Table of Contents

A comprehensive investigation into the SASSA bank verification issues plaguing applicants in November 2025. We break down the technical jargon, explain the common pitfalls SASSA’s system flags, and offer a practical, updated guide on how to correctly submit, update, and verify your banking information on the official SRD portal to avoid payment delays.

The November 2025 Nightmare: Why ‘Bank Verification Failed’ is More Than Just a Glitch

As we head towards the end of 2025, a wave of panic is sweeping through thousands of SASSA SRD R350 grant applicants. You’ve applied, you’ve waited, and then you see it: ‘Bank Verification Failed’. It’s a frustratingly vague message that leaves you without answers and, more importantly, without your grant money. This isn’t just a random system error; it’s a specific flag raised by an automated system cross-referencing your details with the Department of Home Affairs and your bank. In November 2025, with stricter checks in place to combat fraud, this verification step has become a major hurdle for genuine applicants. This article isn’t just another guide; it’s an insider’s look into why this happens and a concrete plan to fix it for good.

Decoding the Jargon: ‘Verification Failed’ vs. ‘Bank Details Pending’

First, let’s clear up the confusion. These two statuses, while related, mean different things.

- ‘Bank Details Pending’: This is often a normal part of the process. It means you’ve submitted your details, and SASSA is in the queue to send them to your bank for verification. It can take several days or even weeks, especially during high-volume periods like November. Patience is key here, but if it’s been pending for more than a month, it’s time to act.

- ‘Bank Verification Failed’: This is the red flag. It means SASSA sent your details to the bank, and the bank sent back a ’no match’ response. The system has actively rejected your information. This status will not resolve itself; you must take action to correct it.

The Top 5 Hidden Reasons Your Bank Details Were Rejected in 2025

Our investigation reveals it’s rarely a complex issue. The SASSA system is automated and unforgiving. Here are the most common reasons for failure we’ve identified in 2025:

- Name & Surname Mismatch: The single biggest culprit. The name and surname you used for your SASSA application must match exactly with the name registered at your bank and the Department of Home Affairs. A missing initial, a shortened name (‘Thabo’ vs. ‘Thabiso’), or a different surname spelling will cause an instant failure.

- Incorrect Bank Account Type: The SRD grant can only be paid into a standard transactional bank account. You cannot use a credit card account, a business account, or certain types of savings accounts with restricted access.

- Dormant or Inactive Accounts: If you haven’t used your bank account for several months, banks often mark it as dormant. The SASSA system cannot pay into an inactive account. Ensure your account is active by making a small transaction.

- Using Someone Else’s Bank Account: This is an absolute non-starter and a primary fraud check. The bank account details must belong to you, the applicant. Attempting to use a friend’s or family member’s account will lead to an immediate and permanent rejection for that payment cycle.

- Simple Typos: A single wrong digit in your account number or an incorrect branch code during submission is enough to cause the verification to fail.

