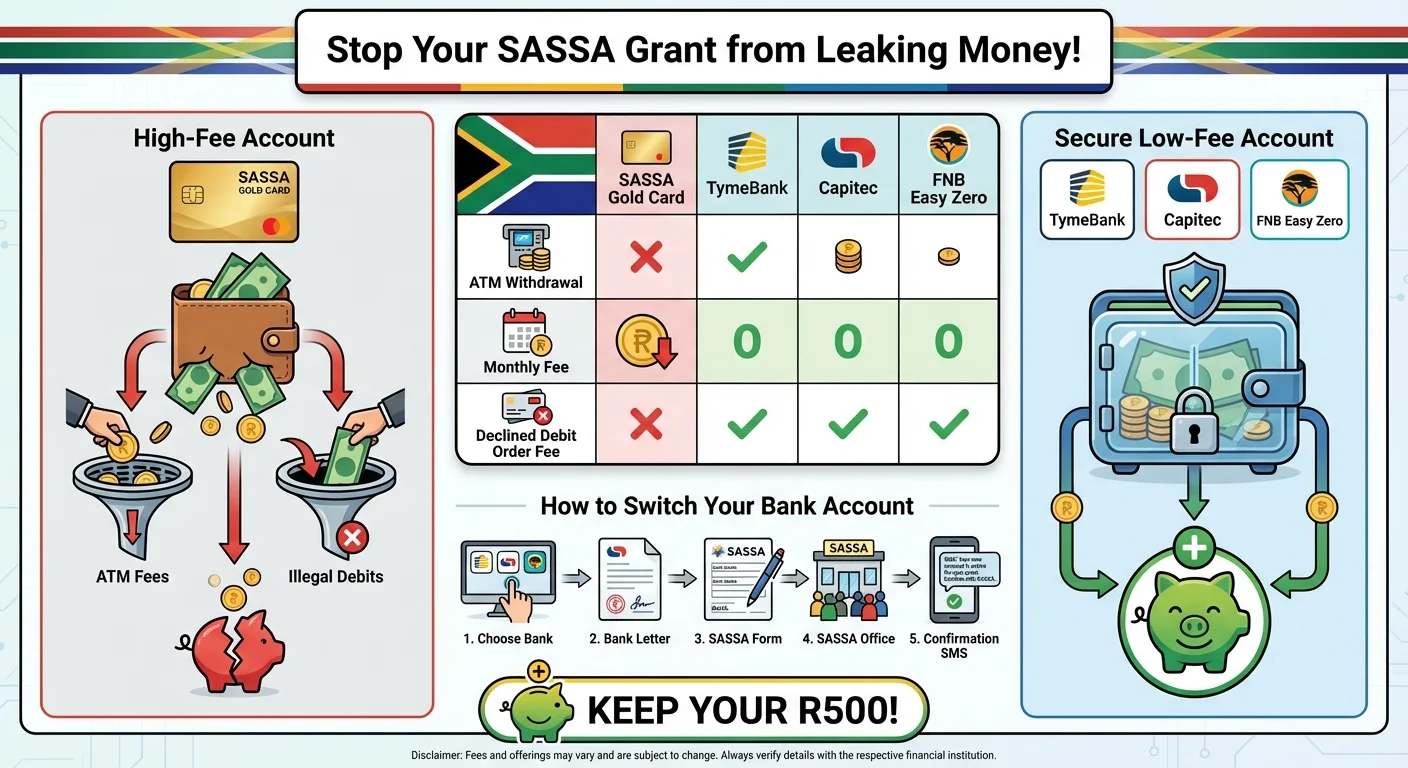

Discover the shocking truth about hidden banking fees attached to SASSA grants in 2025. We break down exactly how ATM fees, account charges, and illegal funeral cover debit orders can cost you up to R500 a month. Learn how to identify these costs, fight back, and switch to a secure, low-fee bank account to keep every Rand of your grant.

