Table of Contents

As of December 2025, millions of South Africans rely on the R350 SRD grant, but many find their balance shrinking due to hidden costs. This article reveals the truth about bank account fees, the aggressive marketing of funeral policies, and how to fight back against predatory financial products to maximize your grant money.

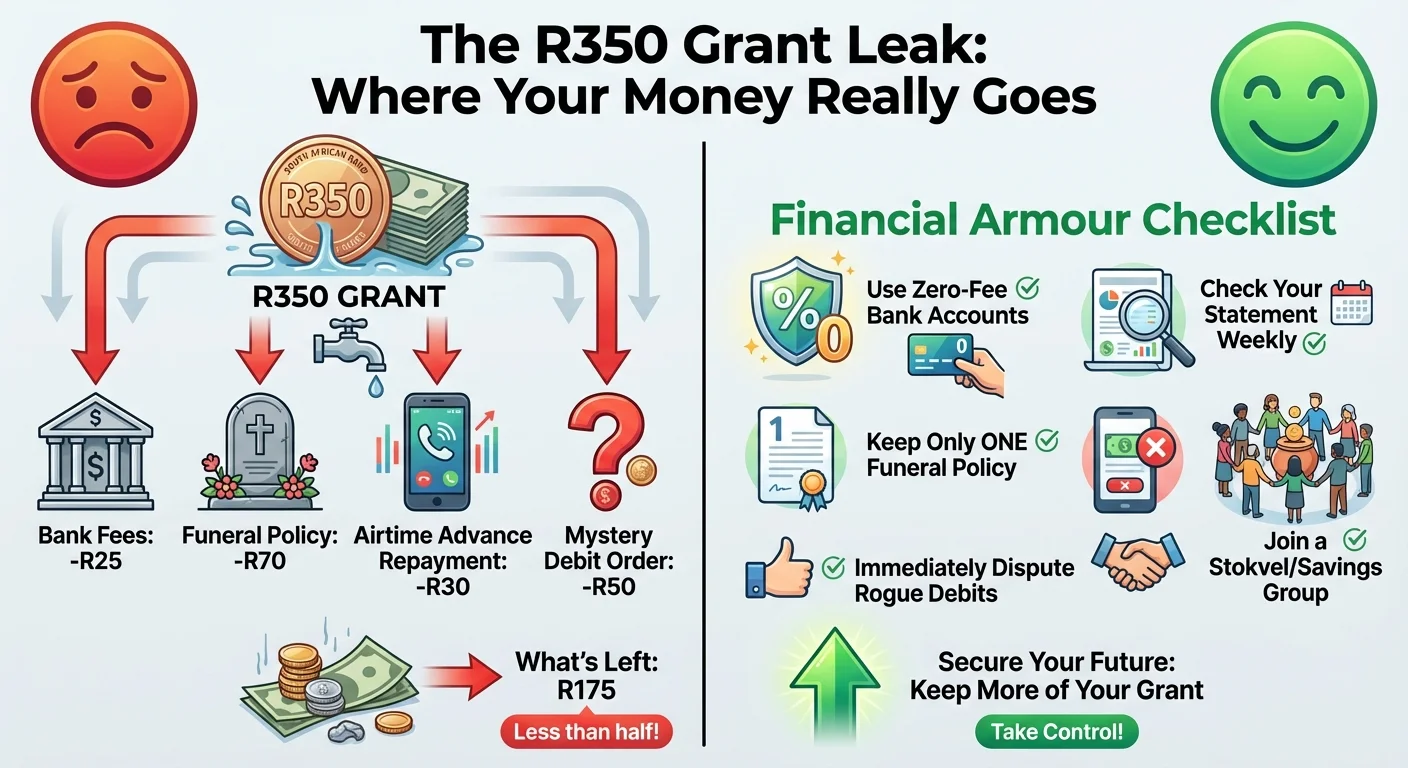

The Harsh Truth: Why Your R350 Grant is Already Spent Before You Get It

Let’s be brutally honest. For millions in South Africa, the notification that the R350 Social Relief of Distress (SRD) grant has been paid is not a moment of relief, but the start of a frantic race. A race against debit orders, bank fees, and service charges that treat this lifeline not as support, but as a target. In December 2025, the R350 grant is worth less than ever before, and it’s not just inflation to blame. A silent, systemic erosion is happening in bank accounts across the country, and it’s time we called it out. This isn’t just a guide; it’s an exposé of the financial traps designed to keep the poor, poor.