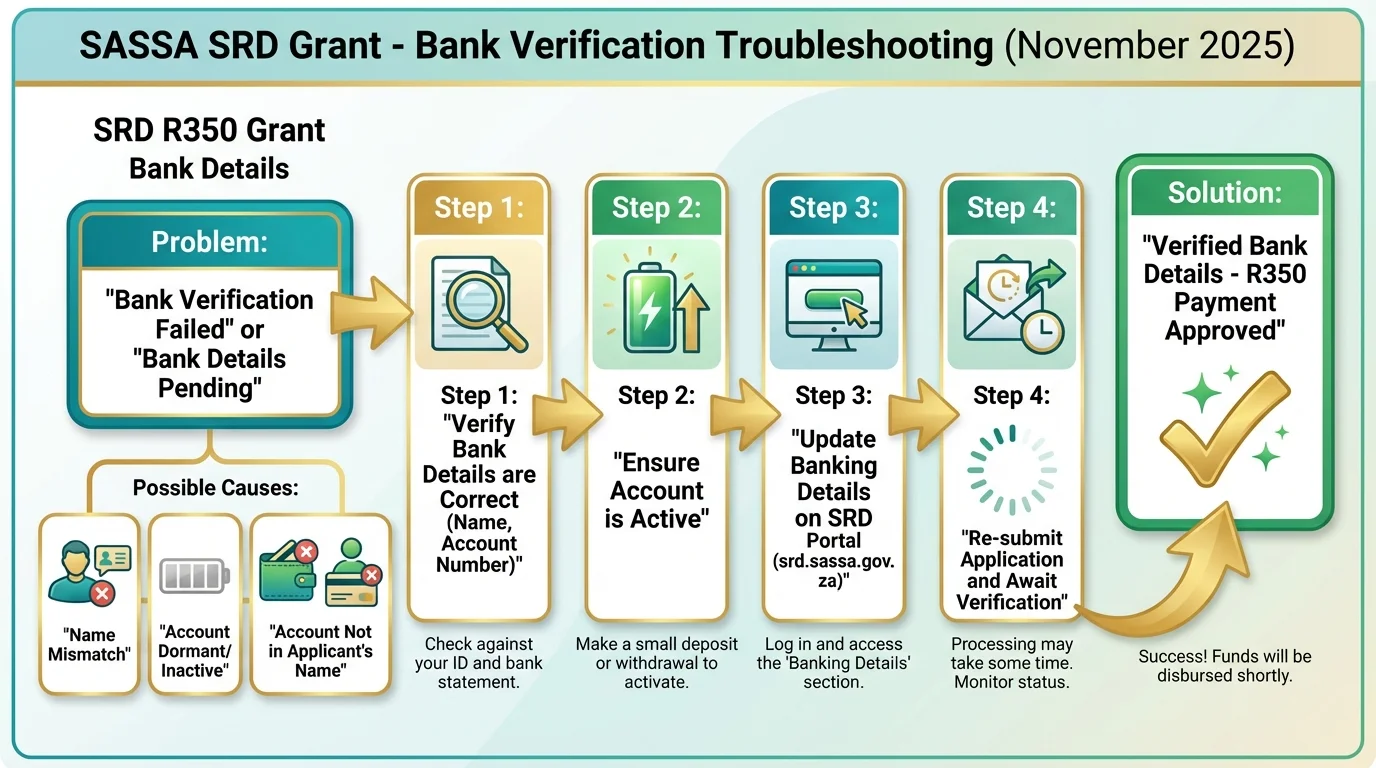

Your 4-Step Action Plan to Fix Bank Verification Issues (Updated for November 2025)

Don’t just re-submit the same details blindly. Follow this proven process to identify and fix the problem.

Step 1: The Triple-Check Investigation Before you touch the SASSA website, gather three documents: your ID book/card, your official bank statement, and your SRD application details. Compare them side-by-side. Is your name spelled identically on all three? Is the ID number perfect? Is the account number correct? This is your diagnostic phase.

Step 2: Log in to the SASSA SRD Portal Navigate to the official SASSA SRD website. Use your ID number and the mobile number you used for your application to log in. This is the only legitimate portal for making these changes.

Step 3: Carefully Re-Submit Your Banking Details Find the option ‘How do I change my banking details’. You will be sent an SMS with a secure link. Click this link and meticulously re-enter your details. Select your bank, enter your account number, and choose the correct account type (usually ‘Cheque’ or ‘Savings’). Double-check every single digit before submitting.

Step 4: Monitor Your Status and Be Patient After submitting, your status will likely change back to ‘Bank Details Pending’. This is a good sign. The verification process starts over. It can take 7-14 business days for SASSA to get a response from the bank. Check your status periodically via the SRD Status Check page, but avoid changing the details again unless the status reverts to ‘Failed’.

A Critical Warning: The Danger of Using Someone Else’s Bank Account

Let’s be unequivocally clear: You cannot and must not use another person’s bank account for your SRD grant. This is viewed by the system as a primary indicator of identity fraud. Not only will the verification fail, but it could also flag your profile for further investigation, potentially delaying future grants. The grant is tied to your ID number, and the bank account must also be tied to that same ID number. There are no exceptions to this rule.

What If My Details Are 100% Correct But Still Fail?

This is a rare but incredibly frustrating scenario. If you have triple-checked everything and are certain your details are correct, the issue might be on the bank’s end or a deeper system error.

- Contact Your Bank: First, call or visit your bank. Ask them to confirm the exact name and surname registered to your account and confirm that the account is active and can receive payments.

- Consider the Cash Send Option: If the bank verification continues to fail despite correct details, your safest bet to receive payment is to switch your payment method to a Cash Send option (e.g., Pick n Pay, Shoprite, Checkers). While less convenient, it bypasses the bank verification system entirely, allowing you to collect your grant in cash using your ID and phone. You can make this change on the same SASSA portal.

- Contact SASSA Directly: As a last resort, contact the SASSA helpline, but be prepared for long waiting times. The online portal is almost always faster for resolving this specific issue.

How Long Does Re-Verification Take in November/December 2025?

Once you have successfully re-submitted your banking details, the waiting game begins again. Typically, the re-verification process takes between 7 to 14 business days. However, with the end-of-year rush and public holidays in December, expect potential delays. Our analysis suggests that if you fix your details in late November, you should realistically expect the payment to be processed with the December batch, assuming verification is successful. For the latest on specific SASSA Payment Dates, always check the official schedule.

The Future: Could Biometrics Solve SASSA’s Banking Woes?

This entire verification mess highlights a core weakness in the current system. There is growing chatter within social development circles about a move towards biometric verification for grant payments by 2026. This would involve using a fingerprint or facial scan to confirm your identity at a payment point, completely removing the reliance on bank details. While this presents its own set of logistical challenges, it could drastically reduce fraud and eliminate the ‘Bank Verification Failed’ issue for millions, ensuring that the grant reaches the right person every single time.

Frequently Asked Questions

Why is my SASSA status stuck on 'Bank Details Pending' for weeks?

Can I use a family member's bank account for my SRD grant?

How many times can I update my banking details with SASSA?

What happens if I don't fix my failed bank details?

I updated my details, but my status hasn't changed. What now?

Does SASSA accept TymeBank, Capitec, or other digital banks?

Can I receive my grant if my bank account is new or has a zero balance?

How do I switch from a bank payment to a Cash Send option?

Read Next

Home Affairs ID Crisis 2026: Your R390 SASSA Grant Now Blocked? Your Emergency Plan

BREAKING March 2026: A catastrophic system failure at the Department of Home …

Stage 8 Blackout: Your March 2026 SASSA R390 Payment is Trapped. The Ultimate Survival Guide.

BREAKING March 2026: Eskom has plunged South Africa into an unprecedented Stage …

Comments & Discussions