The R500 Hole in Your Grant You Never Knew Existed

It’s December 2025, and for millions of South Africans, the SASSA grant is not just a payment—it’s a lifeline. But what if I told you that a significant portion of that lifeline is silently being siphoned away before you even spend a cent? We’re not talking about a few Rands here and there. We’re talking about a potential loss of R300, R400, or even R500 every single month. This isn’t a government cut; it’s a slow, silent bleed caused by a banking system that often sees grant recipients as easy targets for high fees and predatory products. While you’re worrying about the next SASSA Payment Dates, banks and third-party companies are quietly taking their slice. This article is an exposé of the hidden financial traps facing beneficiaries in 2025 and your guide to fighting back.

The SASSA Gold Card Myth: Why ‘Free’ Is Never Really Free

The SASSA Gold Card, issued by Postbank, was meant to be a secure, low-cost way to access your funds. However, the constant system ‘glitches’, payment delays, and long queues in 2025 have pushed many beneficiaries towards commercial bank ATMs out of sheer desperation. This is where the trap is sprung. Using your Gold Card at another bank’s ATM is one of the quickest ways to lose money. What starts as a convenience ends up being a costly transaction. Furthermore, the push for beneficiaries to move to commercial bank accounts has opened a Pandora’s box of fees that the Postbank system, for all its faults, was designed to minimize.

The Breakdown: How Hidden Fees Devour Your R350 Grant

So, where does this phantom R500 come from? It’s an accumulation of small, seemingly insignificant charges that add up to a disaster by month-end. Let’s break down the common culprits:

- Out-of-Network ATM Withdrawal Fees: Drawing R100 at another bank’s ATM? That could cost you R10 plus a percentage of the amount. Do this multiple times, and you’ve lost R50-R100.

- Account Maintenance Fees: Many standard bank accounts charge a monthly fee, ranging from R10 to R100, just for having the account open.

- Declined Debit Order Fees: If a debit order tries to go off and you have insufficient funds, the bank charges you a penalty fee—often R50 or more. This is a punishment for being poor.

- SMS Notification Charges: That helpful SMS telling you your grant is in? Banks can charge R1 or more per notification. It adds up.

- Cash Deposit Fees: If a family member deposits cash into your account to help you, the bank takes a cut.

- Statement Fees: Need a printed statement for proof of income? That’ll cost you R20-R30 at the branch.

The Unholy Trinity: Airtime, Electricity, and Funeral Cover Scams

The biggest culprits are often illegal and unauthorized debit orders. Predatory companies get hold of your details and start deducting small amounts for services you never agreed to. The most common are:

- Funeral Cover: You receive a call, they get a ‘yes’ out of you on a recorded line, and suddenly R99 a month is gone for a policy you don’t understand or want.

- Airtime/Data Subscriptions: Small, daily deductions of R5 or R7 for ‘digital content’ or airtime that you never authorized.

- ‘Value-Added’ Services: These can be anything from ‘credit reports’ to ’legal assistance’, often costing R80-R150 per month.

These debit orders are designed to be small enough that you might not notice them, but three or four of them running simultaneously can easily consume R300 of your grant money.

Our Analysis: SASSA’s Hands-Off Approach Is Failing Beneficiaries

Here’s the uncomfortable truth: By encouraging beneficiaries to switch to commercial banks to solve its own logistical problems with Postbank, SASSA has inadvertently thrown many of its most vulnerable clients to the wolves. There is not enough consumer education or protection offered during this transition. It’s one thing to say ‘get a bank account,’ it’s another to provide guidance on which accounts won’t exploit you. In 2025, the government’s responsibility shouldn’t end when the money is paid. There needs to be a stronger partnership with the financial sector to create genuinely free, user-friendly bank accounts specifically for social grant recipients. The current system benefits the banks far more than it benefits the people it’s supposed to serve.