The Banking Dilemma: A Necessary Evil for Grant Recipients?

SASSA has pushed beneficiaries towards personal bank accounts, phasing out the old SASSA/Postbank Gold Card system for many. On the surface, this makes sense: it’s safer than cash and more efficient. But it has also opened a Pandora’s box of problems. While a bank account is essential, choosing the wrong one can cost you a significant portion of your R350 grant every single month. The convenience of a bank card comes with a hidden price tag that many are forced to pay. Understanding these costs is the first step to fighting back.

Trap #1: The Myth of the ‘Low-Cost’ Bank Account

Banks aggressively market ’entry-level’ or ’low-cost’ accounts to SASSA beneficiaries. But how low are they really? Let’s break down the costs that drain your R350:

- Monthly Maintenance Fees: Even R10 a month is almost 3% of your grant gone instantly.

- Transaction Fees: Swiping your card might be free, but withdrawing cash isn’t. ATM fees, especially at another bank’s machine (SASwitch fees), can be as high as R20 per withdrawal. That’s a day’s worth of food.

- Decline Fees: Don’t have enough money for a debit order? The bank charges you a fee for the failed transaction, punishing you for being poor.

- Statement Fees: Need a printed statement to track your money? That’ll cost you. Accessing it via the app might be cheaper, but requires data.

- Notification Fees: That helpful SMS telling you money has come in? You’re often paying for it.

Before you know it, R30-R50 of your grant has vanished into bank charges alone. You must scrutinize your bank’s fee schedule and compare it with others. If you are struggling with payments, it is crucial to check your details. For issues with grant reception, you can always perform an SRD Status Check.

Trap #2: The Aggressive Onslaught of Funeral Cover

Nowhere is the targeting of grant recipients more obvious than with funeral cover. Sales agents, often working on commission, know exactly when grants are paid. They sell policies with premiums of R50, R70, or even R100, framing it as a responsible choice. While having a plan for funeral expenses is important, the reality is devastating:

- Overselling: Many beneficiaries are signed up for multiple, overlapping policies they don’t need, with debit orders coming off one after the other.

- Lack of Transparency: The full terms and conditions, waiting periods, and exclusions are rarely explained properly.

- High-Pressure Sales Tactics: People are made to feel guilty or irresponsible if they don’t sign up on the spot.

A single R70 policy premium consumes 20% of the R350 grant. Two policies could mean nearly half the grant is gone. This is a crisis that needs urgent regulation.

Trap #3: Predatory Loans and the ‘Easy Credit’ Illusion

When the grant runs out, desperation sets in, and predatory lenders are waiting. They offer small loans of a few hundred Rand with astronomical interest rates, guaranteeing repayment via a debit order on your next grant payment day. This creates a vicious cycle of debt where the grant is used to pay off last month’s loan, forcing you to take out another one to survive. Store accounts offering credit for groceries or clothing also operate on this model, locking you into a repayment plan that eats into your future grants.

Exposed: The Unauthorized Debit Order Nightmare

The biggest complaint among grant recipients is the mysterious debit order. ‘DebiCheck’ was meant to solve this, but rogue companies still find ways to process unauthorized deductions for services you never signed up for. These are often for small, ‘under the radar’ amounts like R49.99 or R99, hoping you won’t notice. Reversing these is a nightmare. It requires going to the bank, filling out forms, and waiting, all while your essential funds are gone. This is not just bad business; it’s theft.

Your Financial Armour: A 5-Step Plan to Protect Your R350 in 2025

It’s time to take control. You are not powerless. Here is your plan to fight back and protect every cent:

- Become a Fee Detective: Get your bank statement (even if it costs a few Rand once) and a highlighter. Go through every single deduction. Question everything. Is this monthly fee fair? Can I get a cheaper account?

- Choose the Right Bank Account: Look for accounts with zero monthly fees, free card swipes, and a limited number of free cash withdrawals. Banks like TymeBank, Capitec, and Bank Zero are popular for a reason. Compare their fee structures meticulously.

- The One-Policy Rule: Review all your funeral policies. You likely only need one decent, affordable policy. Cancel the rest. Be firm with salespeople. Your family’s immediate survival is more important than a lavish funeral.

- Master the Debit Order Dispute: As soon as you see an unauthorized debit order, go to your bank branch or use the banking app to dispute it immediately. Don’t wait. The sooner you act, the better your chances of getting your money back. If you believe your grant application was unfairly rejected due to banking issues, you might need to follow the official Appeals Guide.

- Starve the Loan Sharks: Avoid informal and high-interest lenders at all costs. It is better to have less than to be trapped in debt. Explore community-based saving schemes (stokvels) or seek help from registered non-profits for emergency relief.

The SASSA Gold Card: Is the Old Way Better?

Many older beneficiaries still use the SASSA/Postbank Gold Card. While it has its own set of problems (expiries, queues, system downtimes), it has one major advantage: it is a closed system. It is much harder for companies to run unauthorized debit orders on these cards. However, with Postbank’s ongoing technical issues in 2025, relying solely on the Gold Card is also risky. For new applicants, choosing a payment method is a key step. You can learn more about the process in our Complete SRD Grant Application Guide.

What Government and SASSA Should Be Doing

This is not just an individual problem; it’s a systemic failure. The government, SASSA, and the Financial Sector Conduct Authority (FSCA) need to step up:

- Blacklist Predatory Companies: Ban companies with high rates of debit order disputes from accessing the national payment system.

- Cap Funeral Policy Premiums: Introduce regulations that cap the percentage of a social grant that can be taken for financial products like funeral insurance.

- Financial Literacy at Pay Points: Run mandatory, simple financial literacy workshops for beneficiaries.

- A ‘Green List’ of Bank Accounts: SASSA should partner with banks to offer a list of pre-vetted, ultra-low-cost accounts that have beneficiary protection built-in.

The silence from policymakers on this issue is deafening. They celebrate the grant rollout but ignore the vultures that circle afterwards.

Conclusion: Your R350 is Your Power

The R350 grant is more than just money; it’s a statement that in a country with so much inequality, no one should be left with nothing. Protecting it is an act of defiance. By being vigilant, questioning every deduction, and demanding better from banks and government, you are not just managing your money; you are claiming your dignity. Don’t let anyone tell you it’s ‘just R350’. It’s yours, and you have a right to every single cent of it.

Frequently Asked Questions

What is the cheapest bank account for SASSA grants in 2025?

How can I stop an unauthorized debit order from my SASSA grant?

Is it safe to have my SASSA grant paid into my Capitec or other bank account?

How many funeral policies should I have if I'm on a SASSA grant?

Why did my grant amount decrease this month?

Can a loan shark take my SASSA card as security?

What are SASwitch fees and how can I avoid them?

My bank charged me a fee because a debit order failed. Is this legal?

How can I check my SASSA payment dates for the upcoming months?

Read Next

Why Your R350 SASSA Payment Failed in December 2025: The Investigation

Millions of South Africans rely on the R350 SRD grant, but payment failures are …

The R5,000 SASSA Debt Trap: Why Loan Sharks Target Your Grant in 2025

In December 2025, countless SASSA beneficiaries are being targeted by predatory …

Comments & Discussions