The Smart Switch: Top 3 Low-Cost Bank Accounts for SASSA in 2025

You have the power to stop the leakage. Switching to a bank account with zero or low monthly fees is the single best financial move you can make. Here are the top contenders in 2025:

| Bank Account | Monthly Fee | Key Feature for SASSA Recipients |

|---|---|---|

| TymeBank EveryDay | R0 | Free cash withdrawals at Pick n Pay & Boxer. No monthly fee. |

| Capitec Global One | R5 | Low transaction fees and a great, easy-to-use banking app. |

| FNB Easy Zero | R0 | No monthly fee. Free card swipes and cash withdrawals at FNB ATMs. |

Our Recommendation: For most SASSA beneficiaries, TymeBank is an excellent starting point due to its R0 monthly fee and partnership with major retailers, reducing the need for expensive ATM withdrawals.

Your 5-Step Plan to Change Your SASSA Banking Details

Ready to make the switch? Don’t be intimidated. Follow these steps carefully:

- Choose and Open Your New Account: Go to your chosen low-cost bank (like TymeBank or Capitec) with your green bar-coded ID book or Smart ID card and proof of residence.

- Get Proof of Account: The bank must give you an official, stamped letter that proves the account is in your name and is active. This is non-negotiable.

- Get the Official Form: Download the ‘Consent Form for Bank Payment’ from the official SASSA website or get a copy from your nearest SASSA office.

- Complete the Form: Fill out the form accurately. Double-check your ID number, name, and new bank account details. Any mistake will cause delays.

- Submit in Person: Take the completed form and your bank letter to your local SASSA office. Do NOT give it to anyone else. Get a receipt or proof of submission. The change can take up to 90 days, so check your SRD R350 Status Check online for updates.

Fighting Back: How to Stop Illegal Debit Orders in 2025

Seeing unauthorized deductions from your account is infuriating. Here’s how you fight back:

- Act Immediately: As soon as you see a strange debit, contact your bank. You have the right to dispute and reverse any unauthorized debit order.

- Use Your Banking App: Most modern banking apps (like Capitec’s) have a feature to block or reverse debit orders yourself. It’s the fastest method.

- Lodge a Complaint: If the bank isn’t helpful, lodge a complaint with the Payments Association of South Africa (PASA) or the Banking Ombudsman.

- Be Proactive: Never give your ID number or bank details over the phone to someone you don’t know. Be skeptical of any ‘competition’ or ‘survey’ that asks for this information.

Warning: The Loan Shark and ‘Easy Credit’ Trap

Your consistent SASSA grant makes you a prime target for loan sharks (mashonisas) and predatory lenders. They offer quick cash but trap you in a cycle of debt with insane interest rates. Similarly, some retailers may push store cards or credit facilities. Be extremely cautious. This ’easy credit’ can lead to your entire grant being swallowed by repayments, leaving you with nothing. If your grant was unfairly declined and you are desperate, rather focus on the official SASSA Appeals Process than turn to dangerous debt.

Conclusion: Take Back Control of Your Money

Your SASSA grant is your money, earned through your right as a citizen. It is not a bonus for banks or a playground for scammers. By being vigilant, questioning every fee, and choosing the right banking partner, you can stop the silent theft of your grant. That R500 you save each month is rightfully yours. It’s the difference between struggling and stability. Use this guide, share it with your community, and empower yourself to take back financial control in 2025.

Frequently Asked Questions

Can SASSA pay my grant into any bank account?

How long does it take for SASSA to change my banking details?

Is the SASSA Gold Card being phased out in 2025?

What happens if I suspect an illegal debit order on my account?

Are there any bank accounts that are completely free for SASSA beneficiaries?

Can I reverse a funeral policy debit order I didn't agree to?

Why does my SASSA grant amount seem less when I withdraw it?

Is it safer to get my SASSA grant paid into a bank than collecting cash?

Read Next

The R150 SASSA Bank Fee Trap: How Banks Are Secretly Draining Your Grant in 2025

While a bank account seems like a safe place for your SASSA grant, hidden fees, …

Why Your SASSA Grant is a Gamble in December 2025: The Truth They Won't Tell You

Official SASSA payment dates for December 2025 are out, but a perfect storm of …

Comments & Discussions